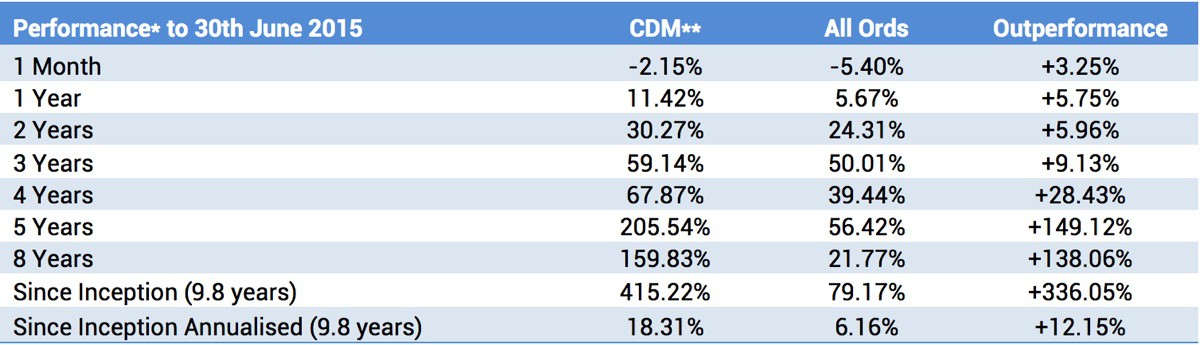

Cadence Capital Limited has had a good past financial year returning a positive gross performance of 11.42% outperforming the All Ordinaries Accumulation Index by 5.75% and the Small Ordinaries Accumulation Index by 10.98%. Cadence Capital Limited returned a negative gross performance of 2.15% during the month of June compared to a decrease in the All Ordinaries Accumulation Index of 5.40% and a decrease in the Small Ordinaries Accumulation Index of 7.77%.

Cadence Capital Limited continues to add to its offshore investments with 34% of the portfolio invested in global listed equities. We estimate a further 19% of the fund’s domestic investments earn income directly from offshore, creating a portfolio with approximately 53% offshore exposure. These offshore investments have performed very well over the past financial year returning approximately 4 times the returns of the funds local investments.

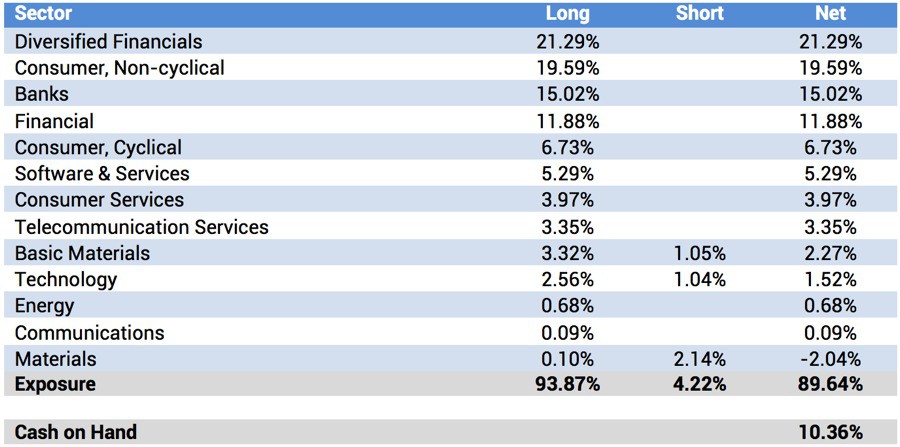

As at the 30th June 2015 the fund was holding 10% cash (90% invested).

