Cadence Capital Limited returned a negative gross performance of 1.4% in March, compared to the All Ordinaries Accumulation Index which was up 1.8% over the month. Financial year to date the fund is up 33.8% outperforming the index by 13.9%. The largest contributors to performance during March were Cettire, Maas Group and Uniti Group. The largest detractors from performance were Resimac Group, Pinterest and Zillow Group. At 31 March 2021, the Company was 71.0% invested.

In February, the Company announced its record half year results and declared a 2.0 cents fully franked interim dividend. This 2.0c interim dividend equates to a 4.5% annual fully franked yield, or a 6.5% gross yield (grossed up for franking credits) based on the CDM share price on the day of the announcement. The Ex-Date for the interim dividend is the 29th April 2021 and the payment date is the 13th May 2021. The dividend re-investment plan (DRP) will not be in operation for the interim dividend as the Company’s shares are trading at a discount to the underlying NTA per share of the Company.

Deepgreen Metals:

On the 5 March the Company updated shareholders on its investment in DeepGreen Metals via an ASX announcement. DeepGreen Metals announced that it intends to list through a merger with Sustainable Opportunities Acquisition Corporation (NYSE Code: SOAC). The combined company will be renamed The Metals Company and is expected to begin trading under the NYSE ticker code TMC.

The DeepGreen Metals investment is approximately 2.8% of the portfolio, and is valued at the weighted average cost of the most recent purchases made in FY2020. The proposed listing is at a valuation substantially higher than our current valuation. The transaction reflects a pro forma equity value for The Metals Company (TMC) of approximately US$2.9 billion and enterprise value of US$2.4 billion. The recent raising of US$330 million was completed at a price of US$10 per share. Our investment is currently valued at US$1.38 per share. Upon listing this would equate to a substantial uplift in Pre and Post Tax NTA for CDM shares. This transaction is subject to shareholder and court approvals. Once the TMC shares are listed and trading freely we will value this investment at market price.

Importantly, the Company’s weekly and monthly NTA announcements will not include the full value accretion of the DeepGreen transaction until the proposed TMC listing.

A summary of the proposed merger transaction is available on both the DeepGreen Metals company website or on the SEC website . We will keep shareholders informed of the progress of this listing through ASX announcements and monthly newsletter announcements.

Fund NTA

* NTA’s do not include the accretion of the DeepGreen Metals transaction announced on 5th March 2021

Fund Performance

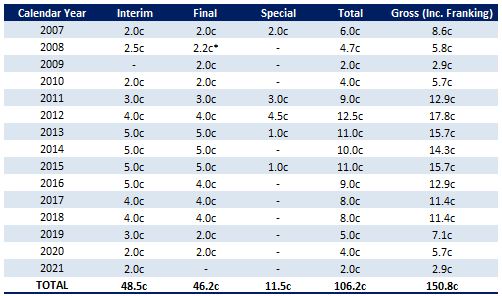

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

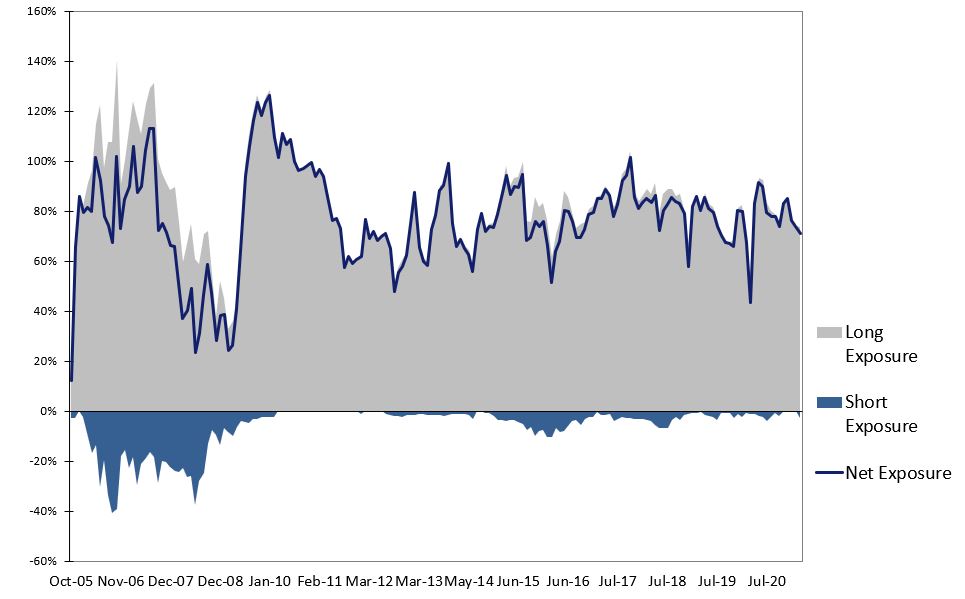

Historic Portfolio Exposure

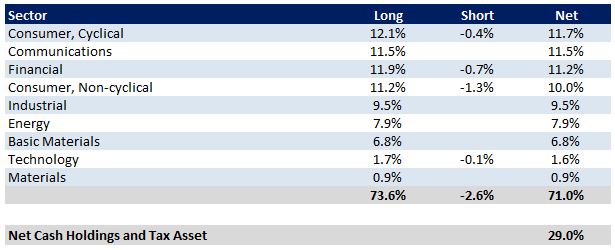

Portfolio Sector Analysis

Top 20 Portfolio Positions

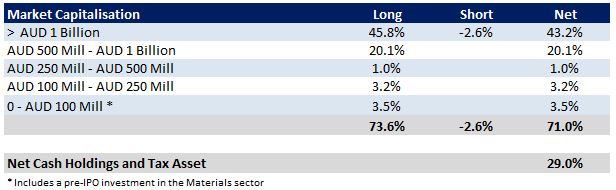

Portfolio Market Capitalisation Analysis

Recent News

The Company released its December 2020 Half Year Webcast. In this webcast, Karl Siegling gives an update on the company’s performance and the portfolio’s composition. Jackson Aldridge and Charlie Gray then discuss the portfolio’s top 20 positions and current investment themes. Karl then gives an update on DeepGreen Metals and finishes with the outlook for 2021.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.