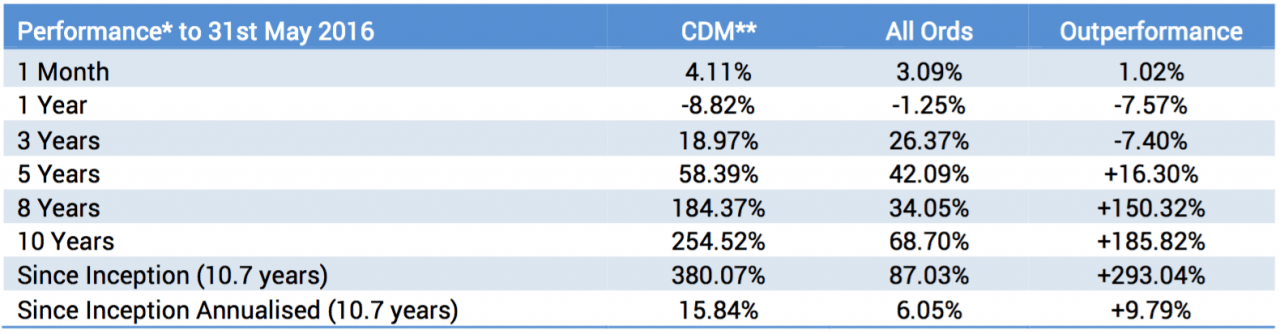

For the month of May 2016 Cadence Capital Limited returned a positive gross performance of 4.11% compared to an increase in the All Ordinaries Accumulation Index of 3.09%. Over the past 12 months Cadence Capital Limited has returned a negative gross performance of 8.82% compared to a decrease in the All Ordinaries Accumulation Index of 1.25%.

