Our AGM and Investor Briefing will be held at the Museum of Sydney, Warrane Theatre, Corner of Bridge and Phillip Streets, Sydney, NSW 2000 at 2:00pm (AEDT) on Thursday 22nd November 2018. If you would like to dial into the AGM remotely, please click here to register.

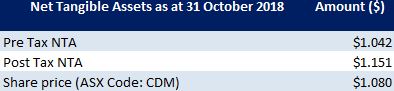

Fund NTA

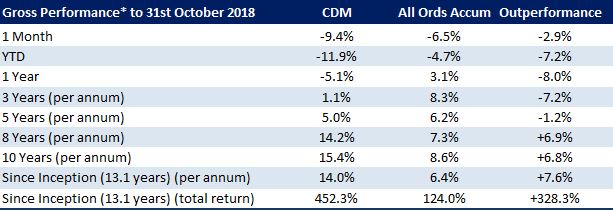

Fund Performance

* Gross Performance: before Management and Performance Fees

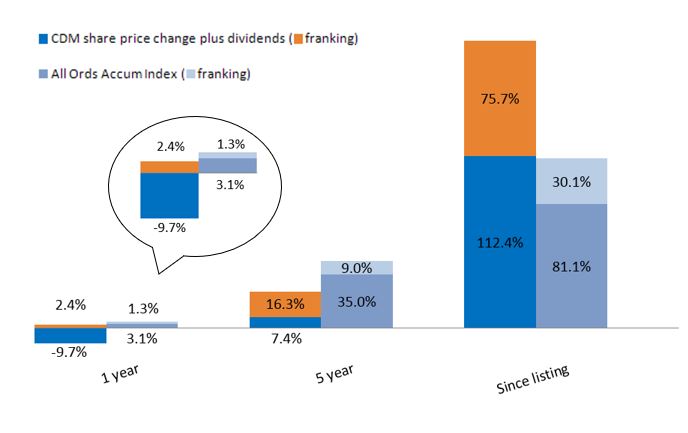

CDM Share Price and Option Returns plus Dividends & Franking

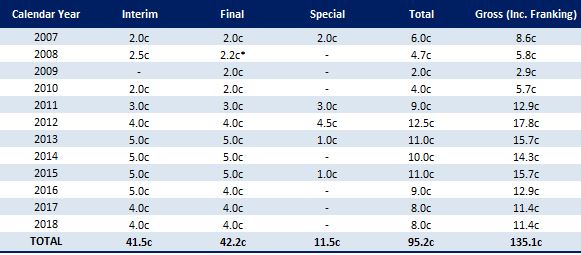

Fully Franked Dividends Declared Since Listing

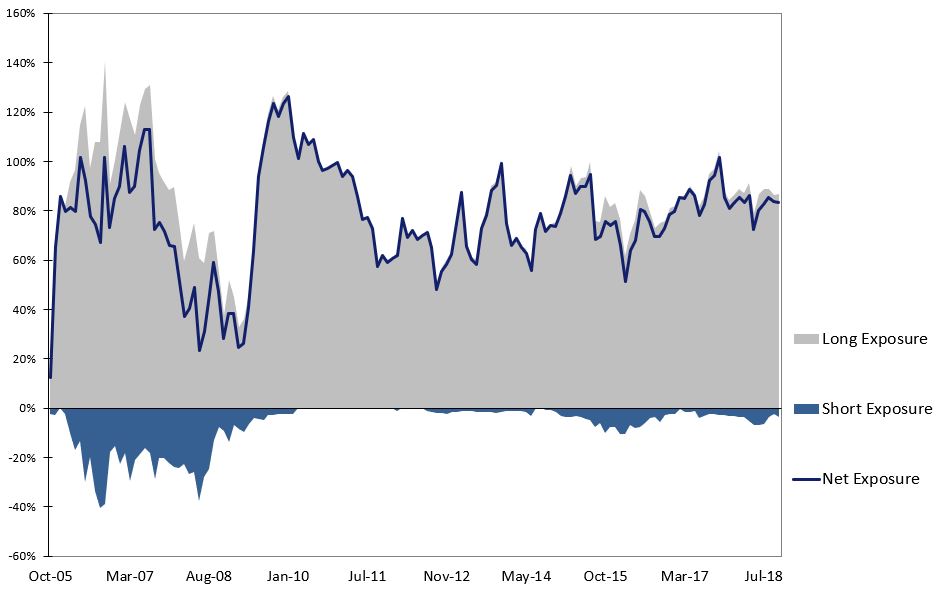

Historic Portfolio Exposure

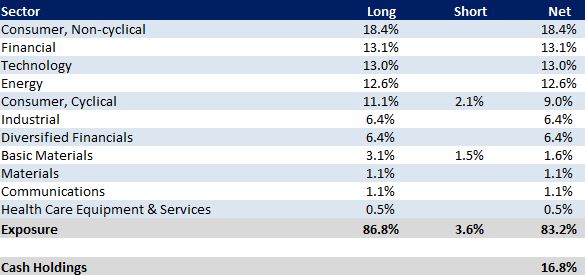

Portfolio Sector Analysis

Top Portfolio Position

Recent News

We are pleased to announce that the Prospectus is now open for Cadence Opportunities Fund (ASX:CDO). All CDM shareholders and newsletter readers have a priority offer to this IPO. Please feel free to watch a short introductory Webcast about this fund and read the Independent Investment Research (IIR) report, which has a Recommended rating. The Fund will have a greater focus on shorter-term price trends than CDM and will look to capture alpha from these shorter-term price trends. Whilst the CDO prospectus is open CDM will be announcing its NTA to the ASX on a weekly basis.

In October we released our September 2018 Webcast, Karl Siegling discusses the company’s performance, including a detailed review of two current positions in the portfolio, ARG Group (ASX:ARQ) and Teva Pharmaceutical Industries (NYSE:TEVA).

Karl Siegling warns “Australian banks are on a slide and investors should keep their distance as the industry reaches, maximum pessimism” in an interview with RFI Group’s, Lucas Baird.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books / documentaries that have influenced our investment style or helped provide insight into the investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.

We welcome any of your friends or colleagues that you feel may benefit from our monthly Cadence Capital Limited Newsletter. Please click here to refer a friend by supplying their name and email address.