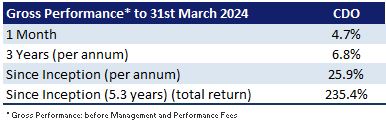

Cadence Opportunities Fund returned a positive gross performance of 4.7% in March outperforming the All Ordinaries Accumulation Index by 1.6% for the month. The top contributors to performance during the month were Alumina, Westgold Resources, Capstone Copper, Cooper Energy, QBE Insurance and Whitehaven Coal. The largest detractors from performance were Zillow, Smart Group and Syrah Resources.

The Alumina share price was up 35% for the month. During the month Alumina announced that it has entered into a Scheme Implementation Deed with Alcoa for Alcoa to acquire all of the shares of Alumina in a scrip for scrip takeover. The Alumina board has recommended the takeover, and a scheme meeting will be held in Q3 2024 for Alumina shareholders to vote on it. We expect the takeover will go ahead as it will consolidate the Alcoa and Alumina joint venture assets into a single entity, removing unnecessary complexity in the ownership structure.

We discussed last month that Westgold Resources has benefited from a rising gold price. The gold price has continued to set new all-time highs and sits at USD 2,283 per ounce at the time of writing. In early April Westgold announced that it was revising its full year production guidance down from 245,000 ounces to between 220,000 and 230,000 ounces due to completion of mining at Paddy’s Flat Prohibition orebody, and recent inclement weather. Despite the production setback the Westgold share price is up over 20% since the end of February. Westgold Resources recently announced that they propose merging with Karora Resources to create a gold company with more than 400,000 ounces of annual production.

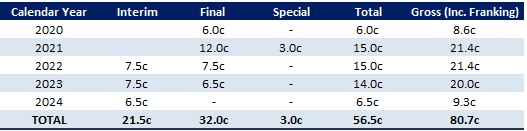

Fully Franked Half-Year Dividend

In February the Company announced a 6.5 cents per share fully franked interim dividend. This interim dividend equated to an 8.1% annualised fully franked yield or a 11.6% gross yield (grossed up for franking credits) based on the share price on the date of the announcement of $1.60 per share. After paying this dividend the Company has 22.5 cents per share of profits reserves to pay future dividends.

The Ex-Date for the dividend is the 15 April 2024. The payment date for the dividend is the 30 April 2024.

DRP Operating for Interim Dividend

The dividend re-investment plan (DRP) will be in operation for this interim dividend. We would encourage shareholders to participate in the DRP as an efficient mechanism to add to existing holdings in the fund. The DRP will be priced at the weighted average share price over the relevant DRP pricing period. The Company will buy-back the shares it issues under the DRP. This buy-back will operate when the CDO share price is trading at a discount to the Pre-Tax NTA.

If you are not registered for the DRP and you would like to participate, please contact Boardroom on 1300 737 760.

CDO Share Price discount to NTA

At the time of writing this newsletter, CDO is trading at a pre-tax NTA discount of around 15% whilst holding some cash balances. If all the shares in the portfolio fell by 16% the pre-tax NTA would still be above the share price.

Half-Year Audiocast

To watch CDO’s Half-Year Audiocast please click here. In this half-year audiocast, Karl Siegling first provides an update on the Company’s half-year performance, the upcoming 6.5c fully franked interim dividend and DRP, the composition of the portfolio and the current investment themes. Karl Siegling and Chris Garrard then discuss two of the Company’s current investments and then finish with the outlook for the rest of the year.

Fund NTA

Fund Performance

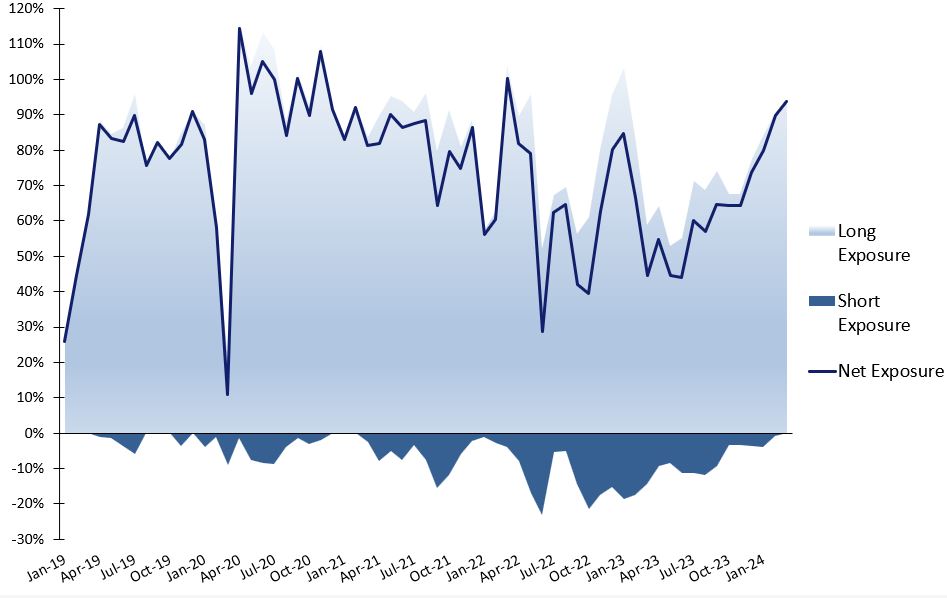

Historic Portfolio Exposure

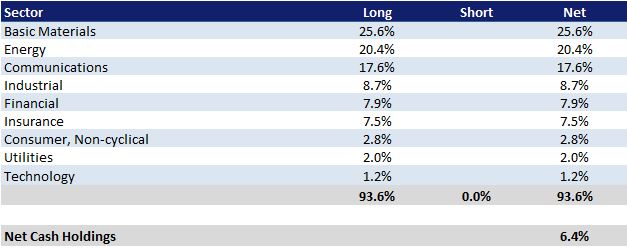

Portfolio Sector Analysis

Franked Dividends Declared

News

To view all previous Cadence webcasts and interviews please visit the Media Section of the website.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process.