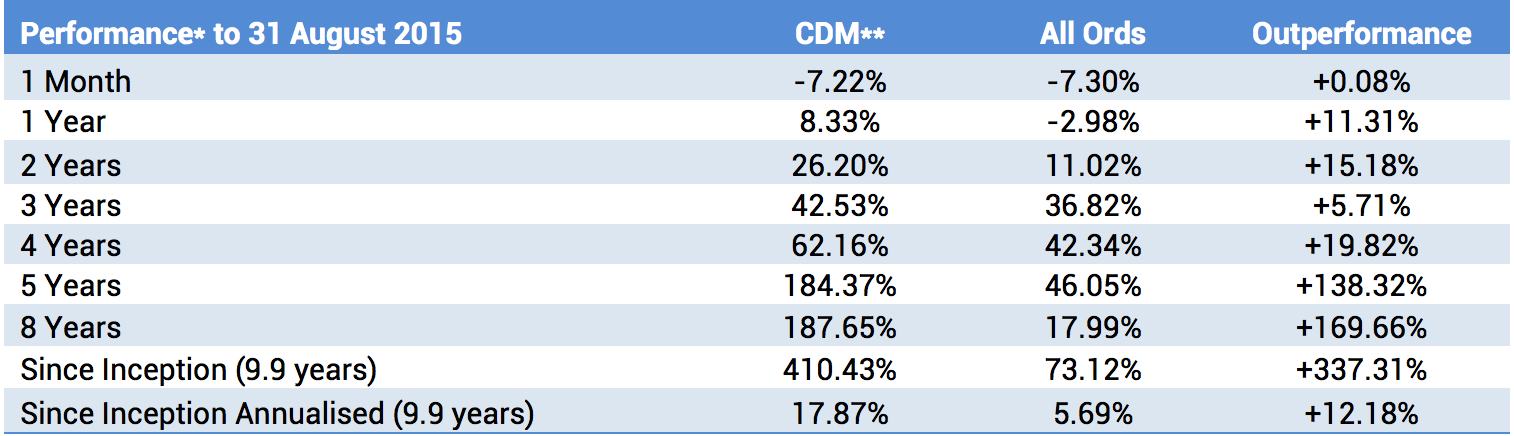

For the month of August 2015 Cadence Capital Limited returned a negative gross performance of 7.22% compared to a decrease in the All Ordinaries Accumulation Index of 7.30% and a decrease in the Small Ordinaries Accumulation Index of 4.87%.

Over the past 12 months Cadence Capital Limited has returned a positive gross performance of 8.33% outperforming the All Ordinaries Accumulation Index by 11.31% and outperforming the Small Ordinaries Accumulation Index of 17.95%. For the financial year to date Cadence Capital Limited has returned a negative gross performance of 0.93% outperforming the All Ordinaries Accumulation Index by 2.44% and outperforming the Small Ordinaries Accumulation Index by 2.46%.

The company is pleased to announce it raised $119 million through its Options exercise. The Directors showed continued commitment to the Company, exercising $12.8 million Options.

