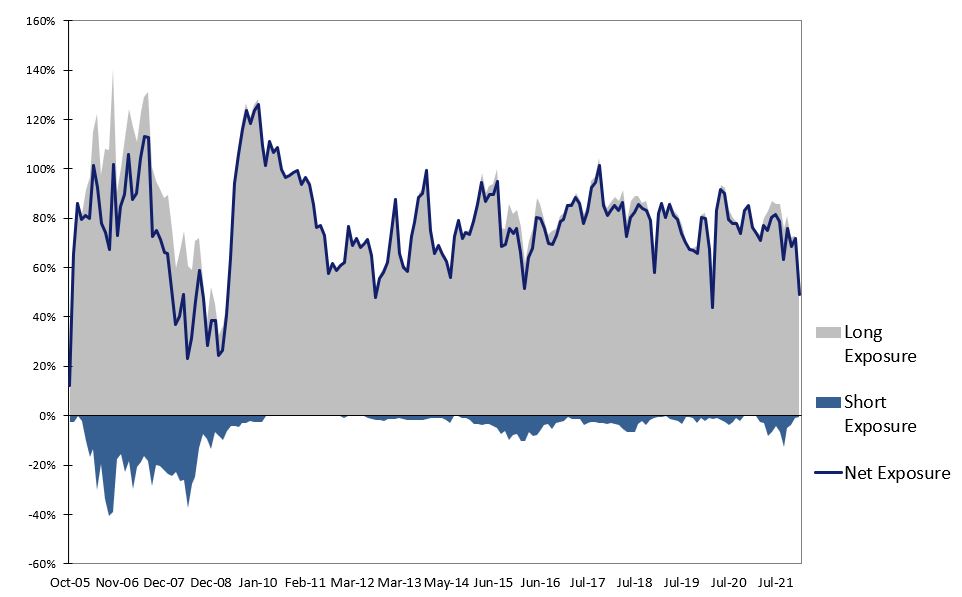

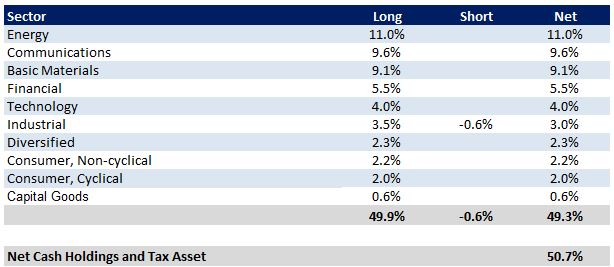

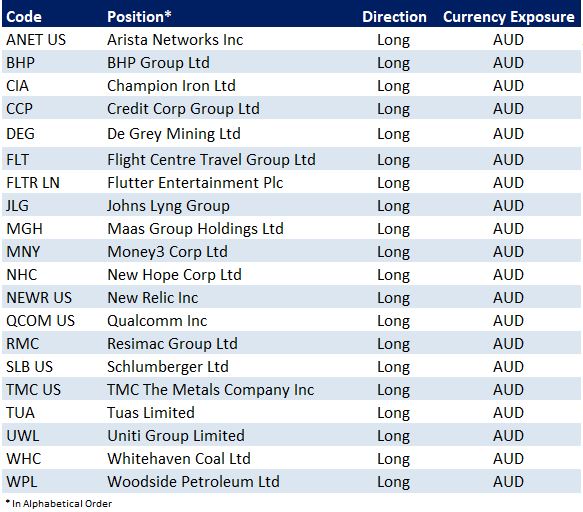

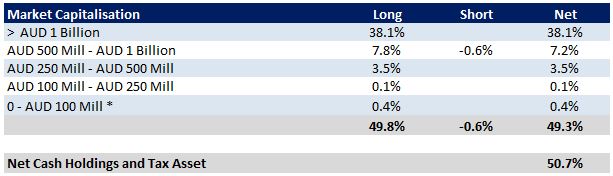

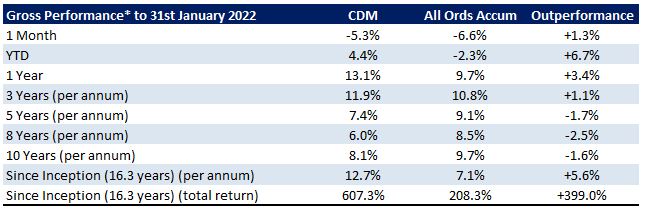

Cadence Capital Limited was down 5.3% in January outperforming the All Ordinaries Accumulation Index by 1.3%. For the past 12 months the fund is up 13.1% compared to the All Ordinaries Accumulation Index which is up 9.7%. For January the top contributors to performance were Champion Iron, BHP Group and Doordash Inc. The largest detractors from performance were TMC The Metals Co., Johns Lyng Group, Gamestop and Money3 Corp. As at 31 January 2022, the Company was 49.3% invested (50.7% cash and equivalents).

Risk-off sentiment from December continued into January with global equity markets falling between 5-10% during the month. The selling was broad-based, with stocks that had held up in prior months, such as mega-cap stocks in the US and large-cap stocks on the ASX, also declining. Portfolio cash levels increased significantly as the fund scaled out of positions which rolled over. Increased shorting activity was also a feature and contributed positively to returns. The trend towards energy and resources and other sectors that benefit from high inflation and increasing interest rates continued in January. The fund added to existing positions and initiated new positions across these sectors which continue to meet our criteria, as well as increasing our exposure selectively to other areas of emerging strength such as the travel sector.

Half Year Audiocast

In the coming week we will be releasing the December 2021 half year audiocast which will discuss the Company’s first 6 months performance, its portfolio composition, its current investment themes and holdings, and the outlook for the rest of the year.

Fully Franked Half Year Dividend

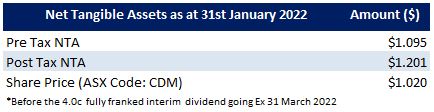

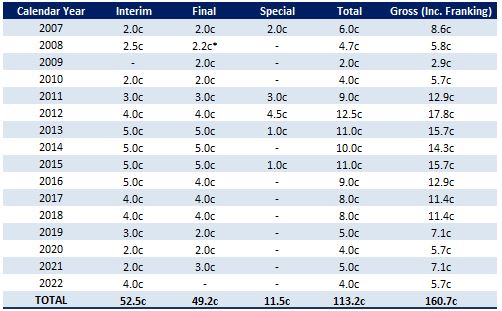

