Cadence Capital Limited returned a negative performance of 1.0% during the month of January 2020 compared to an increase in the All Ordinaries Accumulation Index of 4.7%. For the month, the largest detractors from the performance were Resimac Group, Webjet and Strike Energy, whilst the largest contributors to the performance were Money3 Corporation and Link Administration. For the financial year to date, the largest contributors to performance are Resimac Group, Shine Corporation, Money3 Corp and Macquarie Group whilst the largest detractors from performance are Arq Group, Champion Iron and Ausnutria Dairy Corporation.

In the upcoming weeks the Company will release its half year results along with its half year webcast. The half year webcast will give shareholders a detailed update on the fund’s performance, the initiatives being undertaken to close CDM’s discount to NTA, and the current top positions of the Company. We will also be holding investor presentations in all major cities around Australia. We will be sending investors the details of these presentations as soon as the dates of these presentations are finalised.

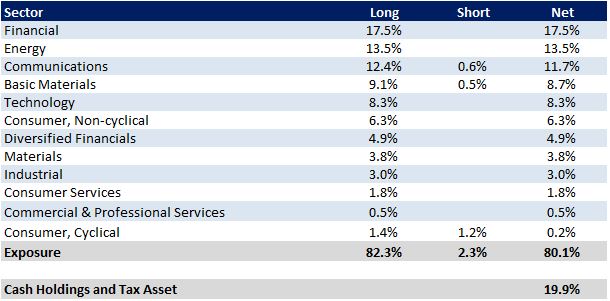

At 31st January 2020, the Company was 80.1% invested.

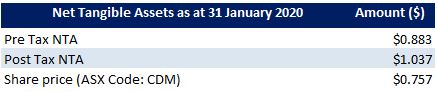

Fund NTA

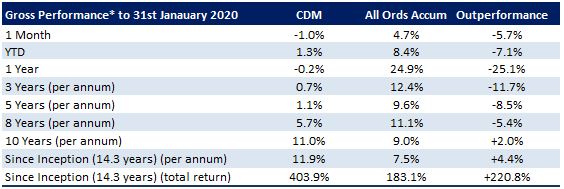

Fund Performance

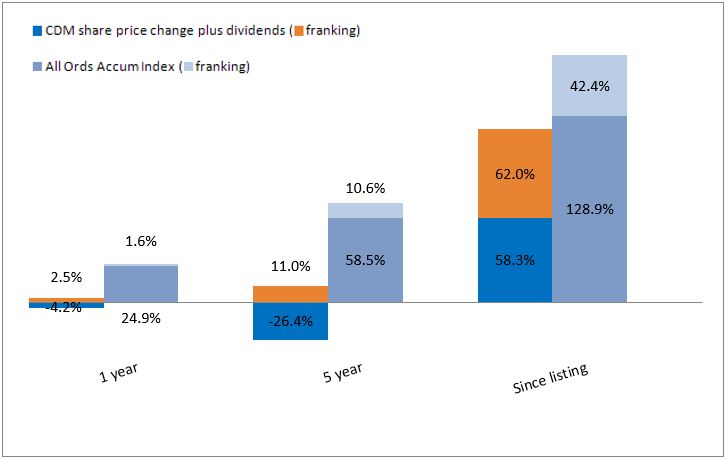

CDM Share Price and Option Returns plus Dividends & Franking

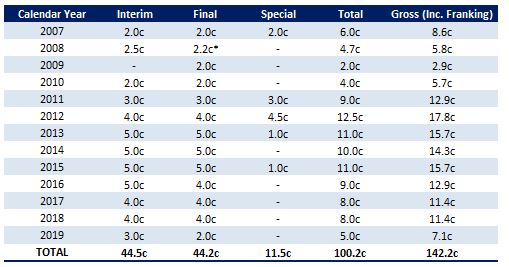

Fully Franked Dividends Declared Since Listing

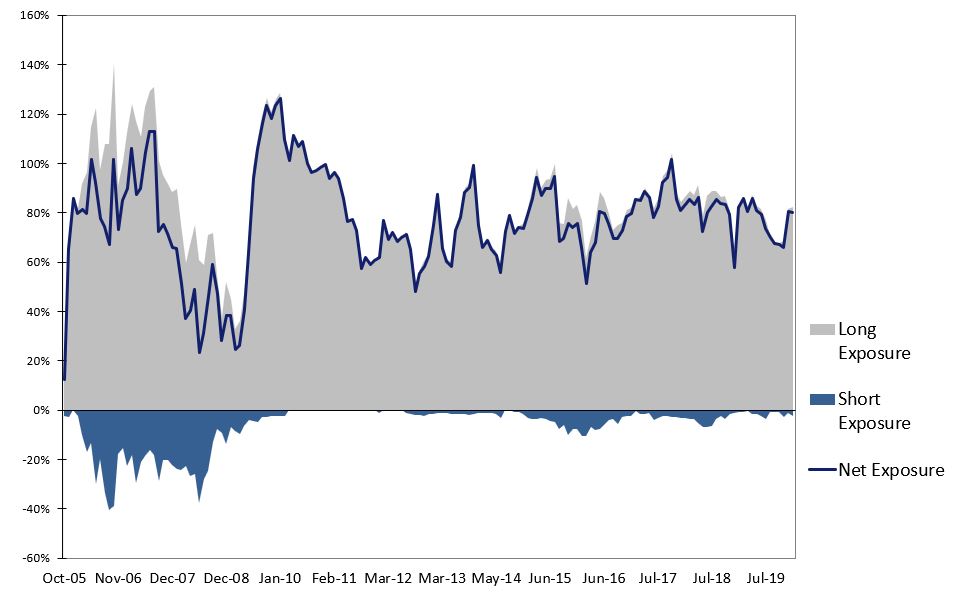

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Position

Recent News

At the AGM and Investor Briefing held in November, Chairman Karl Siegling firstly discusses the company’s performance over the past year and the opportunity which presents in the company’s shares trading at a discount to NTA. Independent director Jenelle Webster then discusses the corporate governance review that was undertaken during the year and the improvements that were made following the review. Lastly, Karl and portfolio managers Charlie Gray and Jackson Aldridge discuss a number of current portfolio positions as well as the outlook for 2020.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.

We welcome any of your friends or colleagues that you feel may benefit from our monthly Cadence Capital Limited Newsletter. Please click here to refer a friend by supplying their name and email address.