Dividend Reinvestment Plan (“DRP”)

Please see below for Frequently Asked Questions regarding the Company Dividend Reinvestment Plan.

What is a Dividend Reinvestment Plan (“DRP”)?

A DRP is the opportunity to invest all, or part, of your dividends into new shares in the Company, without paying any brokerage.

How does a DRP work?

If you decide to participate fully in the DRP, the Company issues new shares to you in lieu of cash.

What is the Subscription Price?

DRP shares are issued at the Subscription Price. The Subscription Price is the weighted average market price of Shares sold on the ASX on the books closing date for the relevant dividend and the 3 days preceding that date less any applicable discount.

How do I participate in the DRP?

To participate in the DRP please complete the DRP Application Form and return it to our Share Registry, BoardRoom Pty Limited (contact details are noted on the Application Form).

What are the tax implications?

The Australian Tax Office (‘ATO’) treats dividends the same whether the shareholder participates in the DRP or not. You will receive a dividend statement explaining the dividend and franking component to lodge with your annual tax return. The shares acquired via DRP are simply new shares purchased at the subscription price on the issue date.

Further information

Please read the Cadence Capital Ltd DRP Rules.

Please contact our Share Registry, BoardRoom Pty Limited, for any further information regarding the Company’s DRP.

You’re on our team

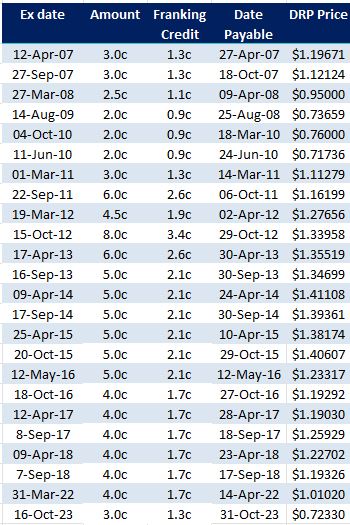

DRP History