For the month of October 2015 Cadence Capital Limited returned a positive gross performance of 5.60% compared to an increase in the All Ordinaries Accumulation Index of 4.59%. Over the past 12 months Cadence Capital Limited has returned a positive gross performance of 14.42% outperforming the All Ordinaries Accumulation Index by 13.97%. Financial year to date Cadence Capital Limited has returned a positive gross performance of 3.65% outperforming the All Ordinaries Accumulation Index by 5.12%.

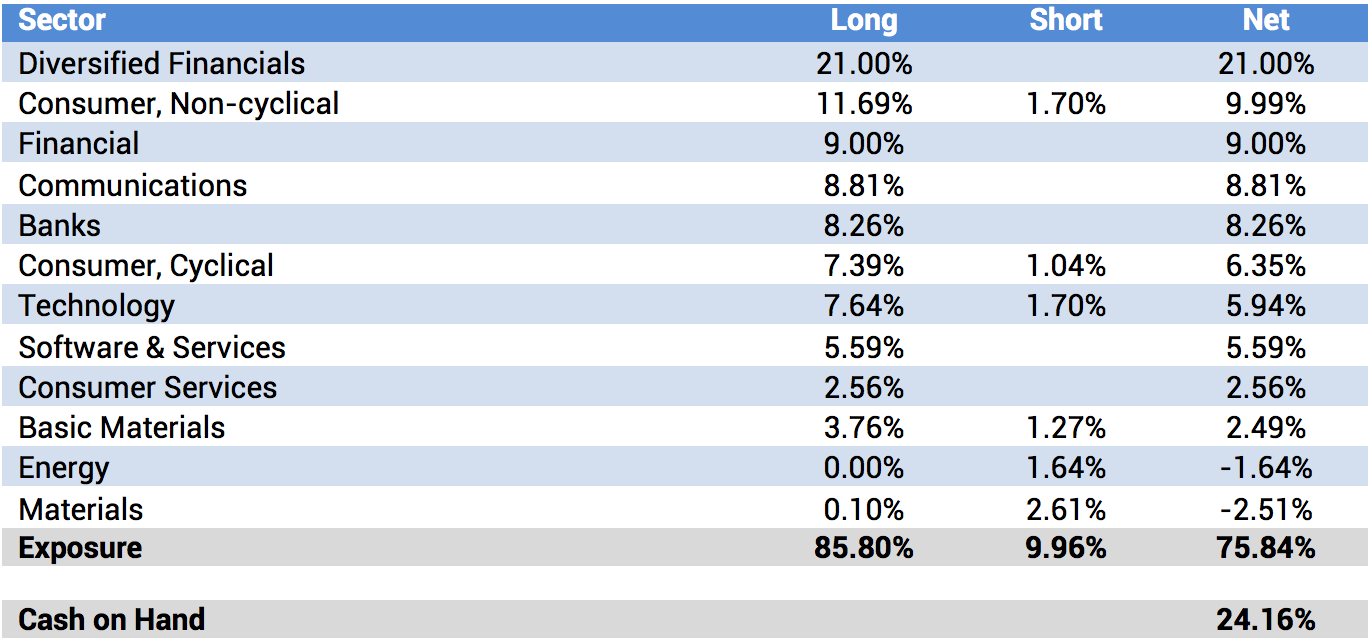

During the month Cadence Capital Limited shareholders received a 6.0 cent fully franked year-end dividend. Based on the end of month CDM share price the dividends for the year equate to a 7.4% fully-franked yield, or a 10.6% yield grossed up for franking credits. As at the 31st October 2015 the fund was holding 24% cash (76% invested).

