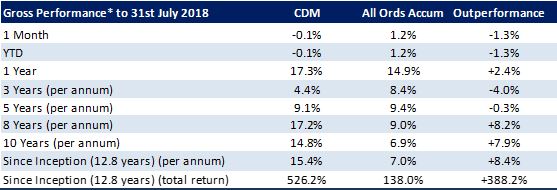

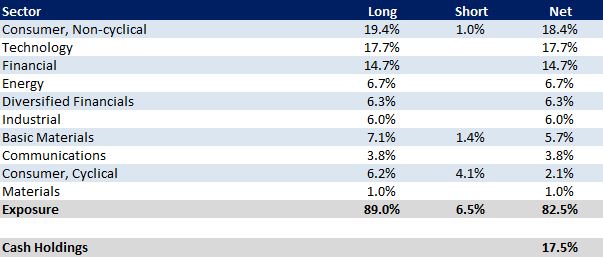

For the month of July 2018, Cadence Capital Limited returned a gross performance of -0.1%. compared to an increase in the All Ordinaries Accumulation Index of 1.2%. As at the 31st July 2018 the fund is 82.5% invested (17.5% cash).

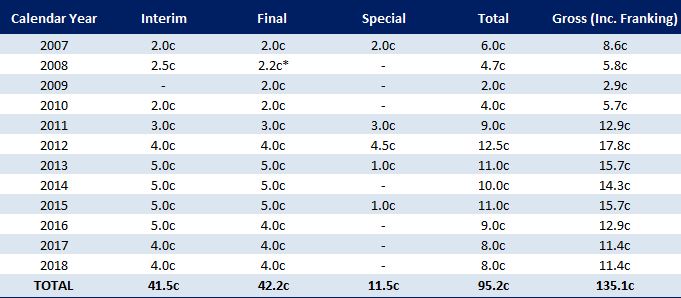

On the 7th August 2018, the Company announced a record full year profit after tax of $41.2 million for 2018 and a 4.0 cent fully franked final dividend. This equates to a 6.4% annual fully franked yield (9.1% gross yield) based on the CDM share price as at 30th June 2018 of $1.25. The Ex-Date for the dividend is the 7th September 2018 and the payment date is the 17th September 2018. Shareholders can participate in the Dividend Re-Investment Plan (“DRP”) at a 3% discount. The closing date for the DRP election is the 12th September 2018. If you would like to participate in the DRP, please complete the DRP Application Form and return it to our Share Registry, BoardRoom Pty Limited, by this date. Directors Karl Siegling and Wayne Davies intend to fully participate in the DRP.

Over the coming months, Cadence intends to list a new investment company, Cadence Opportunities Fund (ASX:CDO), that follows Cadence Capital’s proven Fundamental and Technical research process whilst trading more actively within established shorter duration trends. Cadence Capital Limited (ASX:CDM) shareholders will be offered a priority allocation in the Initial Public Offering (IPO).

