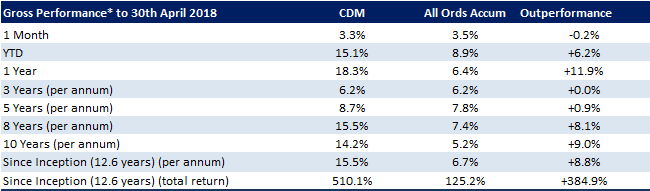

For the month of April 2018 Cadence Capital Limited returned a positive gross performance of 3.3% compared to an increase in the All Ordinaries Accumulation Index of 3.5%. For the current financial year, Cadence Capital Limited has returned a positive gross performance of 15.1% outperforming the All Ordinaries Accumulation Index by 6.2%.

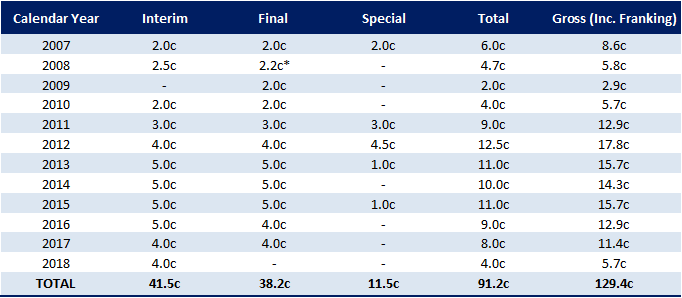

On the 23rd April 2018 the Company paid a 4.0 cent fully-franked interim dividend, which equated to a 6.2% annual fully franked yield, or an 8.8% gross yield (grossed up for franking credits), based on the CDM share price at the time of the announcement.

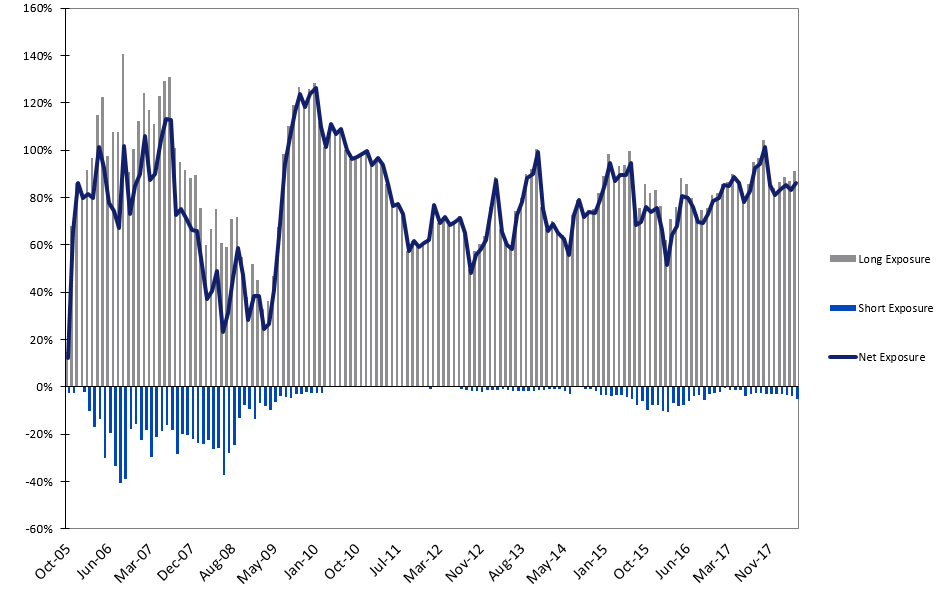

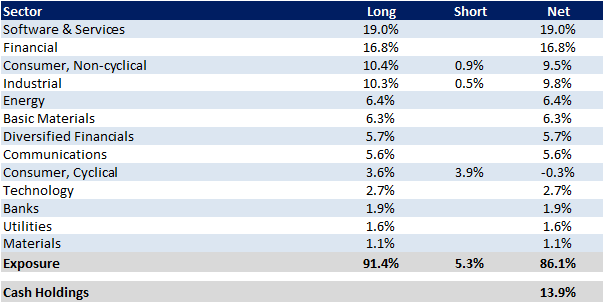

As at the 30th April 2018 the fund is 86.1% invested (13.9% cash).