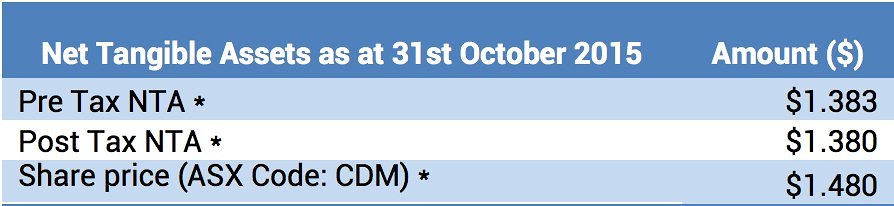

Fund NTA

*The NTAs and Share price are post the 6.0c fully franked year-end dividend

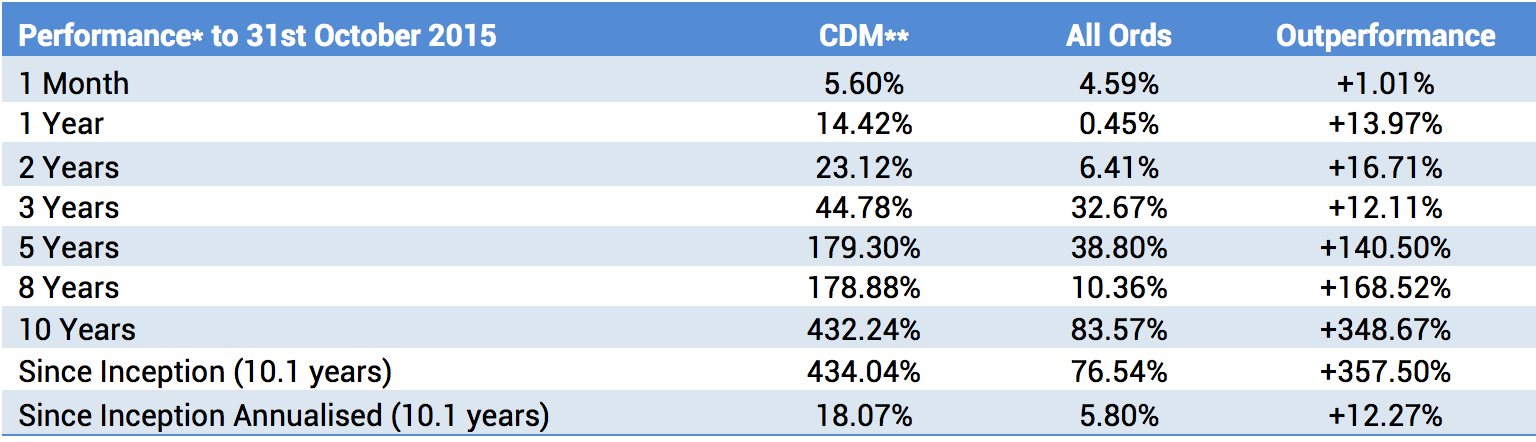

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

Upcoming AGM and Investor Briefing – Monday 23rd November 2015

We would like to remind you about our upcoming AGM and Investor Briefing to be held at the Museum of Sydney, Warrane Theatre, at 10.30am (AEDT) Monday 23rd November 2015. We would like to invite all shareholders to extend this invitation to any family, friends and peers that may be interested in Cadence Capital Limited. Registration is essential for all non-shareholders so please click here to register via email (attendance is free).

Cadence is offering a facility to phone in and listen to the AGM and Investor Briefing . To register to phone in and listen to the AGM please click here. Please note that a webcast will be made available after the event.

