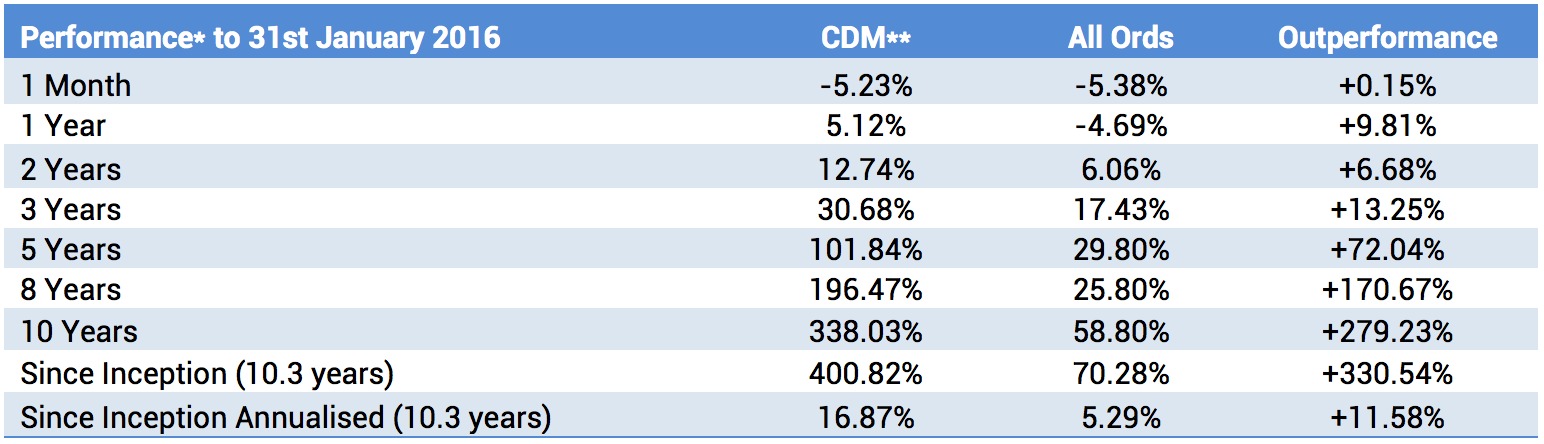

For the month of January 2016 Cadence Capital Limited returned a negative gross performance of 5.23% compared to a decrease in the All Ordinaries Accumulation Index of 5.38%. Over the past 12 months Cadence Capital Limited has returned a positive gross performance of 5.12% outperforming the All Ordinaries Accumulation Index by 9.81%.

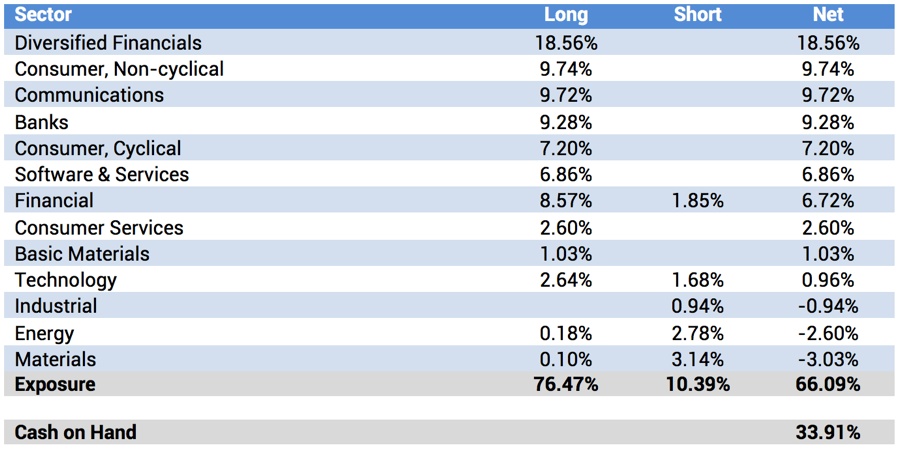

As at the 31st January 2016 the fund was holding 34% cash (66% invested).