On the 13th January the Board declared a 4.0 cents fully franked half year dividend, an increase of 100% over the previous half year dividend. This interim dividend equates to an 8.2% annualised fully franked yield or a 11.7% gross yield (grossed up for franking credits) based on the share price on the date of the announcement of $0.98 per share. Importantly this equates to a 7.3% dividend yield based on the current pre-tax NTA, as the Company shares are currently trading at a discount to NTA despite the fund’s recent strong performance and a 16-year track record of significant outperformance against the All Ordinaries Accumulation Index. After paying this dividend the Company still has 30 cents per share of profits reserves to pay future dividends.

The Dividend Reinvestment Program (DRP) will be operational for the half year dividend. There will be no DRP discount applied. Shares will be issued at the weighted average of the prevailing share price over the relevant pricing period. If you are not registered for the DRP and you would like to participate, please contact Boardroom on 1300 737 760.

The Ex-Date for the dividend is the 31st March 2022. The payment date for the dividend is the 14th April 2022.

Fund NTA

Fund Performance

Fully Franked Dividends Declared Since Listing

Historic Portfolio Exposure

Portfolio Sector Analysis

Top 20 Portfolio Positions

Portfolio Market Capitalisation Analysis

Recent News

Cadence Capital Limited held its AGM and Investor Briefing on the 1 December 2021. At the Investor Briefing, Chairman Karl Siegling started by giving an update on the company’s performance, dividends, and profits reserves balances and CDM’s current portfolio structure. Portfolio managers Jackson Aldridge and Charlie Gray then discussed a number of the company’s current holdings. Karl Siegling closed with the outlook for 2022. Click here to view this Investor Briefing.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.