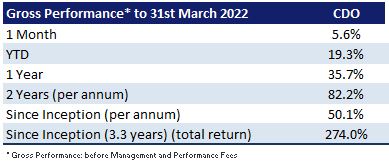

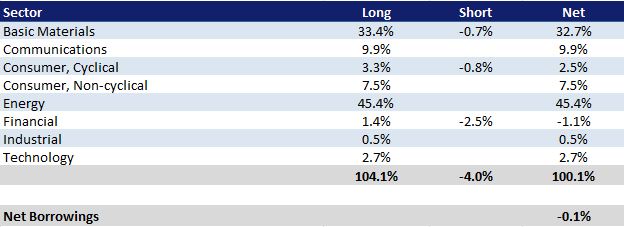

Cadence Opportunities Fund was up 5.6% in March, compared to the All Ordinaries Accumulation Index which was up 6.9% for the month. For the 9 months ended 31 March 2022 the fund is up 19.3% outperforming the All Ordinaries Accumulation Index by 13.0%. For March, the top contributors to performance were Whitehaven Coal, Stanmore Coal, Champion Iron, New Hope, BHP Group, Mosaic, Woodside Petroleum and Journey Energy. The largest detractor from performance was Tuas.

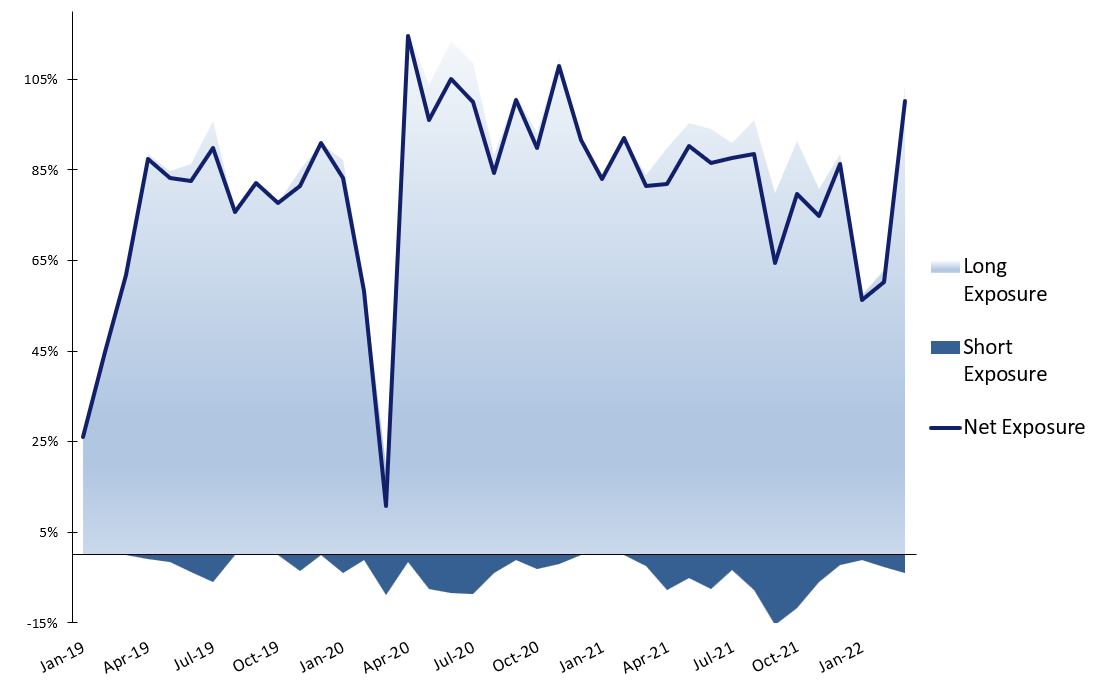

Markets recovered through March with resources, energy and financial sectors leading. Increased participation from smaller capitalisation commodity related stocks was also a feature, with fund returns benefitting from participation in selective equity raisings and placements which met our criteria. High cash levels and the short book detracted from performance during the month given the strong index return. Since month end, there has been notable weakness from some typically economically sensitive sectors such as transport, semiconductors and shipping potentially indicating higher interest rates and elevated inflation is starting to take its toll on end consumer demand. This will be an important trend to monitor.

Fully Franked Half Year Dividend Declared

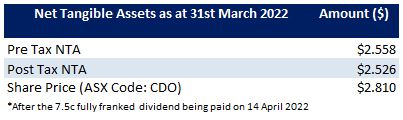

The Company’s 7.5 cents fully franked half year dividend went ex-dividend on the 31 March 2022 and will be paid out on the 14 April 2022. This interim dividend equates to a 5.1% annualised fully franked yield or a 7.3% gross yield (grossed up for franking credits) on the share price on the date of the announcement of $2.94 per share. After paying this dividend the Company still has more than 50 cents per share of profits reserves to pay future dividends

Fund NTA

Fund Performance

Historic Portfolio Exposure

Portfolio Sector Analysis

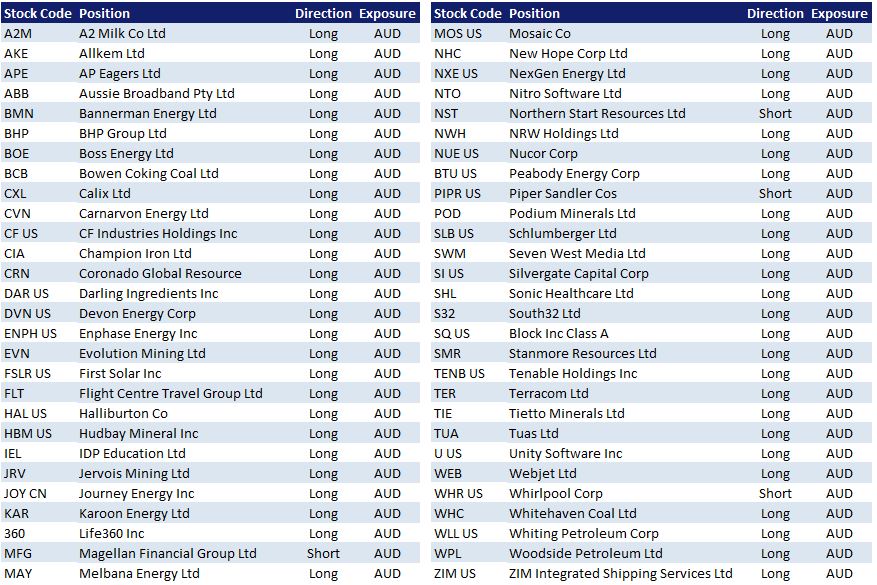

Portfolio Positions

News

We recommend that you watch the December 2021 half year Audiocast where Karl Siegling firstly provides an update on the Company’s half year results, fully franked interim dividend and the portfolio’s composition. Charlie Gray and Jackson Aldridge then discuss the Company’s trading statistics, some investment themes and positions held. Karl Siegling finishes with an update on the outlook for 2022.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.