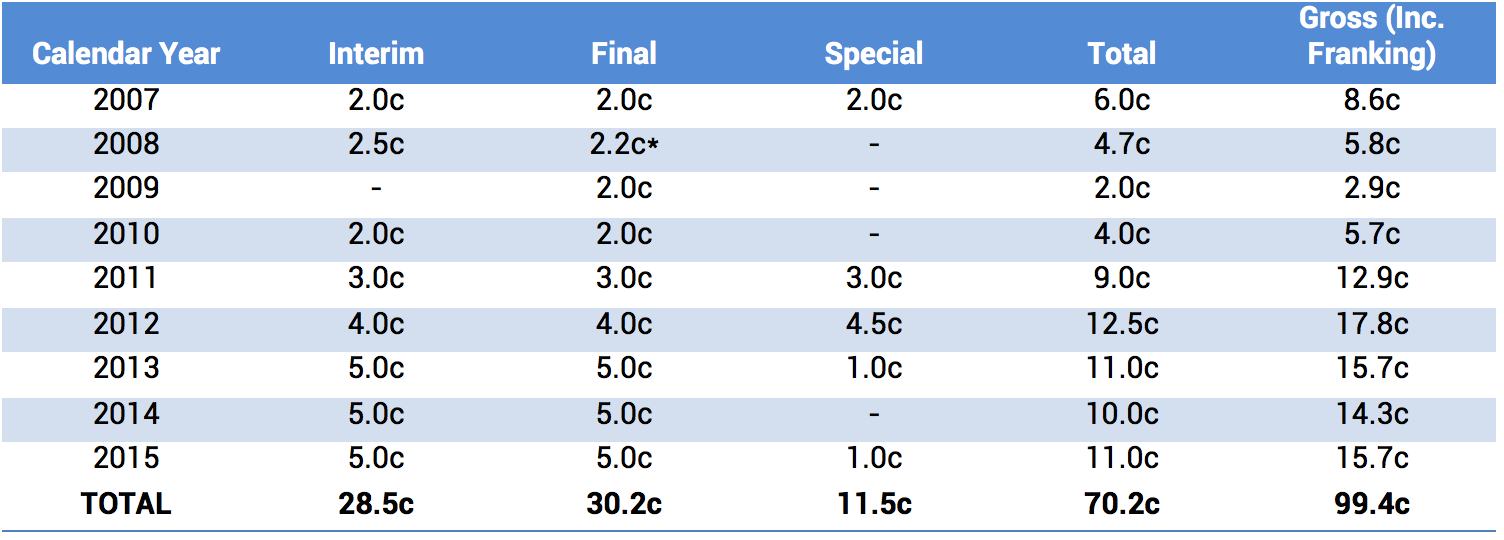

All shareholders, including those who exercised options, will be entitled to the 6.0 cent fully franked year-end dividend. The Ex-Date for the dividend is 20th October 2015 and the Payment Date is 29th October 2015. Based on the CDM share price at the 31st August 2015 this equates to a 7.6% fully-franked yield, or a 10.9% yield grossed up for franking credits.

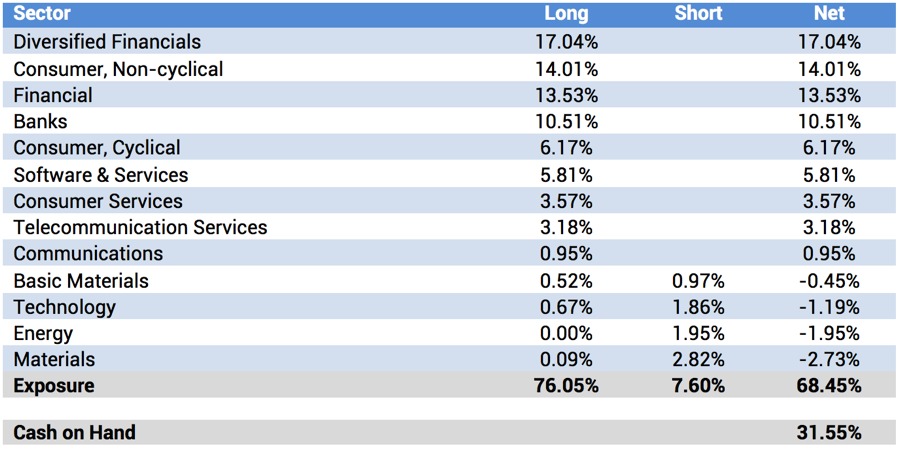

As at the 31st August 2015 the fund was holding 32% cash (68% invested).

