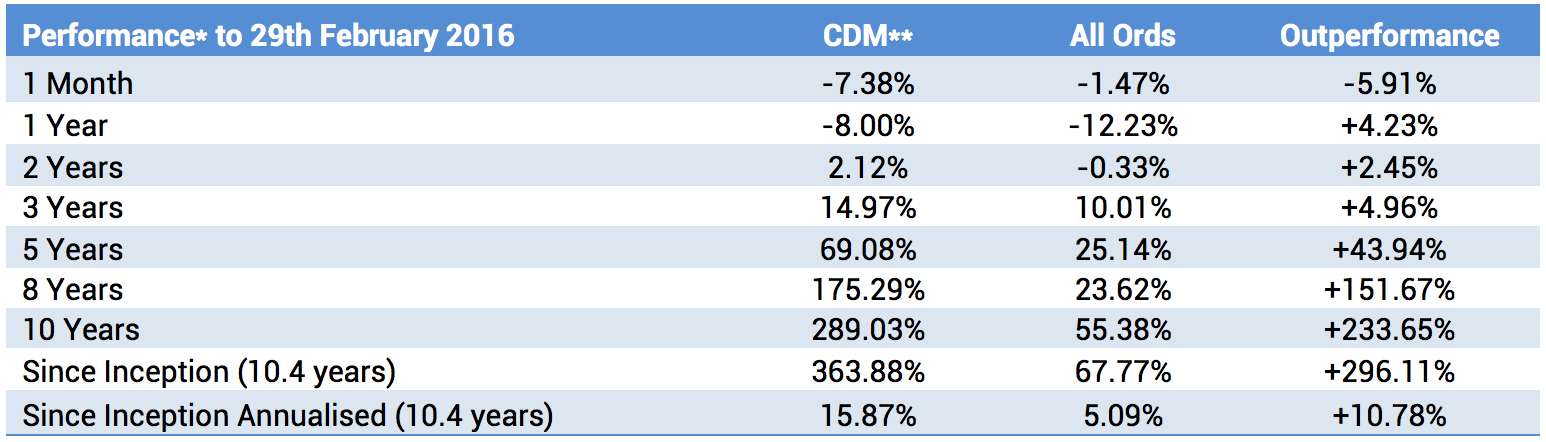

For the month of February 2016 Cadence Capital Limited returned a negative gross performance of 7.38% compared to a decrease in the All Ordinaries Accumulation Index of 1.47%. Over the past 12 months Cadence Capital Limited has returned a negative gross performance of 8.00% compared to a decrease in the All Ordinaries Accumulation Index of 12.23%.

