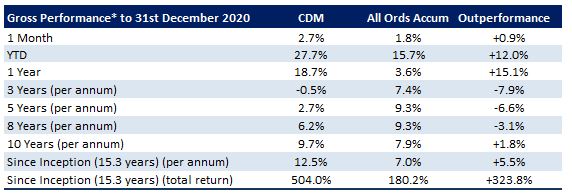

Cadence Capital Limited returned a positive gross performance of 2.7% in the month of December, compared to the All Ordinaries Accumulation Index which was up 1.8% over the same period. The Company has had a strong start to FY21 with the fund up 27.7% over the first six months of the year, outperforming the All Ordinaries Accumulation Index by 12%. The top contributors to performance during 1H21 were Resimac, Pinterest, Lynas, Money3, AP Eagers, Pointsbet, Credit Corp, ARB Corp, Redbubble, Qualcomm and Reece. The largest detractors from performance were short positions in Wisetech Global and Jumbo Interactive.

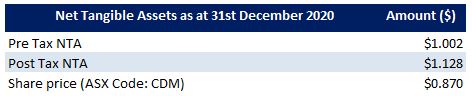

We are pleased to note that the CDM share price discount to NTA has been improving in recent months. The CDM discount to pre-tax NTA is currently around 13%, which compares with the nearly 40% discount reached at the panic lows in March. We are also pleased to see buying interest returning from both new and past CDM shareholders. The CDM share price is up more than 150% (including dividends but excluding franking) since the March lows of 35 cents where the company’s shares were trading below cash backing. The Company’s tax asset per share is currently around 13 cents, from around 18 cents per share at FY20 year end. The Company can utilize this tax shield as and when it so choses to.

We remain focused on continuing to reduce CDM’s discount to NTA. The Company has continued to implement its on-market share buy-back which increases the NTA per share for all existing CDM shareholders. The Company has now bought back 21 million shares for total consideration of $15.1m or $0.72 per share. Board and management, who are the largest investors in the Company, continue to add to their position in CDM.

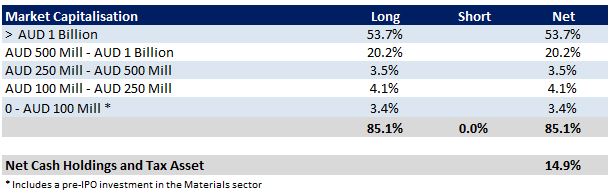

The fund has also made progress on its strategy to significantly improve liquidity and reduce concentration risk. More than 75% of the portfolio is currently able to be liquidated within 1 week, and over 85% of the portfolio can be liquidated within a month. The company currently holds around 60 positions with the largest position being around 7% of the fund. 63% of the funds’ positions are invested in Companies with >$1 Billion market capitalization.

In the coming weeks we will be releasing the December quarterly webcast which will discuss the fund’s positioning and outlook in more detail.

Fund NTA

Fund Performance

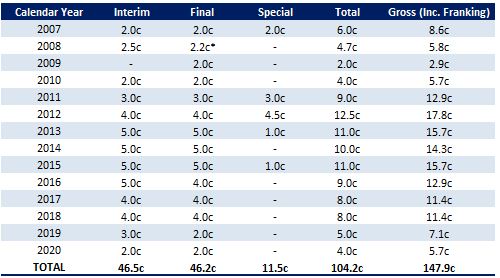

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

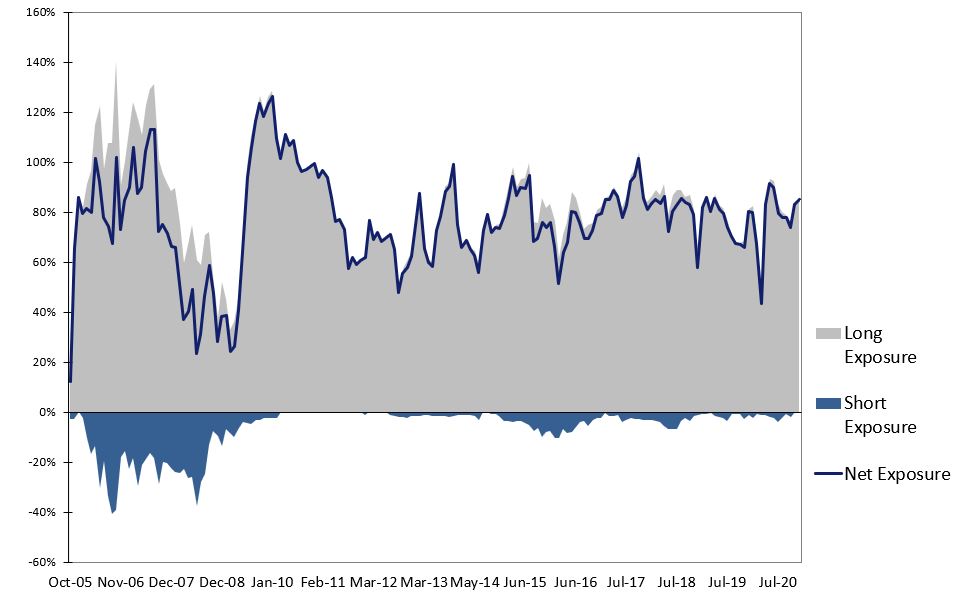

Historic Portfolio Exposure

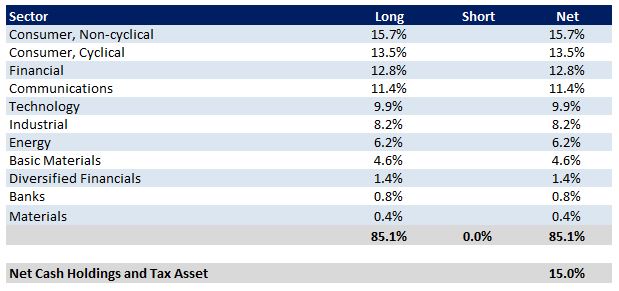

Portfolio Sector Analysis

Top 20 Portfolio Positions

Portfolio Market Capitalisation Analysis

Recent News

Cadence Capital Limited held its AGM and Investor Briefing in November 2020. At the AGM and Investor Briefing, Chairman Karl Siegling firstly gave an update on the company’s performance and then discussed the CDM shares discount to NTA. Karl and portfolio managers Charlie Gray and Jackson Aldridge then discussed a number of the company’s current positions. Karl closes off the briefing with the outlook for 2021.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.