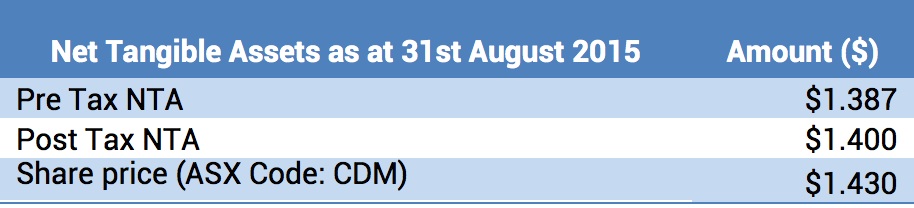

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

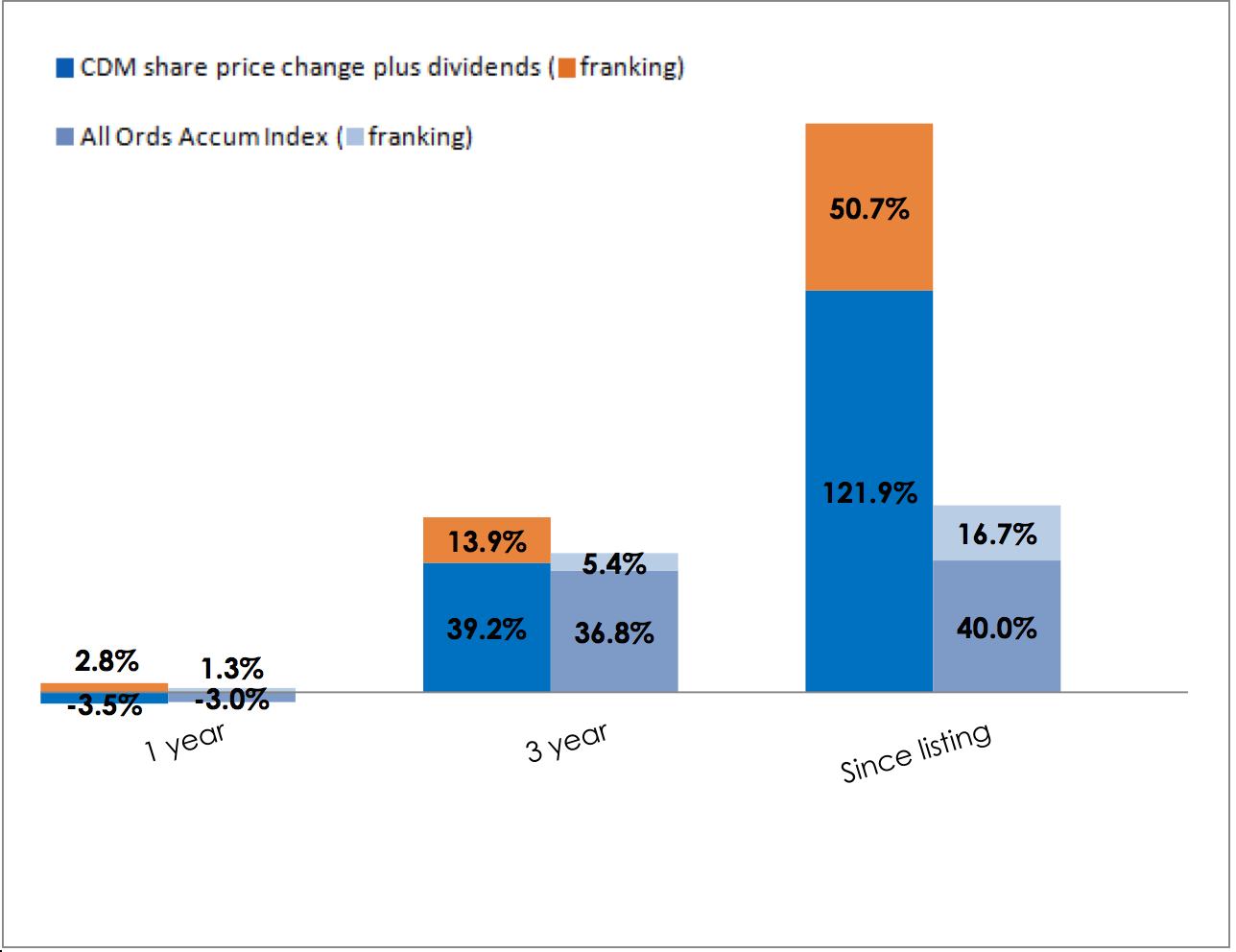

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

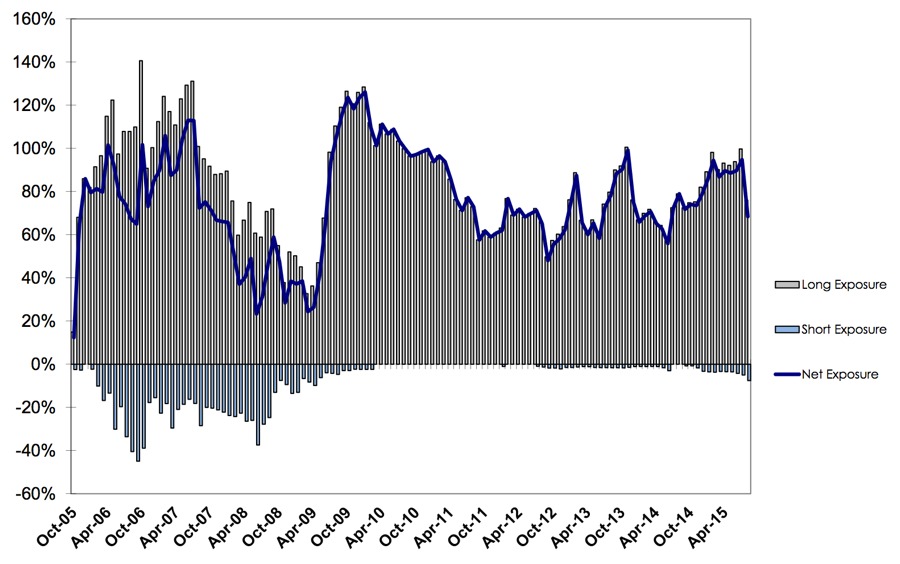

Historic Portfolio Exposure

Portfolio Sector Analysis

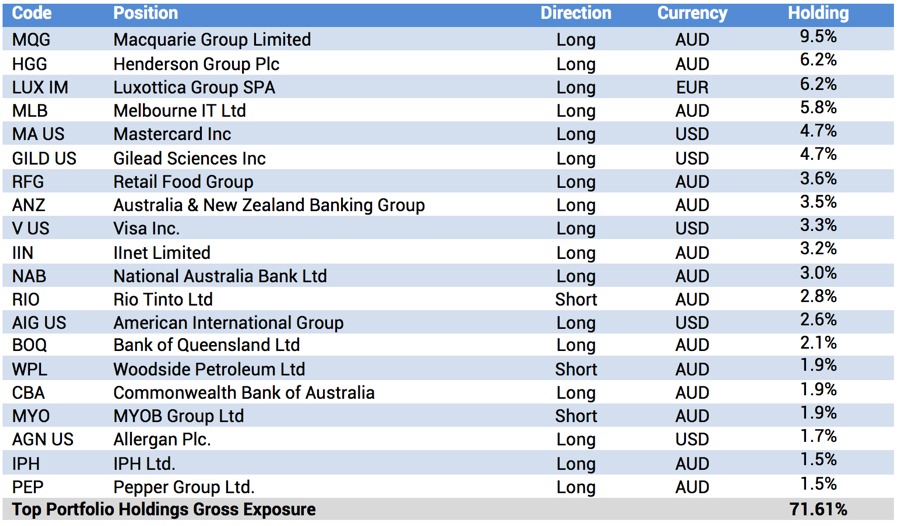

Top Portfolio Positions

Recent News Articles

Independent Investment Research rates CDM “Recommended Plus”. Read the report.

Karl Siegling was featured in a series of Livewire videos where he discussed global and local trends, as well as specific stocks (MPL, RHC, QAN, APN, BKL).

Cadence Capital portfolio manager Simon Bonouvrie was quoted in the AFR – Big four banks mauled in bear market.

Karl Siegling was quoted in the AFR – Macquarie Group’s Nicholas Moore sees cities as the focal point for future income and The Australian – The numbers stack up: Siegling’s high-conviction fund returns 18pc.

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.