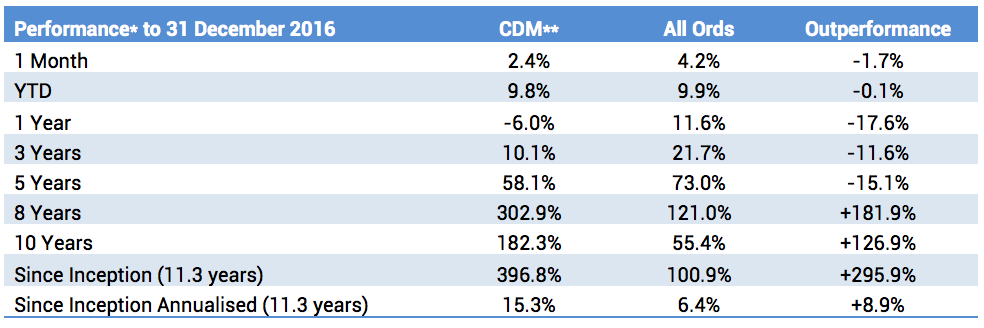

For the month of December 2016 Cadence Capital Limited returned a positive gross performance of 2.4% compared to an increase in the All Ordinaries Accumulation Index of 4.2%. For the first half of this financial year, Cadence Capital Limited has returned a positive gross performance of 9.8% compared to an increase in the All Ordinaries Accumulation Index of 9.9%.

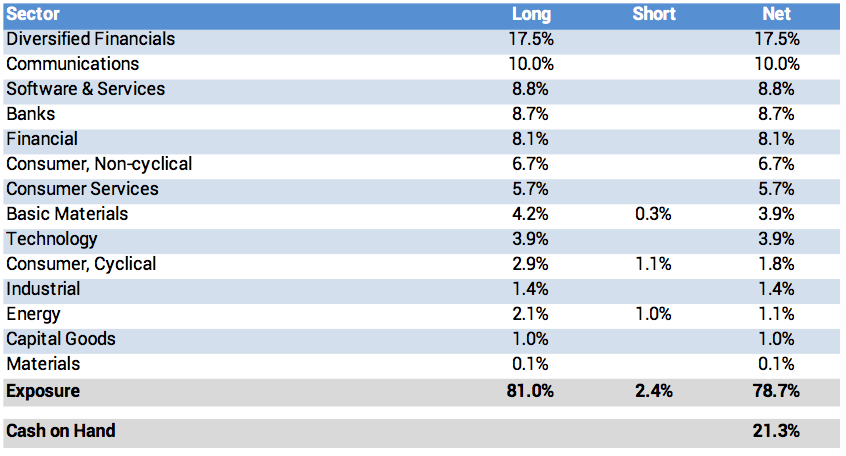

As at the 31st December 2016 the fund was holding 21% cash (79% invested).