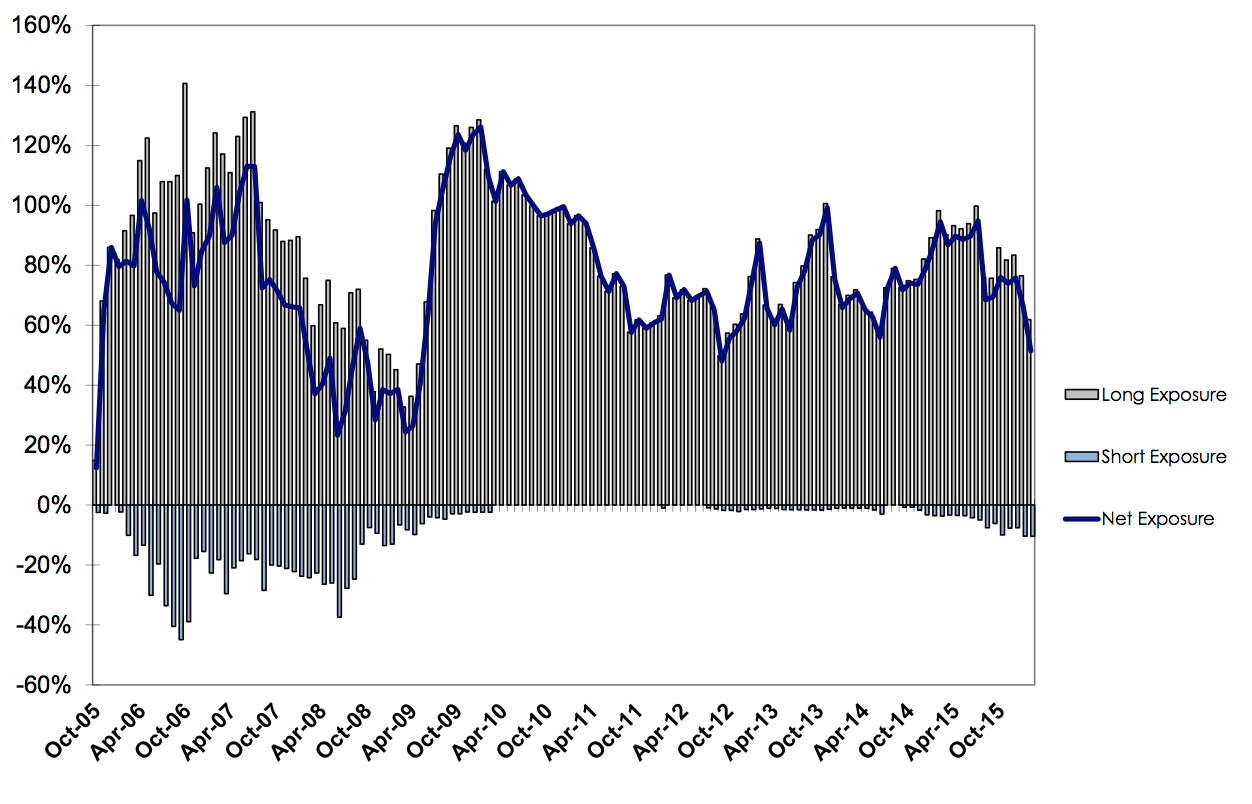

The 2016 year has begun with high volatility and a number of important long term trends have been tested. These include commodity prices, energy prices, the Australian dollar, diversified financials and the banks. As always we reduce exposure when trends change and increase exposure again when trends re-establish themselves. These volatiles periods negatively affect our investment process but the gains to be made when trends are re-established more than offset these losses.

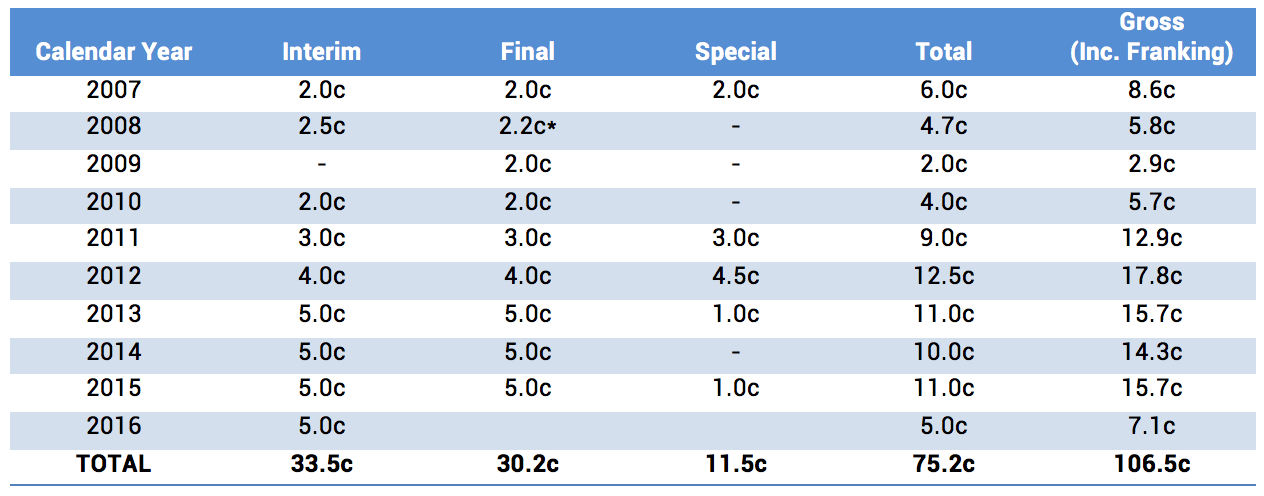

On 16th February 2016, the Company declared a 5.0 cent fully franked interim dividend to be paid on 12 May 2016. The Ex-Date for this dividend is 27 April 2016 and the Record Date is 28 April 2016. CDM shareholders are able to participate in the Dividend Re-Investment Plan (“DRP”) at a 3% discount. The DRP Record Date is 2 May 2016.

