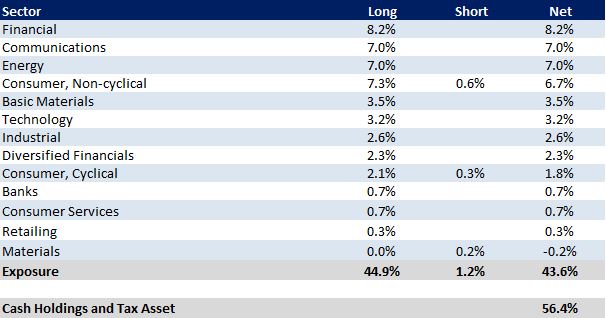

Cadence Capital Limited returned a negative performance of 16.6% during the month of March 2020 compared to the All Ordinaries Accumulation Index which was down 20.9% during the same period. Global financial markets fell over 30% in the span of four weeks, signalling that major indices entered their first bear market since the Global Financial Crisis. At 31st March 2020, the Company was 43.6% invested. Since the March month-end we have started to deploy cash and have scaled into a number of new and existing positions that have begun to recover. At the time of writing the Company was 67% invested.

In February the Company declared a 2.0 cents fully franked interim dividend. This 2.0c interim dividend currently equates to a 7.8% annual fully franked yield, or a 11.1% gross yield (grossed up for franking credits) based on the CDM share price at the time of writing this newsletter (14th April 2020). The Ex-Date for the interim dividend is the 29th April 2020 and the payment date is the 13th May 2020.

On the 23rd March the Company released its March 2020 Quarterly Audiocast. In this Audiocast, Karl Siegling provided an update on recent market movements, the Company’s performance, exposure levels and its cash holdings. He then discussed the upcoming dividend and the CDM’s discount to NTA. He closed by discussing the current outlook for the market and the Company. Due to COVID-19 the Company has decided that it will be holding its upcoming investor presentations online. The details of these presentations will be announced once finalised.

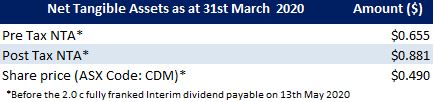

Fund NTA

Fund Performance

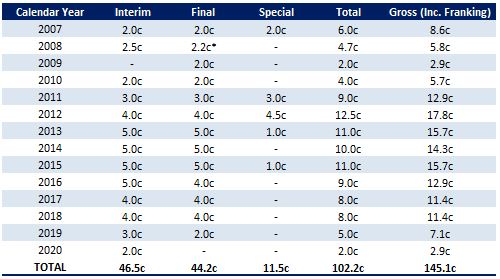

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

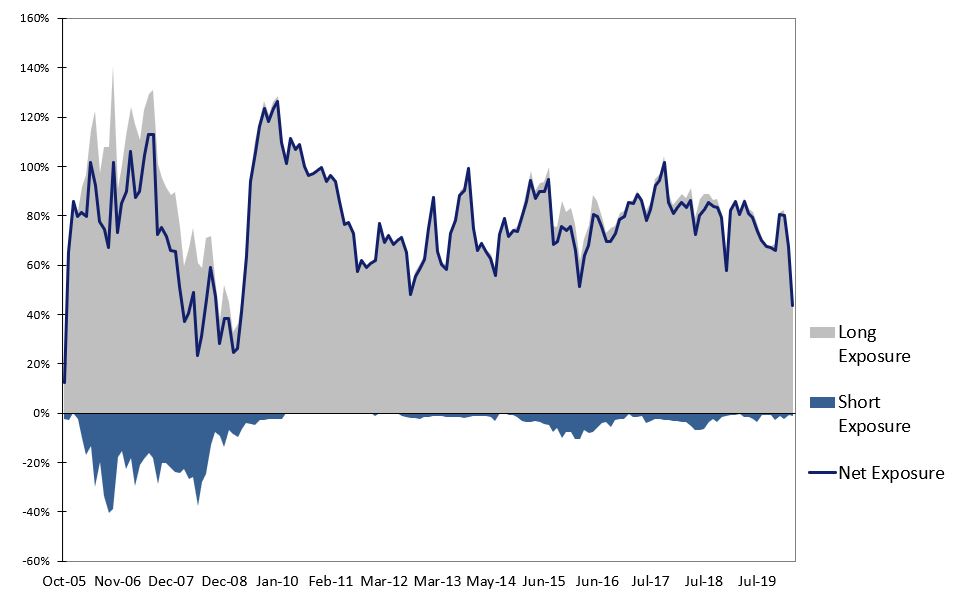

Historic Portfolio Exposure

Portfolio Sector Analysis

Top 20 Portfolio Positions

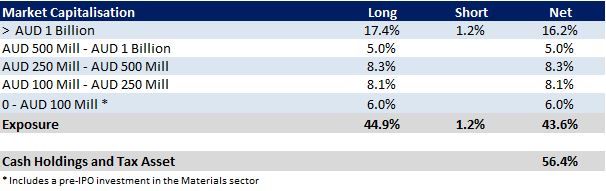

Portfolio Market Capitalisation Analysis

Recent News

At the AGM and Investor Briefing held in November, Chairman Karl Siegling firstly discusses the company’s performance over the past year and the opportunity which presents in the company’s shares trading at a discount to NTA. Independent director Jenelle Webster then discusses the corporate governance review that was undertaken during the year and the improvements that were made following the review. Lastly, Karl and portfolio managers Charlie Gray and Jackson Aldridge discuss a number of current portfolio positions as well as the outlook for 2020.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.

We welcome any of your friends or colleagues that you feel may benefit from our monthly Cadence Capital Limited Newsletter. Please click here to refer a friend by supplying their name and email address.