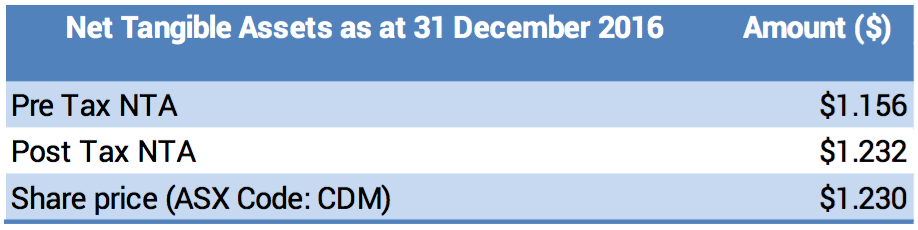

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

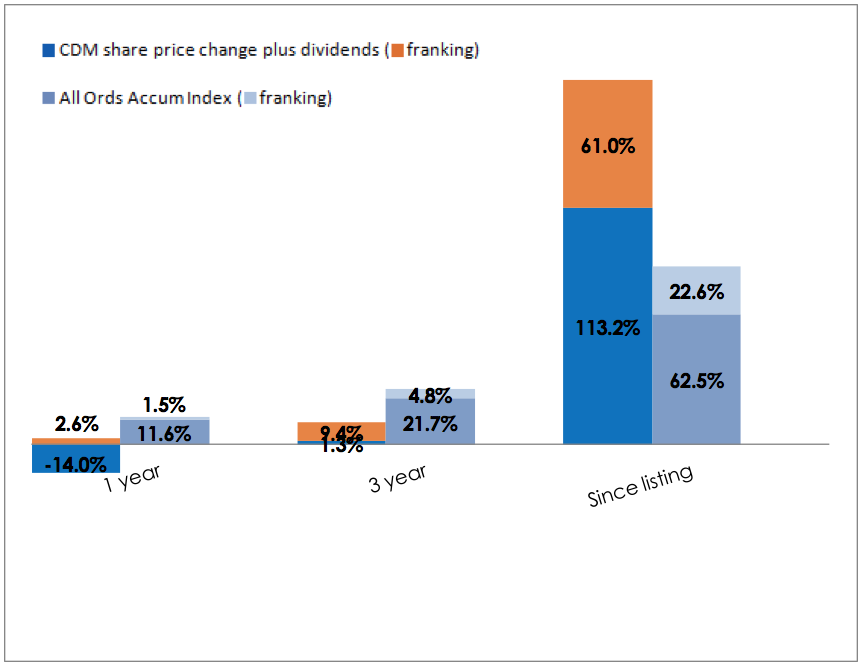

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

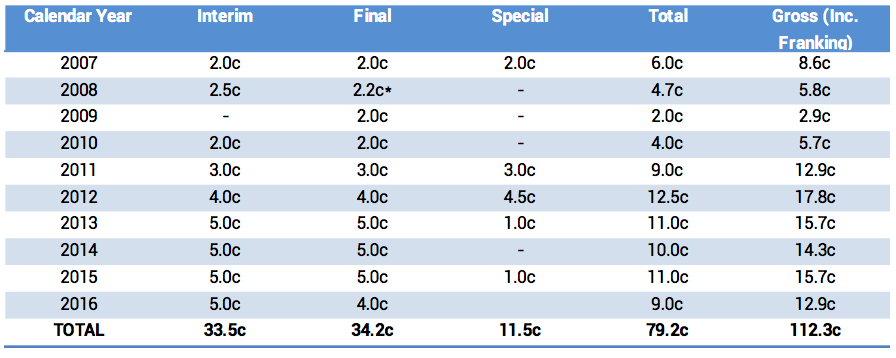

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

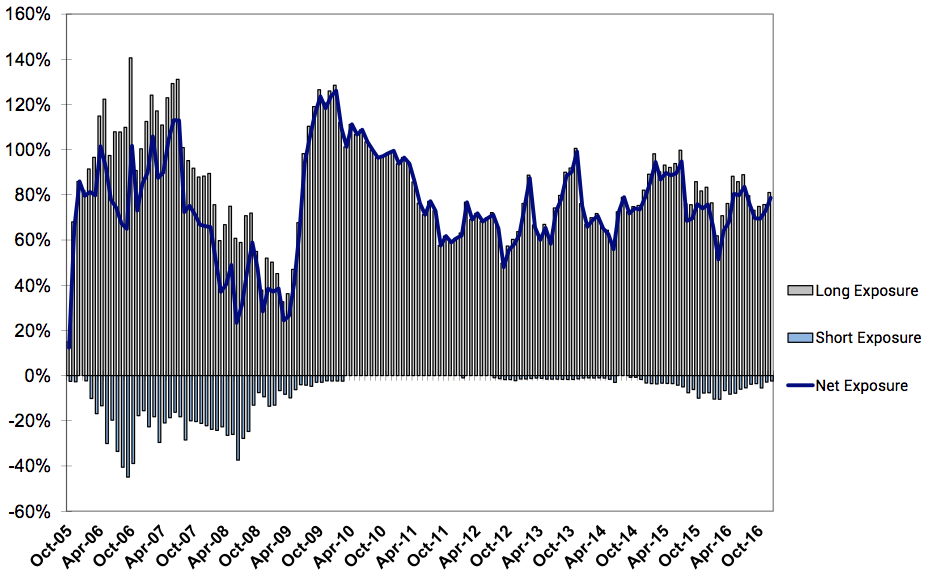

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Karl Siegling was featured in the latest Under the Radar Report discussing the reversal of the downward trend in resource stocks. View the Under the Radar excerpt here.

The Cadence Capital Limited 2016 AGM and Investor Briefing was held in November 2016. Karl Siegling and Chris Garrard, Portfolio Managers of Cadence Capital Limited, gave an update on the Company’s performance, discussed some of the Company’s stock holdings and discussed the outlook for 2017. Click here to watch the AGM & Investor Briefing webcast.

Please also find on our website a recently added book review ‘Masters of the Market – Secrets of Australia’s leading sharemarket investors’. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.