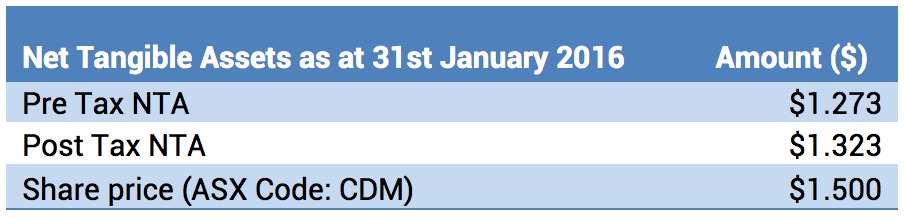

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

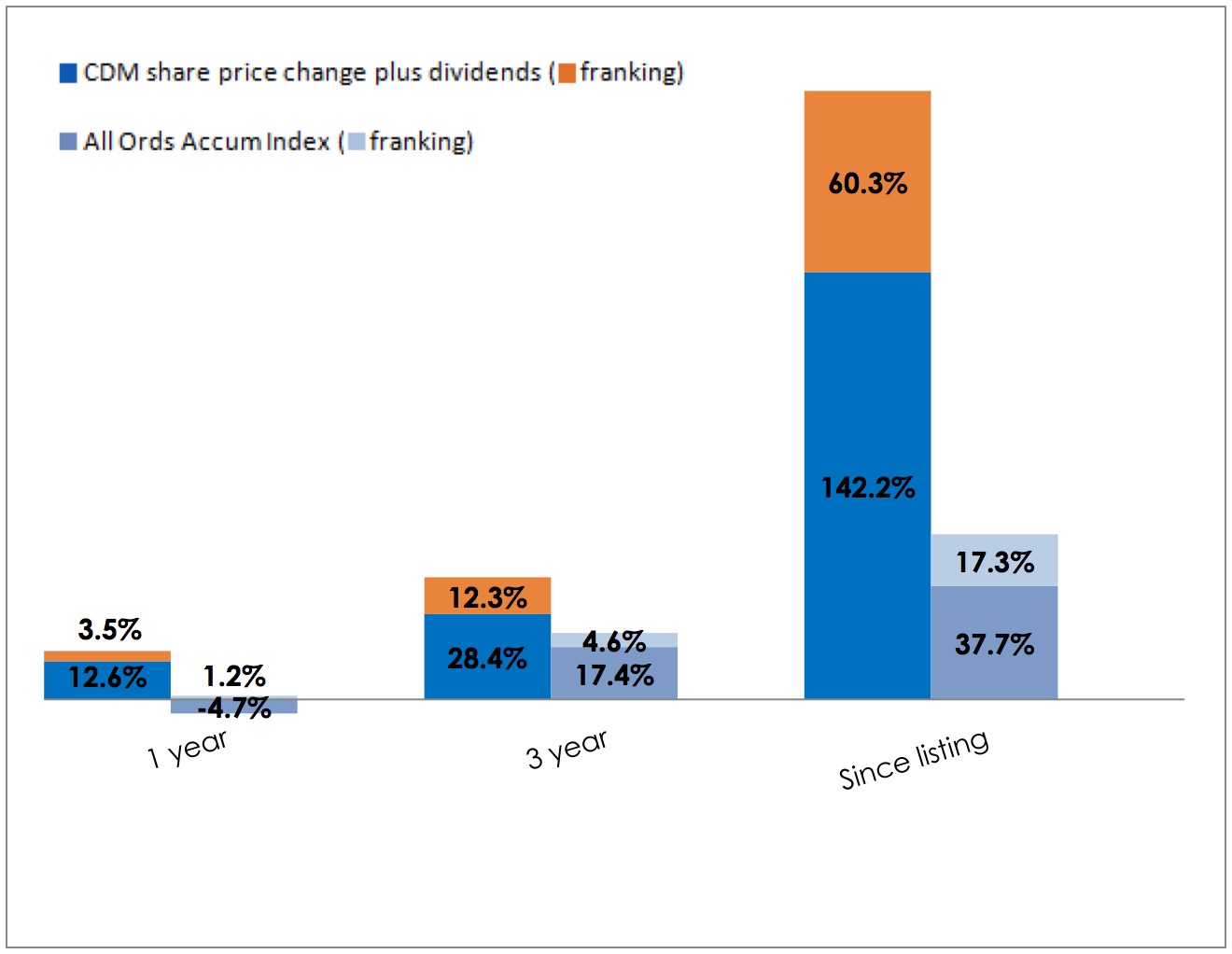

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

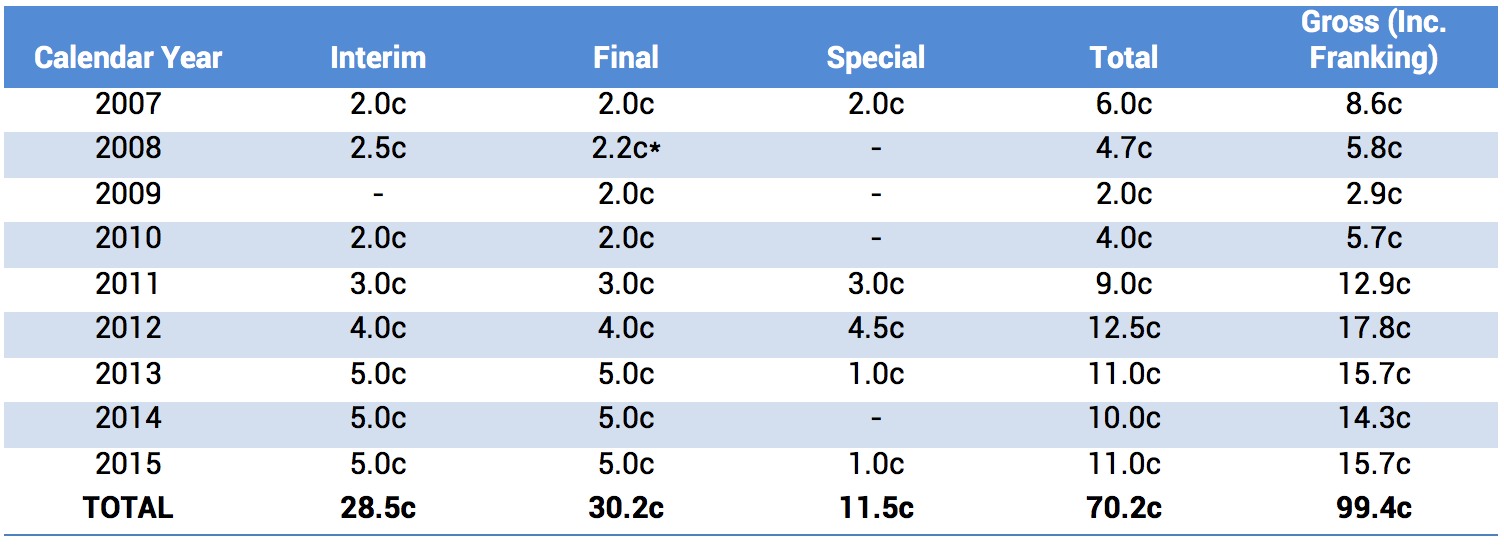

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

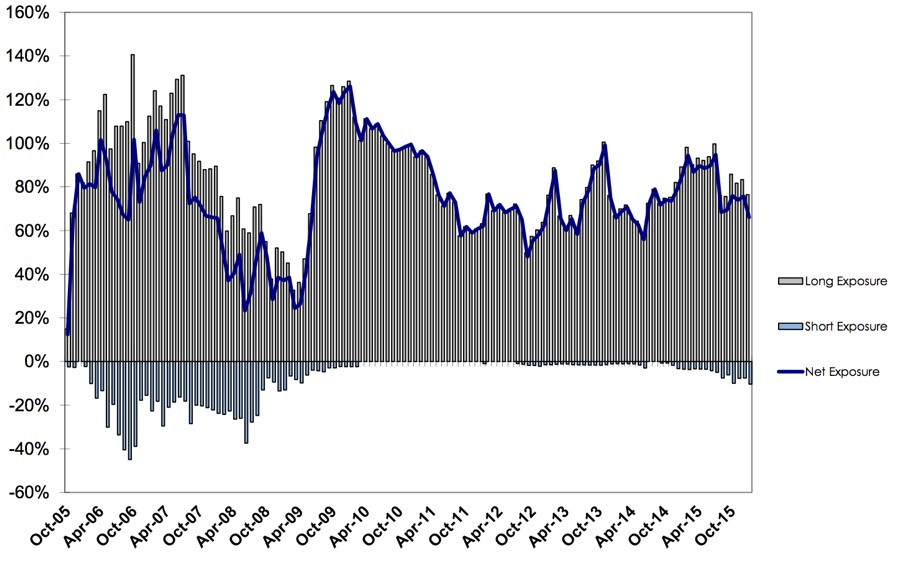

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Karl Siegling discussed the themes and trends that shaped investment returns in 2015, and whether they will hold true through 2016 in his latest interview with Livewire.

ShareCafe featured Cadence Capital Limited as one of the leading listed investment companies on the ASX.

Our 52 Books To Read Before Buying Your Next Stock section has been updated with new recommended titles such as Winning on Wall Street by Martin Zweig, The Alchemy of Finance by George Soros and The Tipping Point by Malcolm Gladwell.

Simon Bonouvrie explained how Cadence acts when a position experiences significant losses, and the importance of being proactive for Livewire’s latest Buy Side Brief.

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.