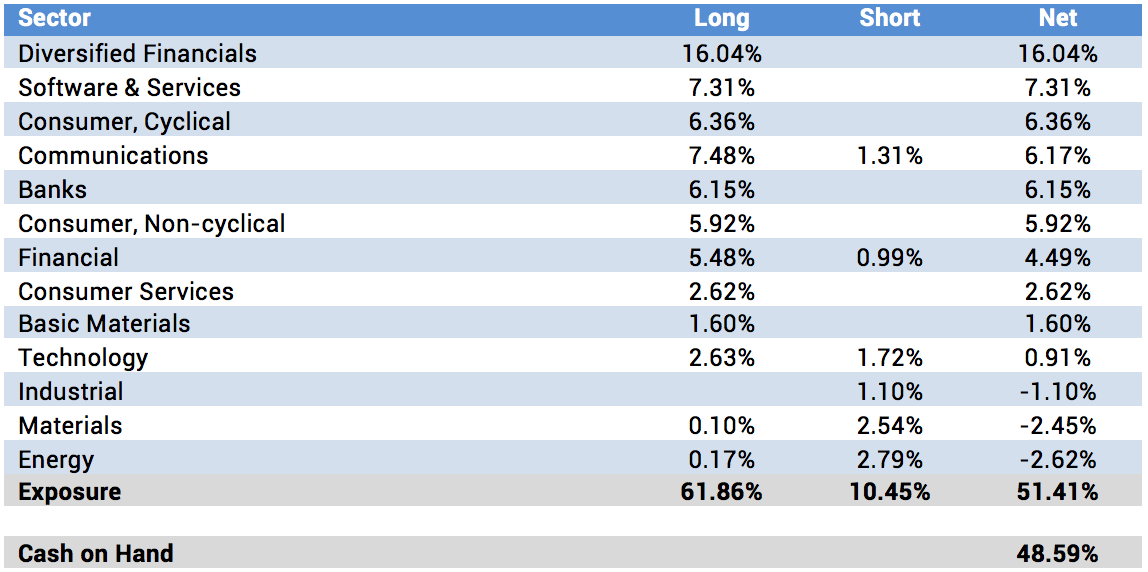

As at the 29th February 2016 the fund was holding 49% cash (51% invested).

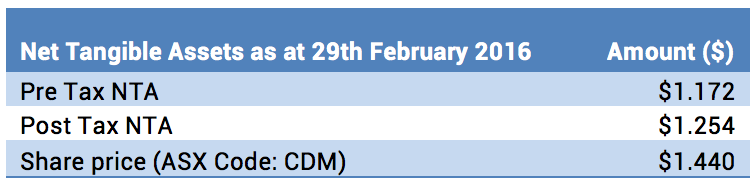

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

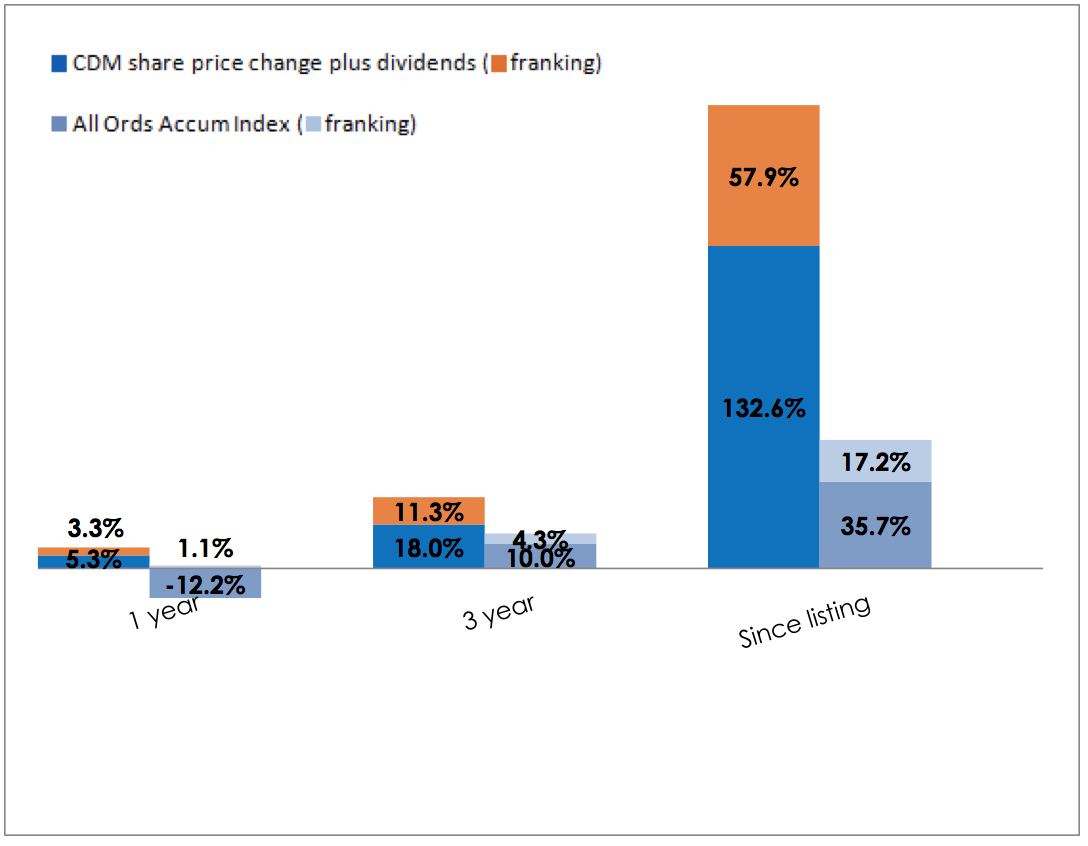

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Karl Siegling participated in the latest Under The Radar report, where he discussed some of the stocks he’s interested in and why.

Karl Siegling was quoted by the AFR and questioned whether the market prices are leading fundamentals.

We’ve added reviews to our 52 Books You Should Read Before Buying Your Next Stock section, including How To Make Money In Stocks by William O’Neil, The Tipping Point by Malcolm Gladwell and Thinking, Fast and Slow by Daniel Kahneman.

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.