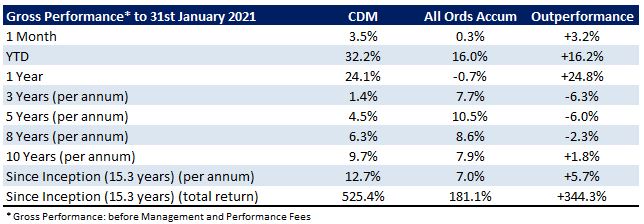

Cadence Capital Limited returned a positive gross performance of 3.5% in the month of January, compared to the All Ordinaries Accumulation Index which was up 0.3% over the same period. The Company has had a strong year so far with the fund up 32.2% over the first seven months of FY21, outperforming the index by 16.2%. For January, the top contributors to performance were Bed Bath & Beyond, Pointsbet Holdings, Lynas Corp, Redbubble and Tencent Music Entertainment. The largest detractors from performance were Genworth Financial and Electro Optic Systems.

In the coming weeks we will be releasing the December Half Year Webcast which will discuss the Company’s half year results, recent changes to the portfolio, current investment themes, and the outlook for the rest of the year.

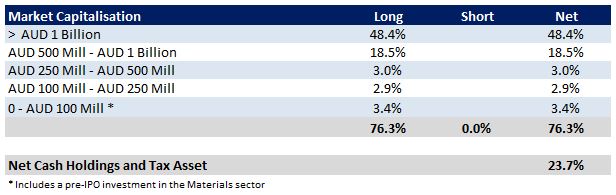

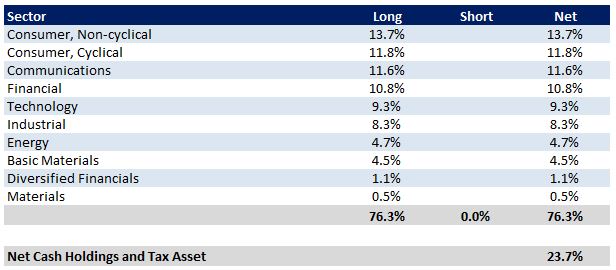

At 31 January 2021, the Company was 76.3% invested.

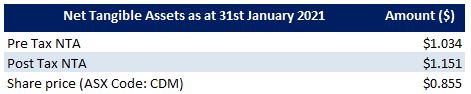

Fund NTA

Fund Performance

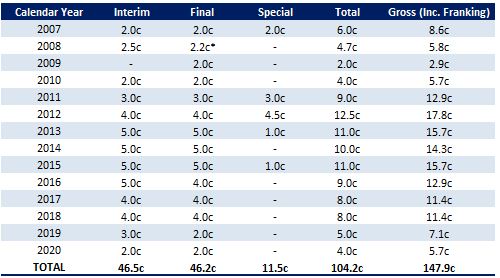

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

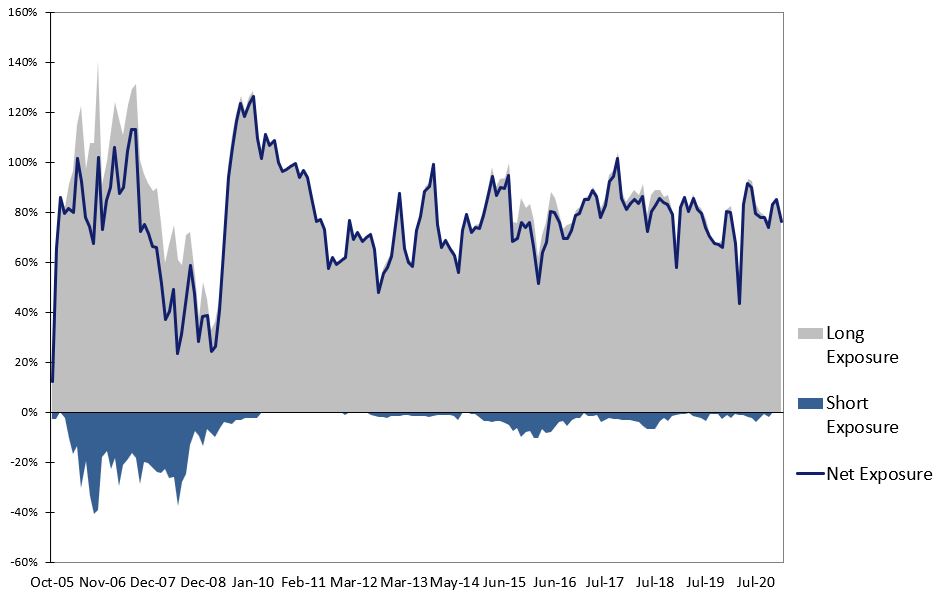

Historic Portfolio Exposure

Portfolio Sector Analysis

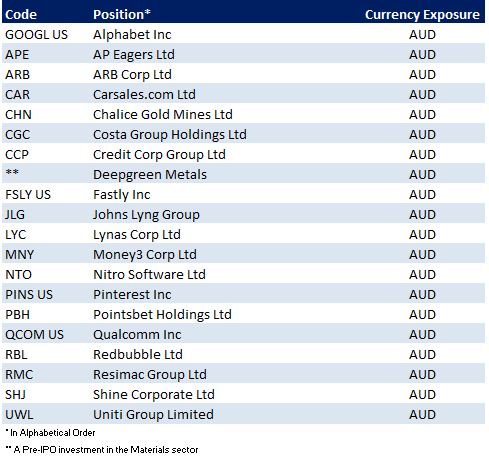

Top 20 Portfolio Positions

Portfolio Market Capitalisation Analysis

Recent News

Cadence Capital Limited held its AGM and Investor Briefing in November 2020. At the AGM and Investor Briefing, Chairman Karl Siegling firstly gave an update on the company’s performance and then discussed the CDM shares discount to NTA. Karl and portfolio managers Charlie Gray and Jackson Aldridge then discussed a number of the company’s current positions. Karl closes off the briefing with the outlook for 2021.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.