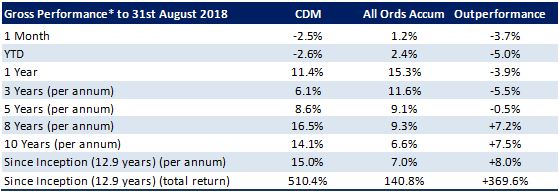

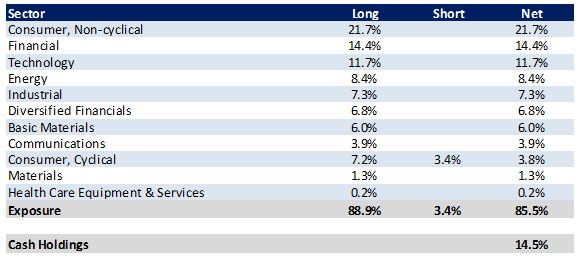

For the month of August 2018, Cadence Capital Limited returned a negative gross performance of 2.5%. compared to an increase in the All Ordinaries Accumulation Index of 1.2%. As at the 31st August 2018 the fund is 85.5% invested (14.5% cash).

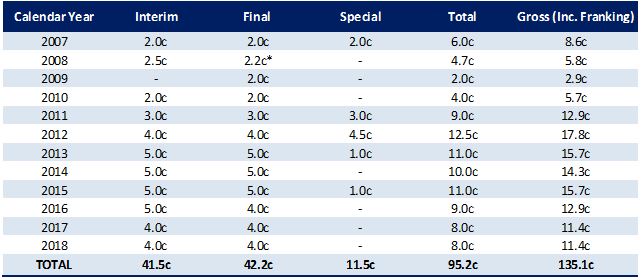

On the 7th August 2018, the Company announced a 4.0 cent fully franked final dividend. This equates to a 6.4% annual fully franked yield (9.1% gross yield) based on the CDM share price as at 30th June 2018 of $1.25. The Ex-Date for the dividend is the 7th September 2018 and the payment date is the 17th September 2018.

Please refer to the ‘News’ section for an update on reporting season and our positions.

Over the coming months, Cadence intends to list a new investment company, Cadence Opportunities Fund (ASX:CDO), that follows Cadence Capital’s proven Fundamental and Technical research process whilst trading more actively within established shorter duration trends. Cadence Capital Limited (ASX:CDM) shareholders will be offered a priority allocation in the Initial Public Offering (IPO).

To register your interest for the upcoming IPO*, visit

https://www.cadencecapital.com.au/register-your-interest-upcoming-ipo/

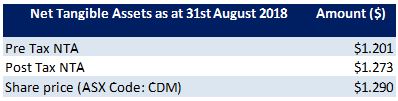

Fund NTA

* The board has declared a 4 cent fully franked dividend going Ex on the 7th September 2018.

