This article was written by Karl Siegling, Managing Director & Portfolio Manager, Cadence Capital Limited (ASX: CDM)

Often in the investment industry we hear people say, “I am a fundamental investor” or “We only look at fundamentals”. This can be couched in many different ways, such as “We buy below fair value” and “We like to sell at fair value”.

Such concepts at face value sound convincing. The one I especially like is, “We like to buy low and sell high”. It all sounds very logical.

More interesting, however, is what actually happens in a market when you involve a whole lot of animals, that is, human beings. Human beings experience emotions and often those emotions are stronger during periods of extreme share price movement.

Jesse Livermore refers to these emotions in his book Reminiscences of a Stock Operator as “hope, fear and greed” (his book is included in our 56 Books To Read Before Buying Your Next Stock section).

Livermore has been referred to as a “boy wonder” and the “best stock investor ever to have lived”. He recognised how important market psychology was in determining stock prices.

You can’t read about a panic, you have to experience it

A quote I have never forgotten that also speaks to the psychology of a market appears in Extraordinary Popular Delusions and the Madness of Crowds, which says “You can’t read about a panic, you have to experience it”. How true that is!

A student of the market who reads that in 2007 and 2008 markets around the world fell more than 50 per cent and have since largely recovered may ask: “What happened? What were the fundamentals? Have the fundamentals changed?”

Some of the answers to these questions might be: “Well, yes, what DID happen?” The world was worried about debt levels in the US.

Debt levels are now much higher in the US. However, a crisis has been averted. While the crisis was based on “worry” or “fear” about high debt, the debt has not gone away. In fact, it is now much bigger. What have gone away are the worry and the fear.

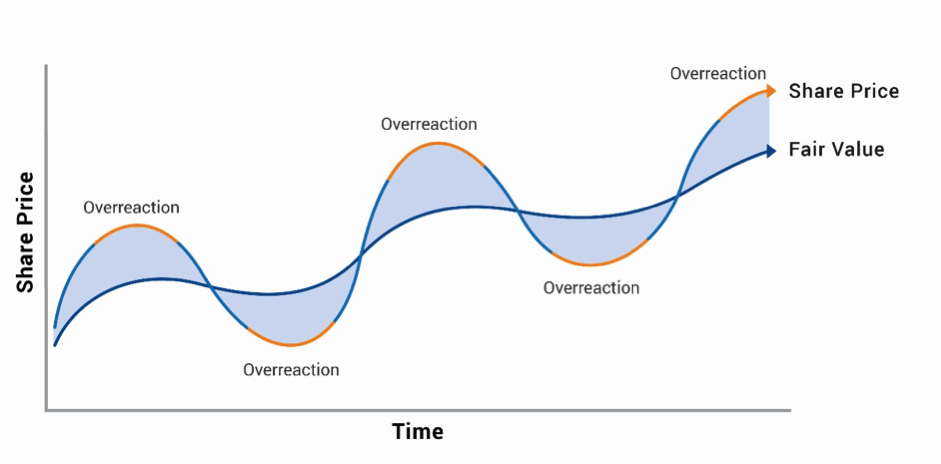

SHARE PRICE AND MARKET PSYCHOLOGY

Source: Cadence Capital Limited

Incidentally, the fundamentals of many stocks before, during and after the global financial crisis (GFC) have also not changed much. In fact, many stocks experienced earnings growth before, during and after the GFC. However, this did not stop the share prices associated with these businesses from gyrating dramatically.

Where does this leave the fundamental investor?

Where does this leave the fundamental investor? And more importantly, if most of the participants that invest in the market do so based on fundamental analysis, the big question is: Who was frantically buying and selling these shares to cause such severe price movements despite a stable earnings profile outlook?

We can go in circles trying to get answers to these questions and of course, with the benefit of hindsight, everyone can construct a well-thought-out answer to these questions.

The probable reality is that prior to the GFC people had moved beyond hope to greed to try and make a return from stocks. They then moved to fear during the GFC and then to the first signs of hope during the initial recovery in the GFC, then on to much larger doses of hope.

At some stage, people will once again move to the early stages of greed before reaching the crescendo of all-out greed. Something will then no doubt happen to instil fear within investors’ minds and the cycle starts all over again.

As a matter of course, it is well worth using a doctrine of “buying low and selling high”. What is often worth asking though is, “How did this stock get so low or so high?” If the answer appears to be that it is so low due to fear or so high due to greed, then it may well be a time to buy and sell.

Never underestimate the power of human psychology in determining the price of a stock.

Never underestimate the power of human psychology in determining the price of a stock. History is littered with booms, busts, bubbles and bursting due to excessive optimism and excessive pessimism.

Written by Karl Siegling, Cadence Capital Limited

For further reading on this specific subject, please read Karl’s article titled Market Psychology: Emotions and… More Emotions.