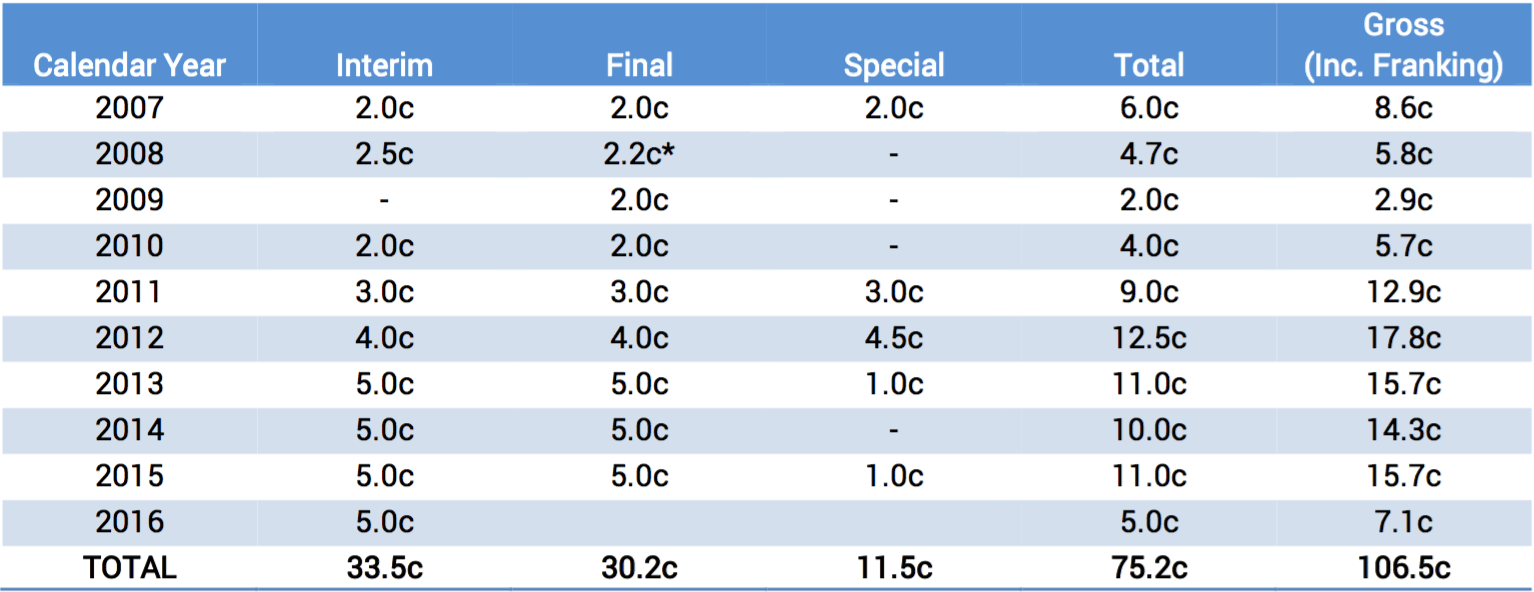

During the month of May 2016, Cadence Capital Limited paid out a 5.0 cent fully franked interim dividend. Cadence Capital Limited shareholders were able to participate in the Dividend Re-Investment Plan (“DRP”) at a 3% discount. The DRP price was $1.23317.

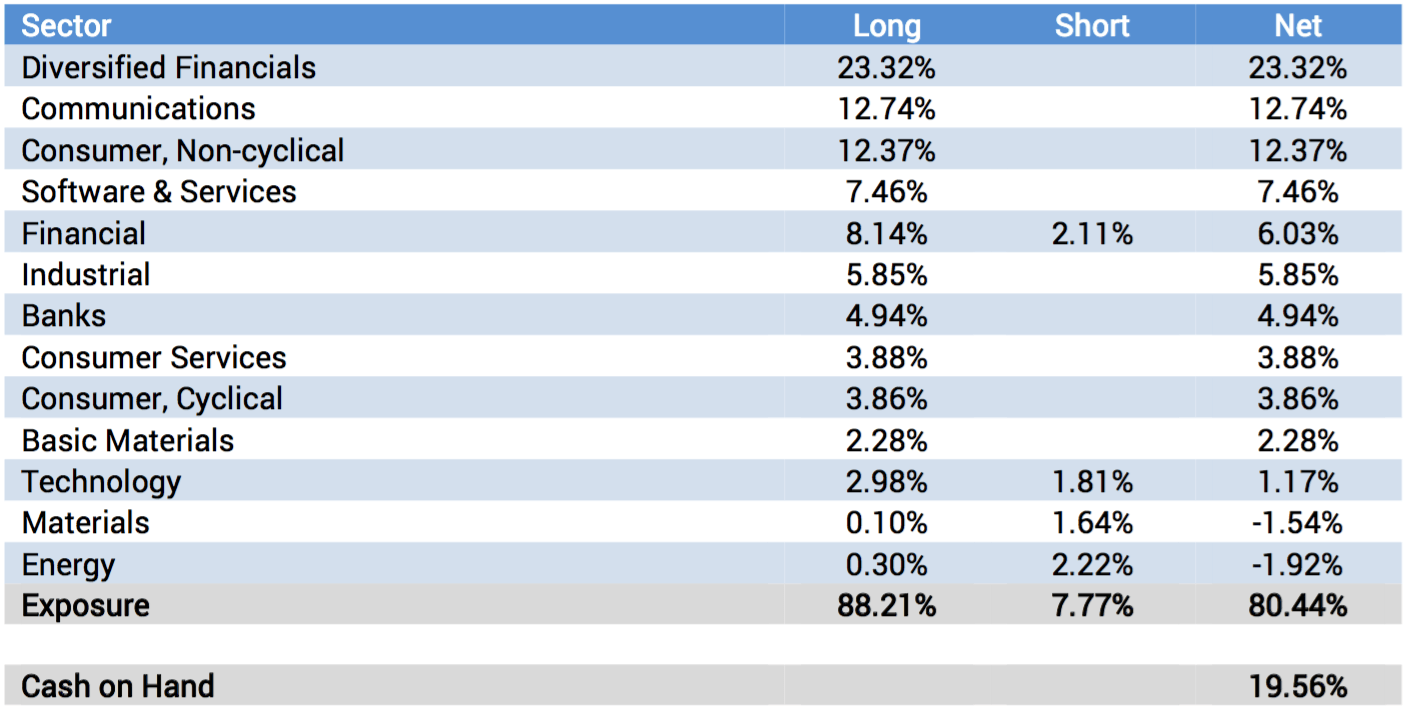

As at the 31st May 2016 the fund was holding 20% cash (80% invested).