Fund Performance

* Gross Performance: before Management and Performance Fees

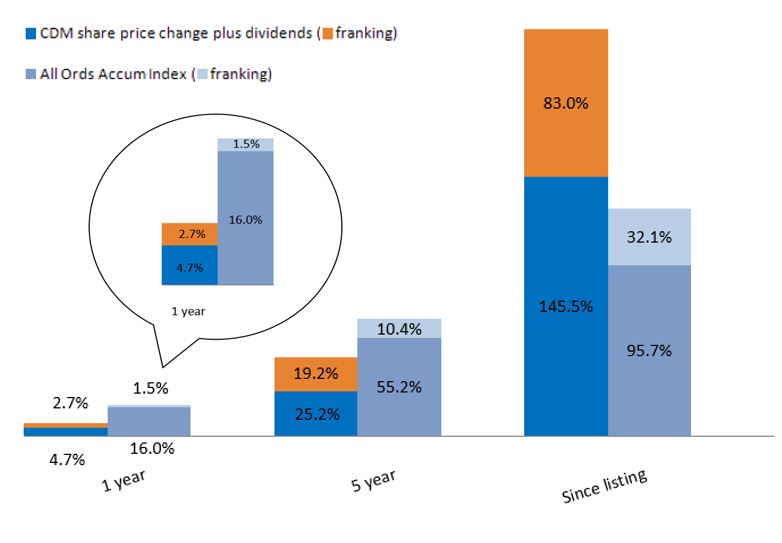

CDM Share Price and Option Returns plus Dividends & Franking

Fully Franked Dividends Declared Since Listing

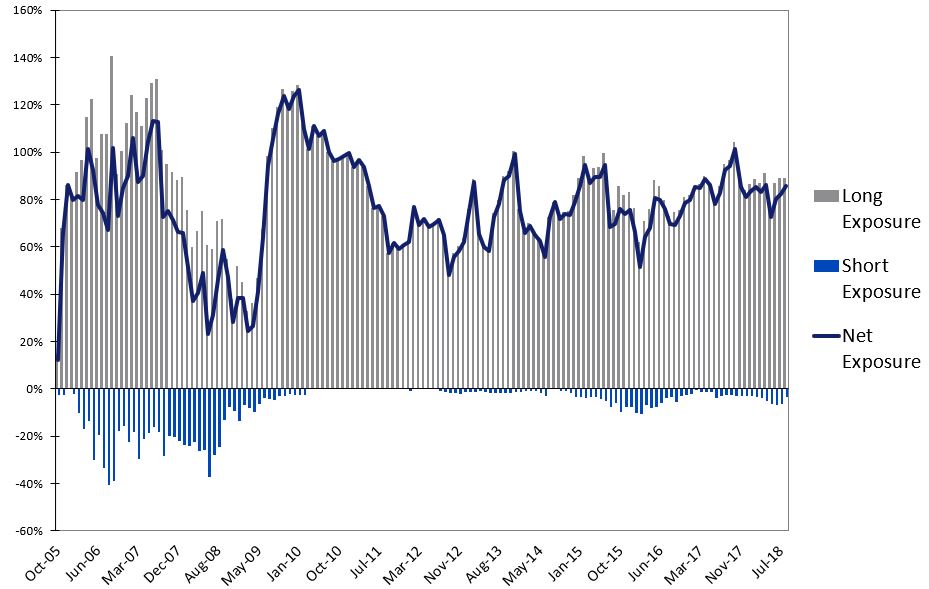

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Position

Recent News

Cadence Opportunities Fund

Over the coming months, Cadence intends to list a new investment company, Cadence Opportunities Fund (ASX:CDO), that follows Cadence Capital’s proven Fundamental and Technical research process whilst trading more actively within established shorter duration trends. Cadence Capital Limited (ASX:CDM) shareholders will be offered a priority allocation in the Initial Public Offering (IPO).

To register your interest for the upcoming IPO*, visit

https://www.cadencecapital.com.au/register-your-interest-upcoming-ipo/

Reporting Season

Generally speaking, the portfolio performed well through the reporting season with most stocks posting results that were in line or ahead of expectations. The positions which were the largest positive contributors to performance for the period included Credit Corp Group Limited, Macmahon Holdings Limited, Homeloans Limited, Aurelia Metals Limited, and Mayne Pharma Group Limited. One notable exception was the half year results for ARQ group (formerly Melbourne IT). Whilst the actual half year result was close to our numbers and the full year guidance was around 5% below our expectations, the guidance for the years ahead was revised downwards, although still reflecting positive and healthy growth. The market interpreted this guidance poorly and the stock price fell around 30% during the month. The stock now has a $300M enterprise value with normalised EBITDA of around $40M putting the company on approximately 7.5 times EV/EBITDA. We believe this is a very low multiple for the earnings stream ARQ delivers.

Australian Shareholders Association

We will be presenting at the Australian Shareholder’s Association Listed Investment Companies Showcase on the 5th October in Brisbane, 10th October in Sydney and 12th October in Melbourne. Should you wish to attend any of these presentations please click here to register your interest.

We encourage you to visit our 56 books you should read before buying your next stock page on our website.

To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.

We welcome any of your friends or colleagues that you feel may benefit from our monthly Cadence Capital Limited Newsletter. Please click here to refer a friend by supplying their name and email address.