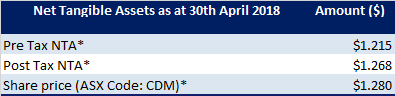

Fund NTA

* These figures are after the 4.0 cent fully franked interim dividend paid on the 23rd April 2018

Fund Performance

* Before Management and Performance Fees

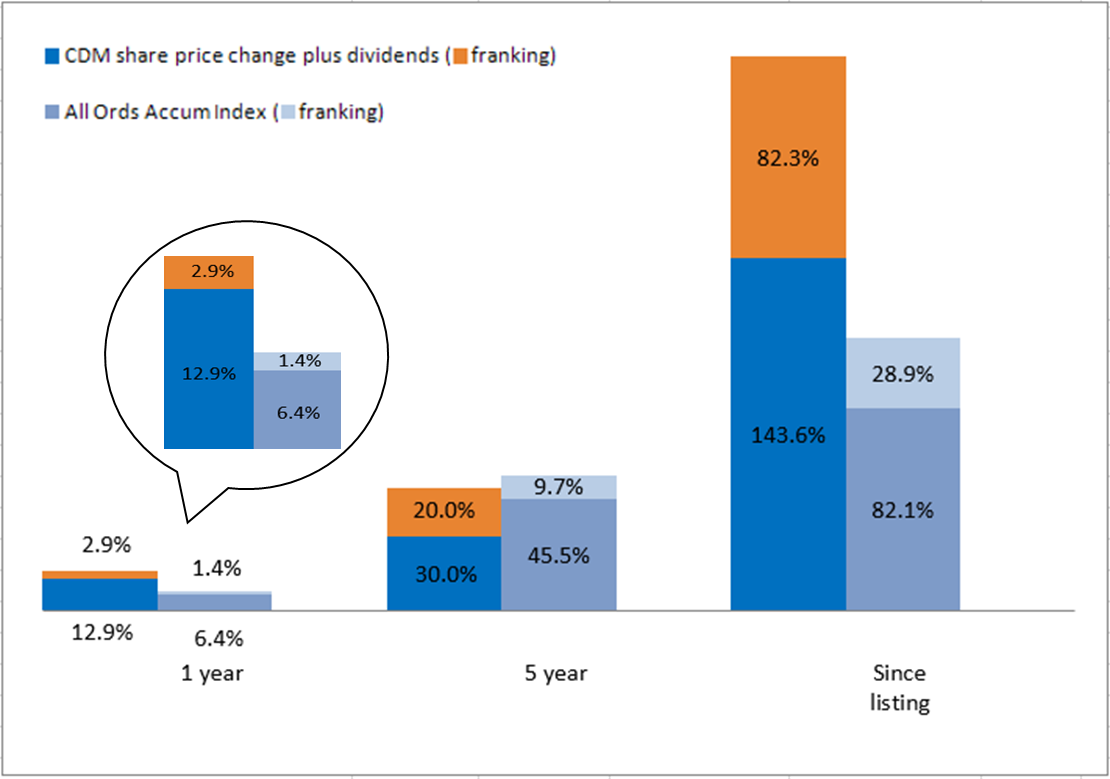

CDM Share Price and Option Returns plus Dividends & Franking

Fully Franked Dividends Declared Since Listing

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Position

Recent News Articles

During the month of April Cadence Capital was featured extensively in the press. Karl Siegling sat down with InvestSMART to pinpoint opportunities in Australia and abroad in a podcast interview. Karl was also quoted in the AFR with views on AMP and Mike Wilkins Mike Wilkins to navigate oil tanker AMP away from Disarray.

Cadence’s 12-part Investing Series Article 1: Hope, fear and greed, Article 2: Reconciling market psychology with fundamentals and Article 3: The emotion factor in buying and selling featured on Livewire.

The Cadence team added Million Dollar Traders and Elon Musk Biography to the compiled list of 56 books or documentaries that have influenced Cadence’s investment style.

We welcome any of your friends or colleagues that you feel may benefit from our monthly Cadence Capital Limited Investment Update. Please click here to refer a friend by supplying their name and email address.