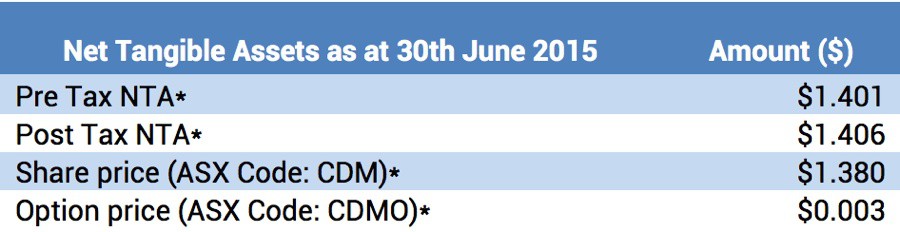

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

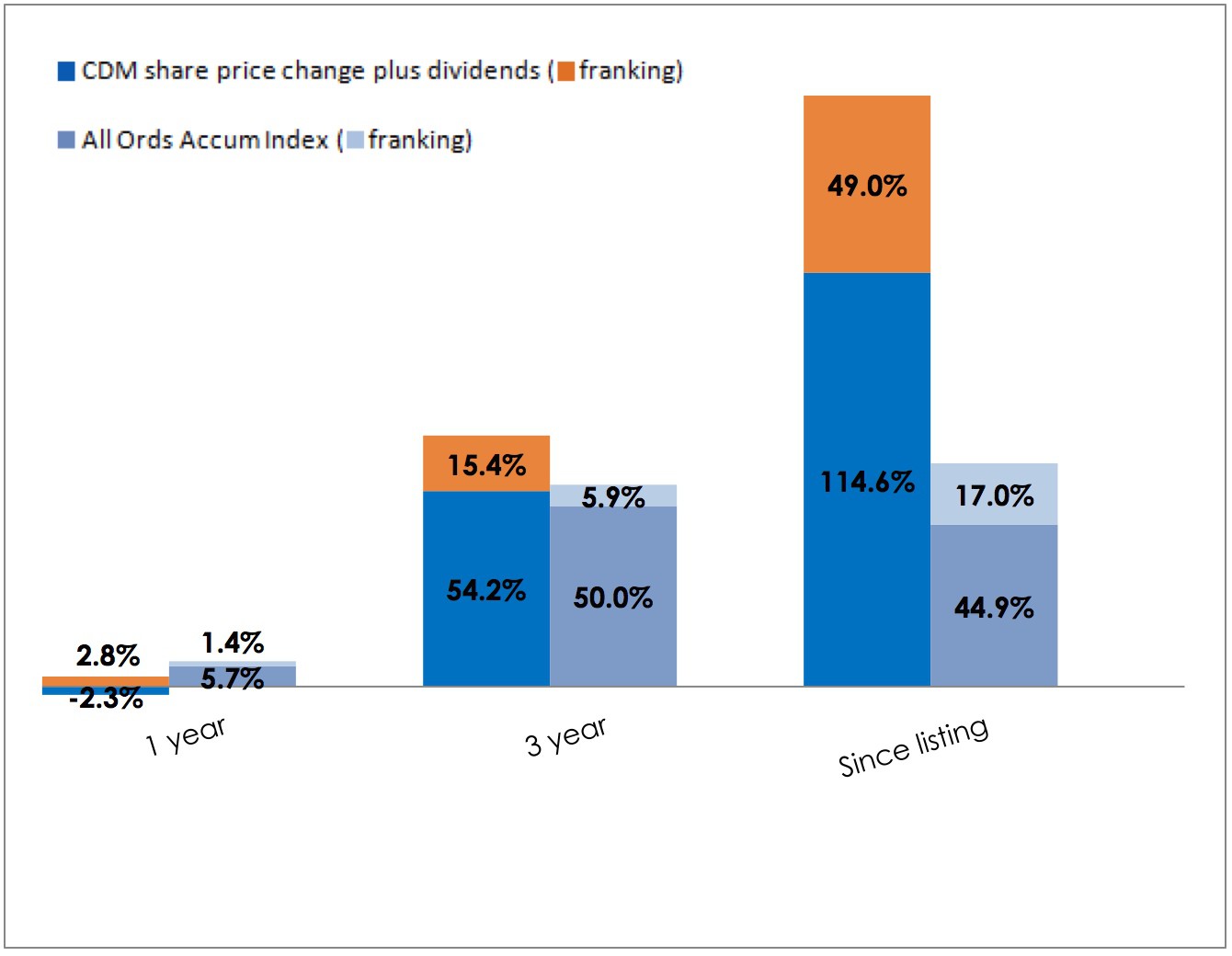

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

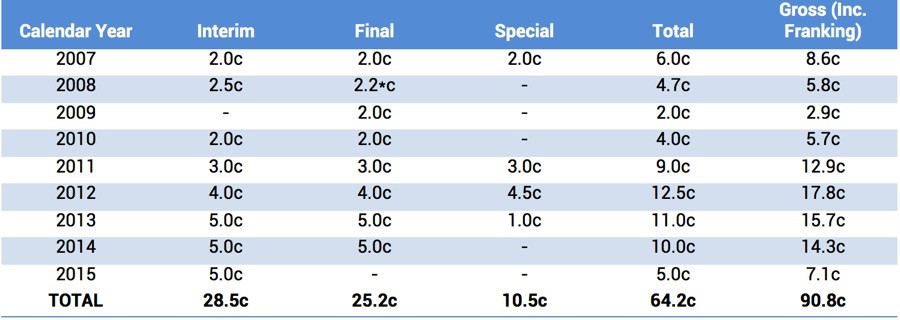

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

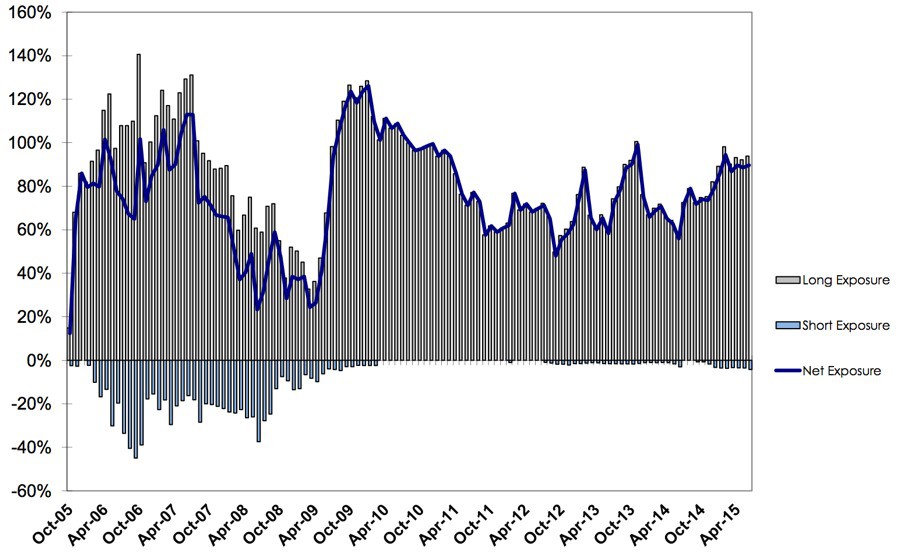

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

ASX ranks Cadence Capital Limited #1 Australian Equity LIC over 5 years in its latest ASX Funds Monthly Update.

Patersons Securities published its June 2015 Quarterly LIC Report which rates CDM as one of its ‘most attractive’ LIC opportunities.

Simon Bonouvrie and Chris Garrard feature in the latest Intelligent Investor report: Top Stock Picks from Australia’s best Fund Managers.

Livewire Markets published an article by Simon Bonouvrie on Going Global with Gilead Sciences Inc. Simon also featured in two Livewire Markets video interviews on the Australian retail grocery sectorand a Buy Sell Hold interview on the ‘Big Cap’ stocks.

ShareCafe featured an article by Karl Siegling on 6 prosperous trends for 2015.

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.