This article was written by Karl Siegling, Managing Director & Portfolio Manager, Cadence Capital Limited (ASX: CDM)

In our previous article, Hope, fear and greed, we wrote about the extreme effects psychology can have on the share price of a stock and the market overall.

Once we accept that psychology can play a big role in the price of a stock we need to develop a way to deal with this fact.

For the purposes of this article, I am going to make the easy but fictitious assumption that using fundamental analysis, one can easily work out the value of a stock or the value that a stock should trade at over time.

This assumption makes the explanation of how to reconcile psychology and fundamentals easier to explain. In fact, calculating the value of a stock using fundamental analysis is very difficult, if not impossible.

We often joke that the only thing certain about an analyst’s forward valuation of a stock is that it will be wrong! It will either be too high or too low.

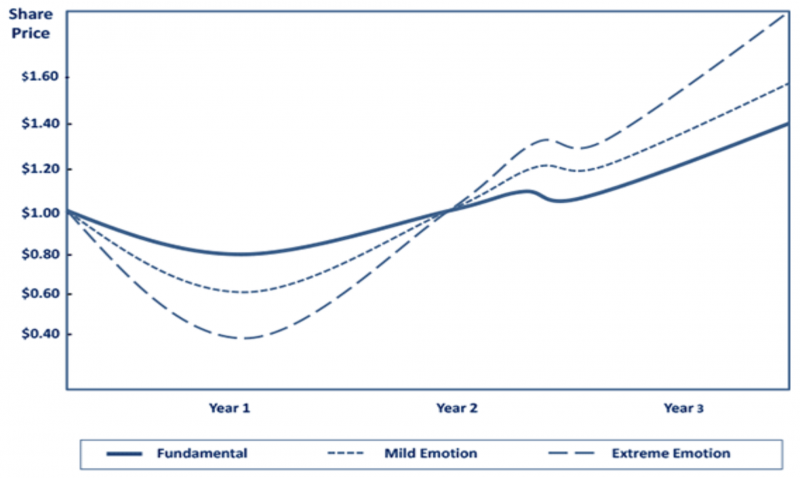

On the assumption that we can work out the fundamental value of a stock at present and form a view on its future value, how does psychology unsettle our perfectly constructed world? The diagram below shows a graphical representation of how psychology and market behaviour can affect the market value of a stock.

In the diagram below, our fundamental value of a stock at present is $1. In year one, the stock has a downgrade and our fundamental value is revised to 80 cents.

In the following reporting season our fundamental analysis says the stock is once again worth $1, and based on earnings growth for the year ahead is worth $1.20.

Our fundamental analysis leads us to the conclusion that the stock should trade 20 cents below $1 and then 20 cents above one dollar over time. However, the two dotted lines indicate what happens when emotion grips the holders of the stock.

On the downgrade, most holders move to a position of “fear” and on the recovery move to a position of “hope” or “greed”. The first dotted line indicates a mild emotional state and the second dotted line a more extreme emotional state.

How psychology and market behaviour affect a stock’s market value

Source: Cadence Capital Limited

The fundamental curve suggests that should you own the stock at $1 you will suffer a 20 per cent downside loss to a price of 80 cents initially, recover your investment by year two and go on to make a 20 per cent return on your investment over three years.

In the event of an extreme emotional reaction to this set of circumstances your $1 would suffer a 60 per cent loss to 40 cents, recover to $1 and then go on to be worth $1.60 or a 60 per cent return on your investment.

Interestingly enough, using fundamental analysis and presuming you could pick the bottom of the stock price movement (80 cents) you could make a 50 per cent return when the stock recovered to $1.20. When extreme emotion enters the equation and you are able to buy the stock at 40 cents and were it to recover to $1.60, the value of your investment would increase by 300 per cent.

To suggest that investors can consistently pick the bottom of a stock movement and sell at the high in a stock movement is a false assumption.

And, of course, this is where the really big returns are made and where all the anecdotes and investment sayings originate: “Buy when there is blood on the streets; Buy when you can hear the cannon fire; Be hopeful when others are fearful and fearful when others are hopeful and greedy.”

To suggest that investors can successfully and consistently pick the bottom of a stock movement and sell at the high in a stock movement is also a false assumption.

However, in our next article we will focus on risk-mitigating strategies that can assist any investor to accumulate a position in a rising stock and reduce exposure to a falling stock.

In summary, it is important from an investor’s point of view to realise that stock prices rise and fall much further than our fundamental analysis would have us believe and this fact creates additional threats and opportunities when making stock investments.

And this is before we even begin to contemplate fundamental or earnings estimates that turn out to be incorrect.

Once we have set the stage on dealing with market behaviour, we will delve into the mystical world of fundamental analysis.

Written by Karl Siegling, Cadence Capital Limited