To register your interest for the upcoming IPO*, visit

https://www.cadencecapital.com.au/register-your-interest-upcoming-ipo/

Fund NTA

Fund Performance

* Before Management and Performance Fees

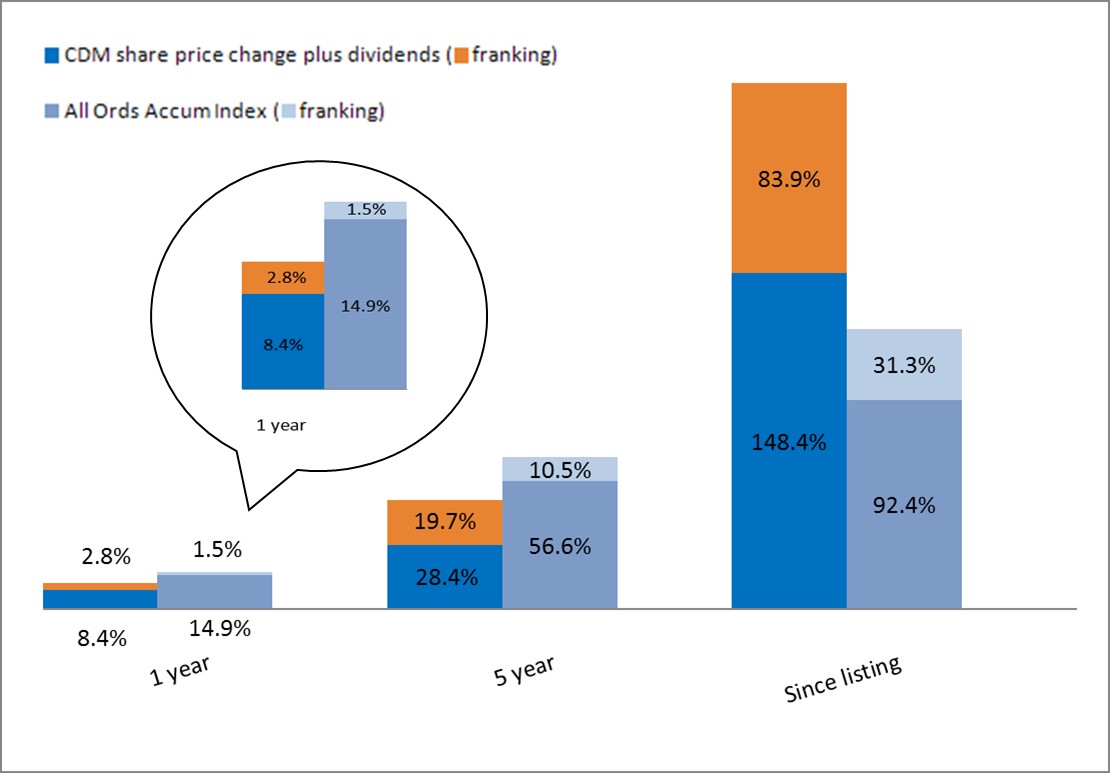

CDM Share Price and Option Returns plus Dividends & Franking

Fully Franked Dividends Declared Since Listing

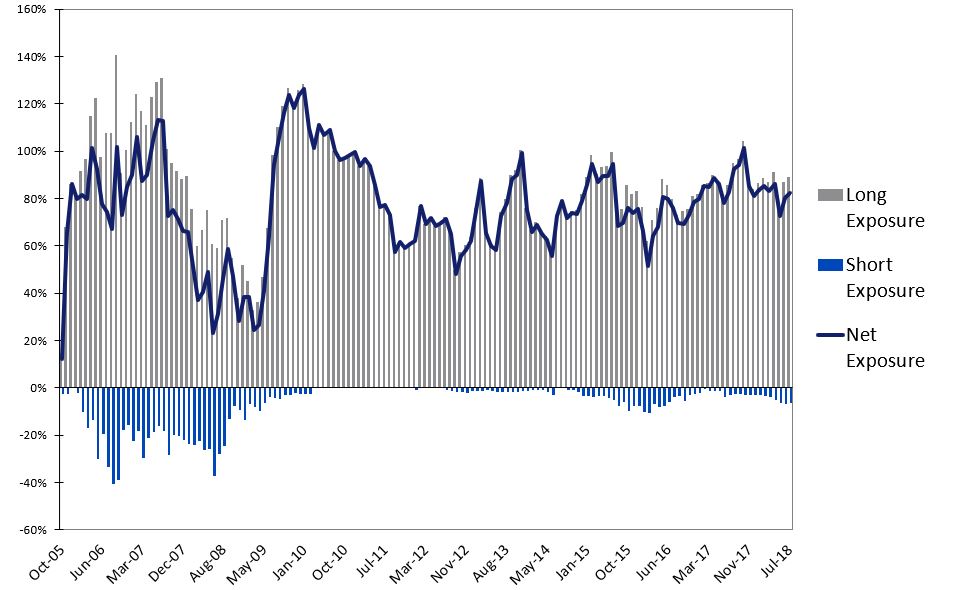

Historic Portfolio Exposure

Portfolio Sector Analysis

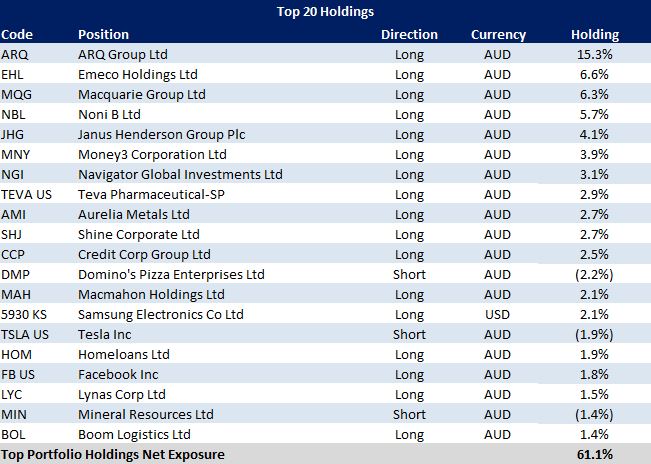

Top Portfolio Position

Recent News

Over the coming months, Cadence intends to list a new investment company, Cadence Opportunities Fund (ASX:CDO), that follows Cadence Capital’s proven Fundamental and Technical research process whilst trading more actively within established shorter duration trends. Cadence Capital Limited (ASX:CDM) shareholders will be offered a priority allocation in the Initial Public Offering (IPO).

The intended new offer has been in the media during the month including an interview with Informed Investor – Karl Siegling discusses the company’s upcoming LIC and an article in the AFR – Karl Siegling’s Cadence puts finishing touches on new $250m LIC.

To register your interest for the upcoming IPO*, visit

https://www.cadencecapital.com.au/register-your-interest-upcoming-ipo/

During the month Cadence’s 12-part Investing Series Article 9: A brief look at the Balance Sheet, Article 10: The industry – A crucial piece in stock evaluation and Article 11: Market Psychology, Emotions and… more…Emotions featured on Livewire.

We encourage you to visit our 56 books you should read before buying your next stock page on our website.

To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.

We welcome any of your friends or colleagues that you feel may benefit from our monthly Cadence Capital Limited Newsletter. Please click here to refer a friend by supplying their name and email address.