SMSF Tools and Resources

You can invest in Cadence by buying shares on ASX

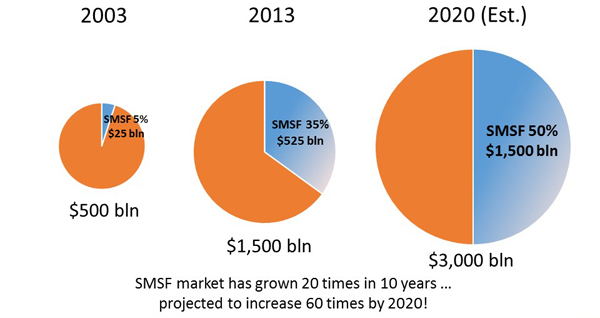

The SMSF market in Australia has experienced significant growth over the last 10 years, and is poised to account for half of the total Superannuation industry by 2020.

A large percentage of investors in Cadence Capital Limited and Cadence Opportunities Fund are SMSFs looking to take control of their financial future. As such, we often get asked by potential shareholders about how to set-up a SMSF. Whilst we are not able to assist directly we have provided the following links for individuals looking to set-up an SMSF:

SMSF Education

Educating yourself is important as a SMSF trustee. We encourage you to visit the following SMSF educational resources.

SMSF Guides, Research and Calculators

Researching and understanding your options is very important when it comes to your SMSF. This collection of guides, research and calculators is intended to assist you in that process.

SMSF set-up and administration

The following links are a good place to start if you’re looking for information on the setup and administration of a SMSF.

SMSF News, Views and Webcasts

- Why small SMSFs are losing money: the $595b self-managed time bomb – on SMH

- Utilising LICs to hunt for yield – on SMSF Adviser it’s worth noting that Cadence Capital Limited (ASX:CDM) has a higher historical yield than the LICs discussed in the article

- Broaden your SMSF investment horizon – on AFR

- Webcast: Cadence Superhero (how an investment in Cadence Capital performs in a SMSF, compared to other forms of investments)

- Presentation: Share Investing Prospects for SMSF Investors (Cadence Capital presentation to SMSF Owners Alliance)

- Research: ASX and Broker Listed Investment Company Research

10 Books To Read Before Buying Your Next Stock

Funds management involves a lot of synthesis of information and reading. Over the years we all end up reading many investment books and refer to them from time to time.

The team at Cadence has compiled a list of books that have influenced our investment style, or helped provide insight into the investment process.

Whilst not an exhaustive list, the 10 titles contained in this eBook provide a good starting point for any interested investor.