News and Insights

Cadence Opportunities Fund December 2023 Half Year Audiocast

In this half-year audiocast, Karl Siegling first provides an update on the Company’s half-year performance, the upcoming 6.5c fully franked interim dividend and DRP, the composition of the portfolio and the current investment themes. Karl Siegling and...

Cadence Capital Limited December 2023 Half Year Audiocast

In this half-year audiocast, Karl Siegling first provides an update on the Company’s half-year performance, the upcoming 3.0c fully franked interim dividend and DRP, the composition of the portfolio and the current investment themes. Karl Siegling and...

CDM and CDO 2023 AGM Investor Briefing

At the 2023 CDM and CDO AGM Investor Briefing, Chairman Karl Siegling starts by giving an update on CDM and CDO’s past and current year performance, discusses the portfolios and talks about some important market trends. Karl Siegling and Chris Garrard then...

Cadence Opportunities Fund June 2023 Year End Audiocast

In this year-end audiocast, Karl Siegling firstly provides an update on the Company’s 2023 financial year performance, the 6.5c fully franked year-end dividend, the portfolio’s composition and CDO’s discount to NTA. Karl Siegling and Chris Garrard then...

Cadence Capital Limited June 2023 Year End Audiocast

In this year-end audiocast, Karl Siegling firstly provides an update on the Company’s 2023 financial year performance, the 3.0c fully franked year-end dividend, the portfolio’s composition and CDM’s discount to NTA. Karl Siegling and Chris Garrard then...

‘Stocking the war chest’: Macquarie raising $1.6bn to fund investments

Karl Siegling, managing director of the $350 million fund Cadence Capital, said low rates were positive for Macquarie's business of backing alternative assets such as toll roads or wind farms. "The Macquarie business model is to have the shareholder equity, then...

Looking for opportunity in LICs – Livewire Markets

Listed investment companies (LICs) can provide investors with an interesting opportunity; purchasing a portfolio of securities below the intrinsic NTA value. CDM was highlighted as a LIC to watch in the Bell Potter Research article on Livewire Markets titled ‘Looking...

Fund manager Cadence kicks off $100m pitch for ‘shorter term’ fund

Sydney-based equities investor Cadence Asset Management has outlined its pitch for a new listed investment company that will seek to profit from market volatility. Cadence chairman Karl Siegling has told potential investors the new fund would would be more focused on...

Banks approaching “maximum pessimism” and on the slide…

In this interview with Lucas Baird from RFI Group, Karl Siegling warns "Australian banks are on a slide and investors should keep their distance as the industry reaches, maximum pessimism." “Royal Commission, Hayne, conflicts of interest, vertical & horizontal...

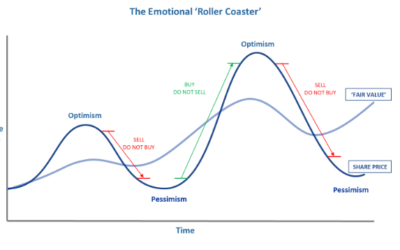

What it means to be a ‘contrarian’ investor

Emotions play a very big role in investing, but so does logic. In finance we often hear people say, “buy low, sell high” or “buy cheap stocks and sell expensive stocks”. You cannot fault the logic. It appeals to common sense, it makes intuitive sense and it should be...

Million Dollar Traders – YouTube

What happens when you take eight people without any prior trading experience and give them one million pounds to manage in the markets for two months, especially when this happens at the onset of the global financial crisis? Enter Million Dollar Traders, a situation...

Elon Musk biography by Ashlee Vance

The Elon Musk biography is a fascinating insight into the CEO of both Tesla and Space X. Ever since childhood Elon has been fascinated by space and believes that it is essential for humans to live on mars so that if earth becomes uninhabitable the human race will not...

The China Hustle

China Hustle is another fascinating documentary from Netflix which deals with Chinese companies ‘reverse listing into US shell companies.’ It is a cautionary tale on the age old saying of ‘buyer beware’ and the forces at work that led to companies being listed on the...

Dirty Money – S01 E03 Drug Short

This documentary featured on Netflix deals with the amazing rise and the amazing fall of Valeant Pharmaceuticals. Once the ‘darling’ of the investment community Valeant has fallen into disrepute with that same investment community. Again we have Bill Ackman,...

Way of the Turtle by Curtis M Faith

This book documents a legendary bet in the early 80’s between two successful commodity traders, Richard Dennis and William Eckhardt. The bet was over whether trading could be taught or whether it comes naturally. Richard Dennis was willing to stake his own money on...

10 Books To Read Before Buying Your Next Stock

Funds management involves a lot of synthesis of information and reading. Over the years we all end up reading many investment books and refer to them from time to time.

The team at Cadence has compiled a list of books that have influenced our investment style, or helped provide insight into the investment process.

Whilst not an exhaustive list, the 10 titles contained in this eBook provide a good starting point for any interested investor.

Riding the Resources and Mining Services Tailwinds

- The inter-relationship between commodity prices, resource and mining services company profits

- The mining services cycle

- Where we are in the cycle?

- Examples of recent mining services investments:

- Emeco Holdings (ASX: EHL)

- Macmahon Holdings (ASX: MAH)

- Boom Logistics (ASX: BOL)

Cadence Capital Limited (ASX: CDM) is one of Australia’s top performing Listed Investment Companies.

A Guide to Analysing Company Fundamentals eBook

- 5 traps in using the P/E ratio

- 5 traps with using the Dividend Yield

- Understanding the Price to Earnings Ratio and how to use it to your advantage

- Examples of financial ratios in action

Cadence Capital Limited (ASX: CDM) is one of Australia’s top performing Listed Investment Companies.

Hope, Fear and Greed: Market Psychology eBook

What you’ll learn:

- Why share prices overreact

- Understand 3 key emotions of investing – Hope, Fear and Greed

- How the emotions of Hope, Fear and Greed played out during the GFC

- How to determine what is a fundamentally ‘cheap’ stock and combine that with technical analysis to determine entry points

- Follow a ‘live’ example using Macquarie Group Limited (MQG)

Cadence Capital Resources eBook

- Has the next resources boom started?

- Are resources gains sustainable?

- How does the Cadence Capital approach to investing take advantage of this?

- Two ‘live’ examples of current resource investments – Monadelphous Group Ltd (MND) and Fortescue Metals Group (FMG)