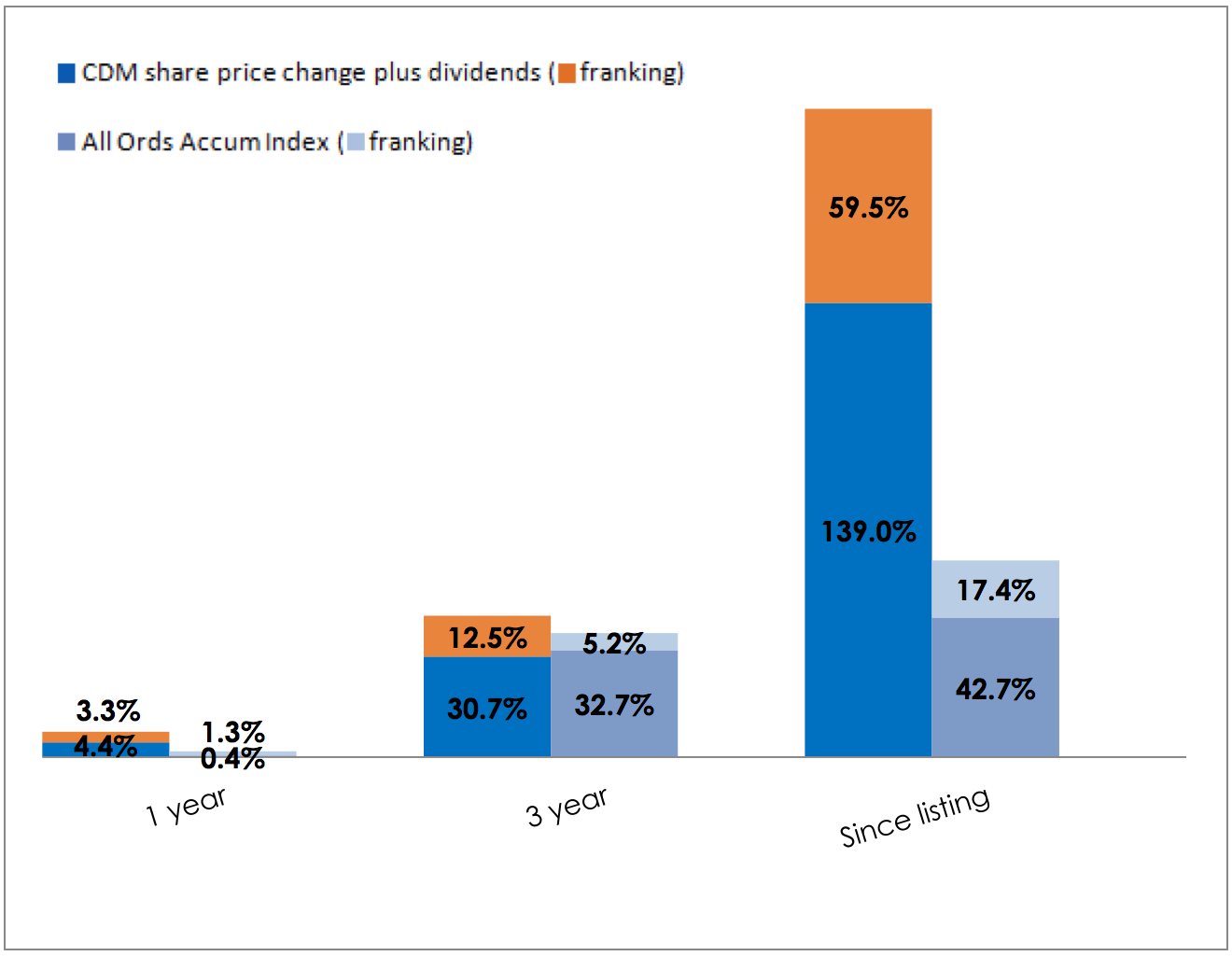

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

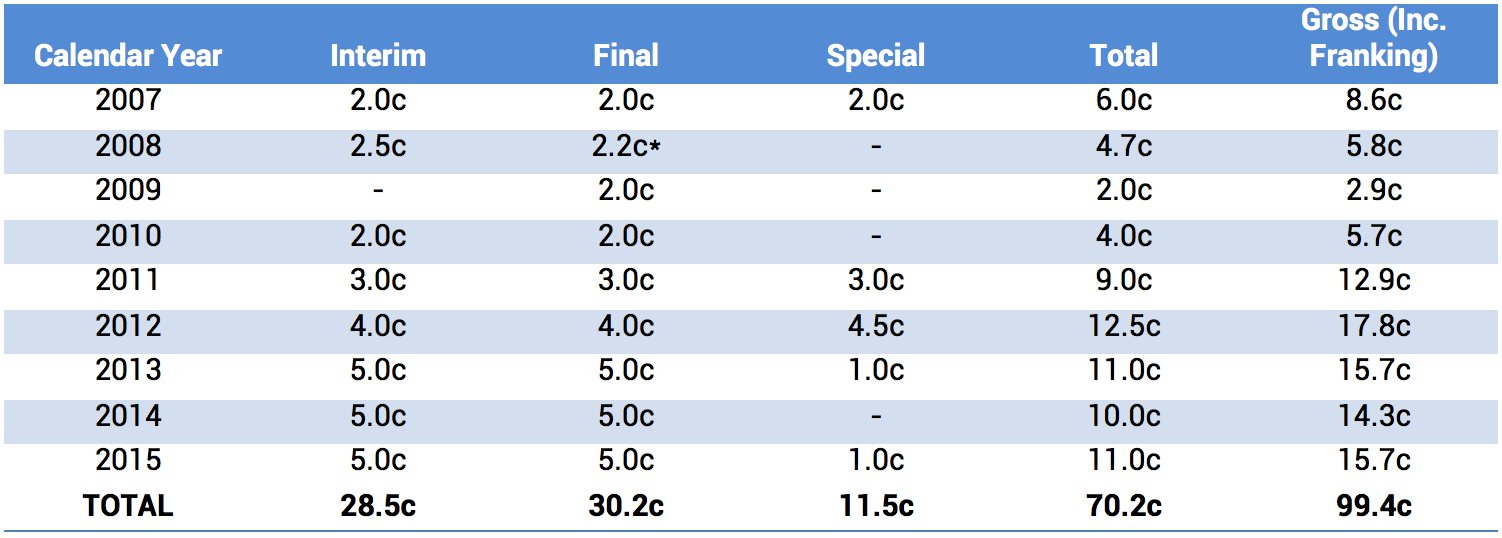

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

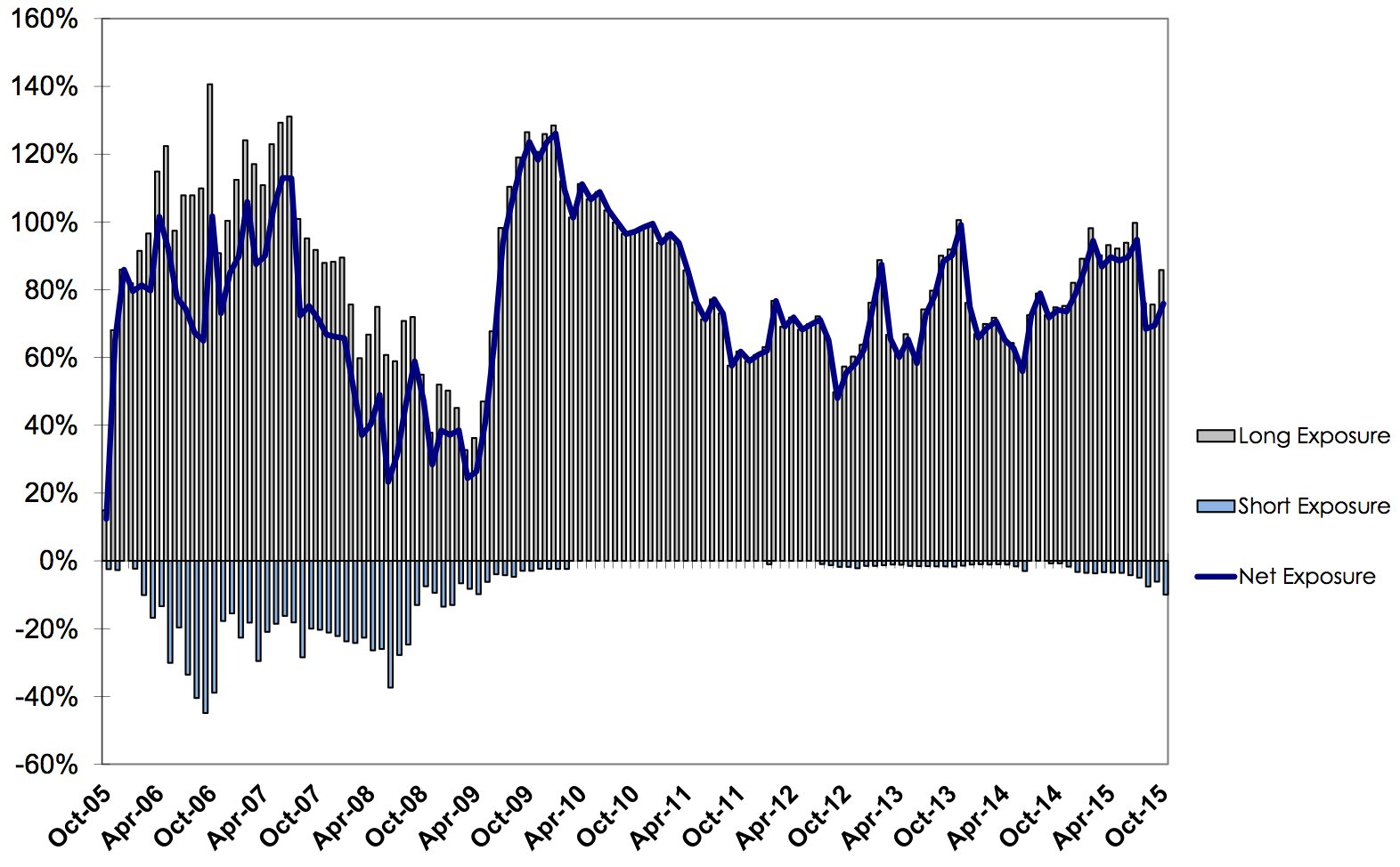

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Cadence released its September quarterly webcast which coincided with the Company’s 10 year anniversary. View the webcast to learn more about the fund’s performance, its overseas investments and our global outlook.

Karl Siegling featured in the November ASX Investor Update newsletter with an article on ‘How to recognise outstanding management’.

Funds management involves a lot of reading and synthesis of information. Whilst not an exhaustive list, we will recommend one book a week for a year in our 52 Books To Read section. Our latest books include Trade your way to Financial Freedom (by Van K Tharp) and One Up On Wall Street (by Peter Lynch).

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.