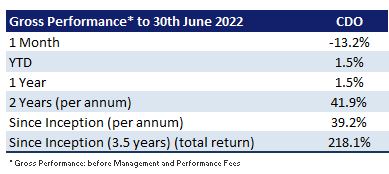

Cadence Opportunities Fund ended the financial year with the fund up 1.5%, outperforming the index by 9.0%. Over the past two years the fund is up 41.9% per annum, outperforming the All Ordinaries Accumulation Index by 32.1% per annum. The fund was down 13.2% in June, compared to the All Ordinaries Accumulation Index which was down 9.4% for the month. The top contributors to performance during the financial year were Whitehaven Coal, Upstart Holdings, TMC The Metals Company, Tuas, Terracom, DigitalOcean Holdings and Stanmore Coal. The largest detractors from performance were Nitro Software, Betmakers Technology, Bed Bath and Beyond, Sofi Technologies and Aussie Broadband.

Financial markets sold off through June as the potential for a global recession has become more apparent. Sectors that are highly sensitive to the economic cycle that had previously performed well such as energy and commodities were some of the worst performers over the month. To put this in context, Copper which is typically seen as a bell weather for global growth, fell 14% in June.

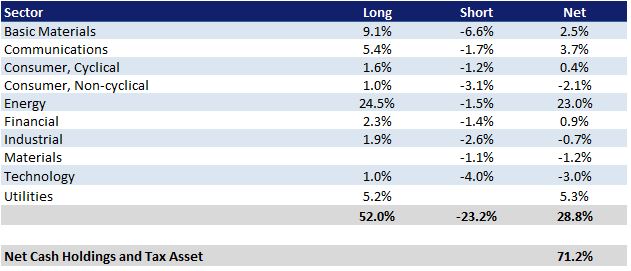

The funds exposure to energy, which has been a significant positive contributor to returns during the year, was the largest detractor in June. Both domestically and globally, governments have been weighing in on windfall profit taxes on both oil and coal, which negatively affected investor sentiment towards these industries. Nevertheless, many companies in the coal sector on the ASX continue to trade at approximately 1-1.5x cash flow with significant capital returns expected in the near term.

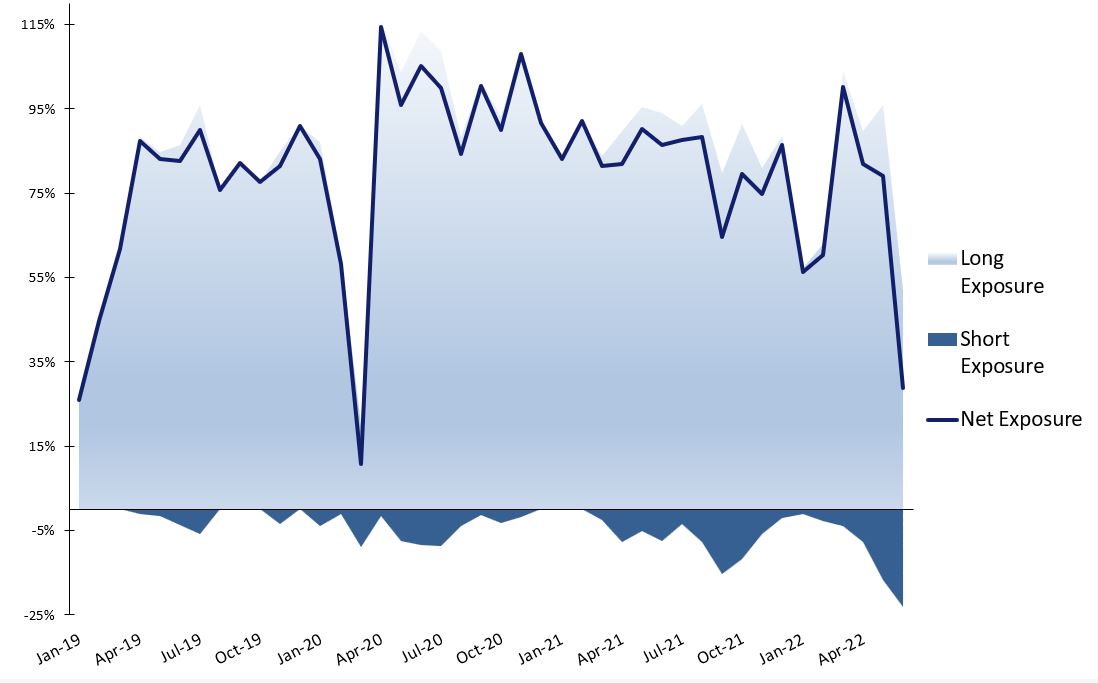

Cash levels increased to 71.2% by the end of the month as the fund scaled out of positions as they rolled over and added to short positions, specifically in cyclical sectors such as commodities and shipping.

Year-end Audiocast

Over the next week or two we will be releasing our year end audiocast which will give an update on the Company’s performance, the portfolio’s composition, its current investment themes and holdings, and the outlook for the coming year.

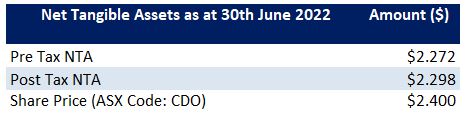

Fund NTA

Fund Performance

Historic Portfolio Exposure

Portfolio Sector Analysis

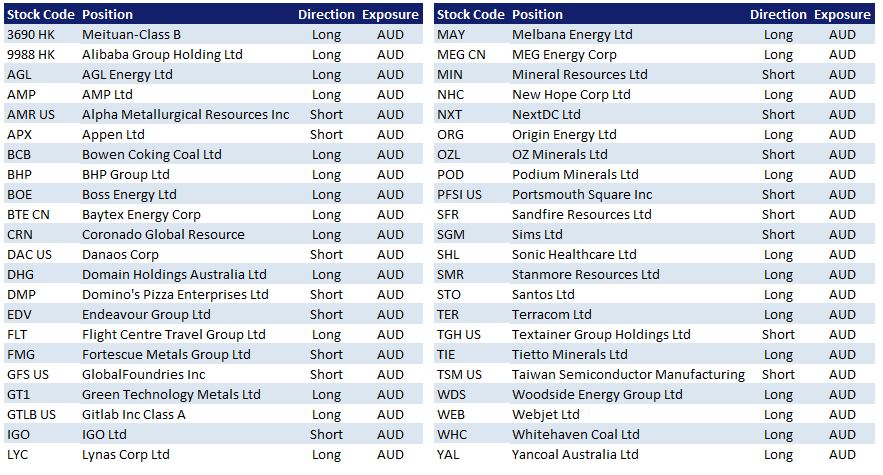

Portfolio Positions

News

As the portfolio has changed substantially over the past 6 months, we strongly recommend that you watch the March 2022 Quarterly Audiocast . In this audiocast Karl Siegling firstly provides an update on the Company’s performance, fully franked interim dividend, portfolio composition and the funds current cash levels. Charlie Gray and Jackson Aldridge then discuss the company’s trading statistics, investment themes and some of its current long and short holdings. Karl Siegling finishes with an update on the outlook for 2022.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.