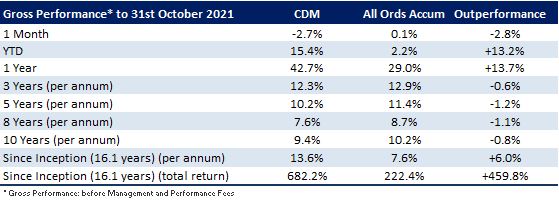

Cadence Capital Limited returned a negative performance of 2.7% in October, compared to the All Ordinaries Accumulation Index which was up 0.1% for the month. Financial year to date the fund is up 15.4% outperforming the All Ordinaries Accumulation Index by 13.2%. The largest detractors from performance during October were TMC The Metals Co, Whitehaven Coal, Resimac and New Hope. The top contributors to performance were Life360, DigitalOcean and Asana.

On the 29th October 2021 the Company paid its 3.0 cents fully franked final dividend, equating to an annualized yield of 5.6% fully franked (gross yield 8%). As the Company’s shares are trading at a discount to the underlying NTA per share of the Company, the dividend re-investment plan (DRP) was not in operation for this final dividend. Cadence shareholders do have the opportunity to re-invest the dividend they receive by buying CDM shares on market at the prevailing discount to NTA. Directors Karl Siegling, Wayne Davies and Jenelle Webster have been re-investing their final dividends by purchasing CDM shares on-market at a discount to NTA.

CDO ASX Listing

For those that participated in the Priority Offer in the Cadence Opportunities Fund IPO, CDO will list and start trading on the ASX on Friday 19th November 2021. The issue price was $2.7716, which was the NTA mid-point as at 31 October 2021. Boardroom registries will be posting out investor statements to all investors following the allotment of shares which is due to happen on 12th November 2021.

Fund NTA

Fund Performance

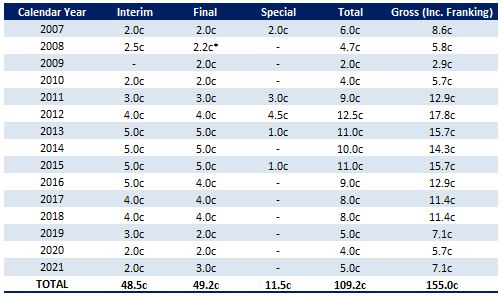

Fully Franked Dividends Declared Since Listing

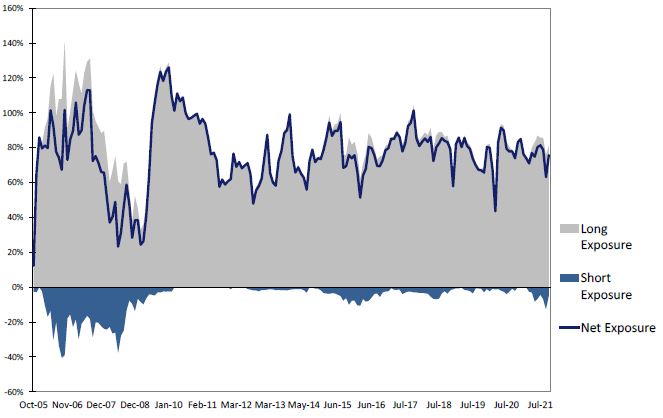

Historic Portfolio Exposure

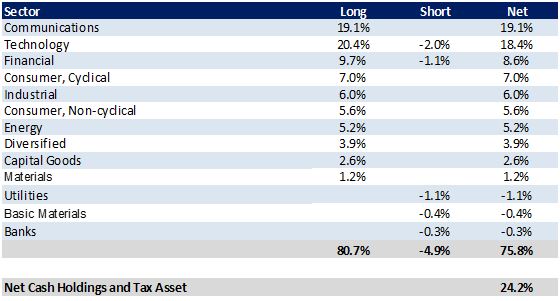

Portfolio Sector Analysis

Top 20 Portfolio Positions

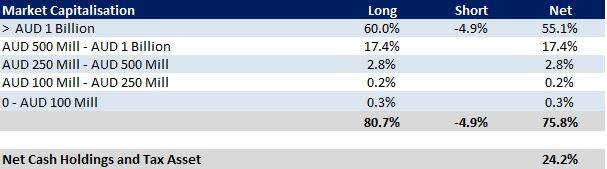

Portfolio Market Capitalisation Analysis

Recent News

CDM was one of the 26 LIC’s that appeared in the form guide for the Affluence LIC Cup that came out around the Melbourne Cup. Daryl Wilson, CEO/Portfolio Manager of Affluence Funds Management mentioned CDM as “Another runner that has hit good form this year, though has come off the boil slightly in recent times. Like many horses we rate, the jockey is a part-owner, which always adds extra incentive to win. A big momentum runner, and if it hits top speed, can be an absolute flyer. Another one to watch.”

Listen to Karl Siegling being interviewed by Henry Jennings from Marcus Today. on his show “On The Couch” where they discuss Cadence Capital Limited (ASX Code: CDM).

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.