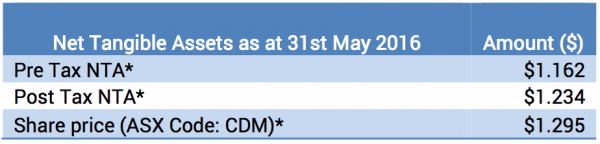

Fund NTA

* The NTA’s and Share price are post the 5.0c fully franked interim dividend

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

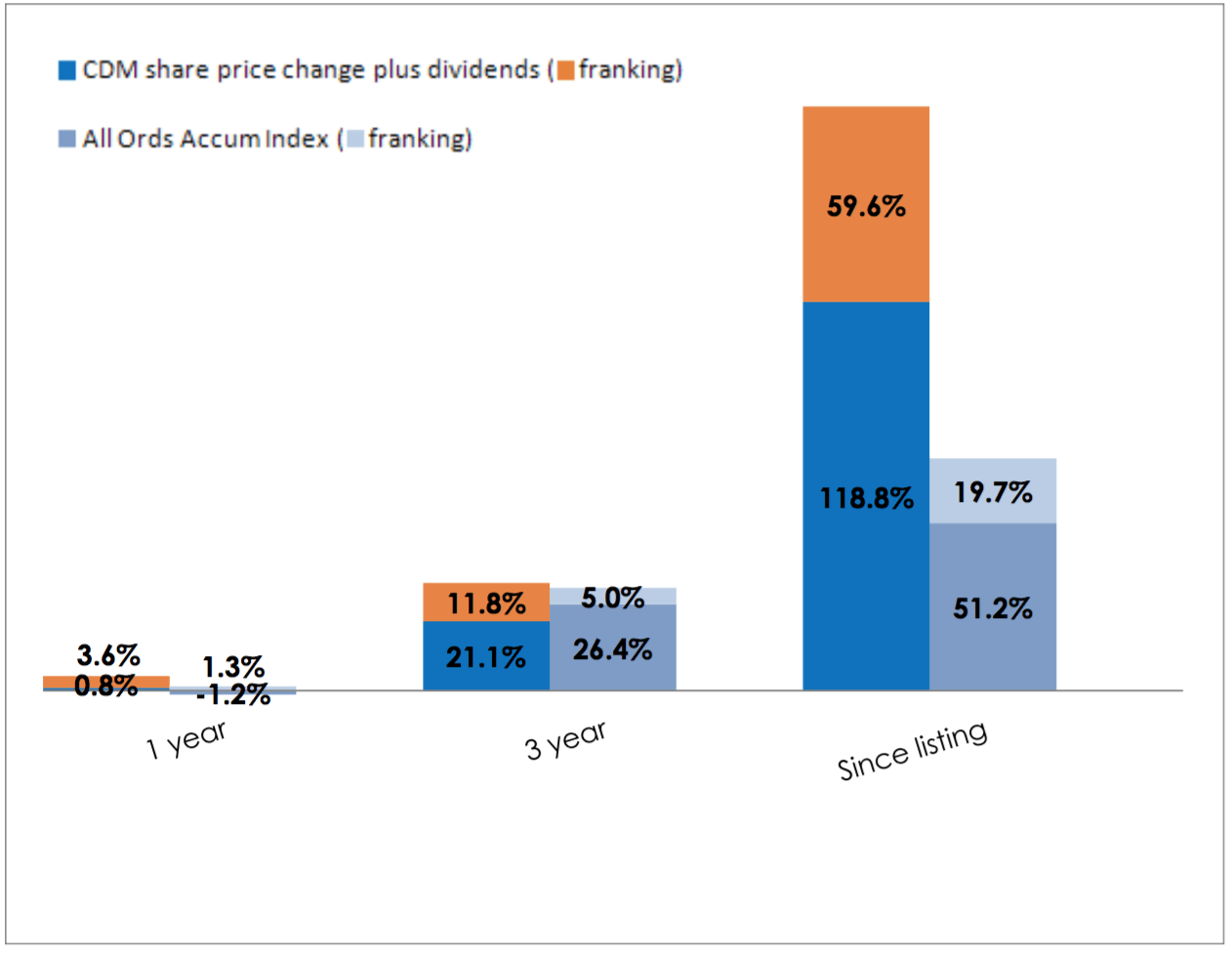

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

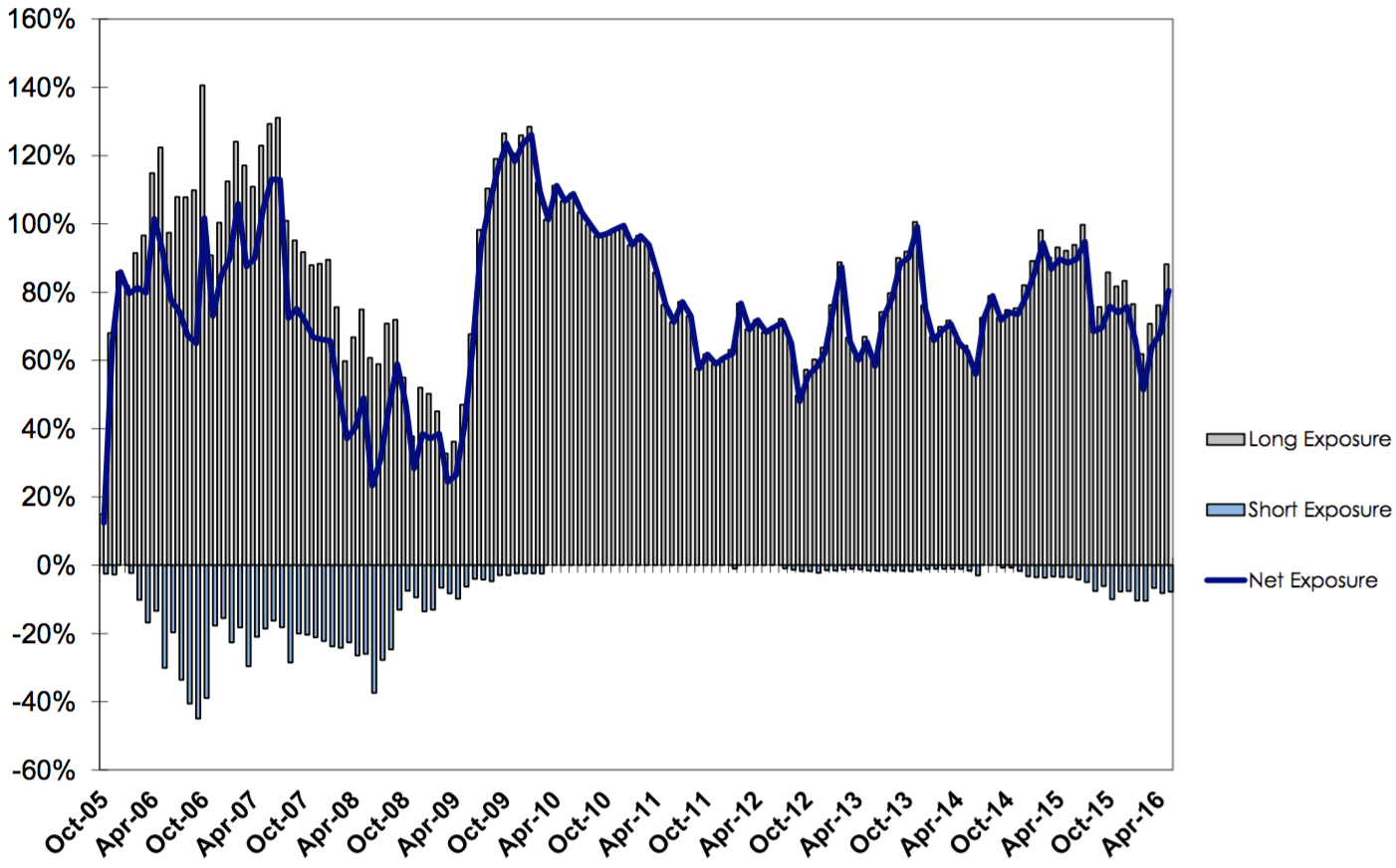

Historic Portfolio Exposure

Portfolio Sector Analysis

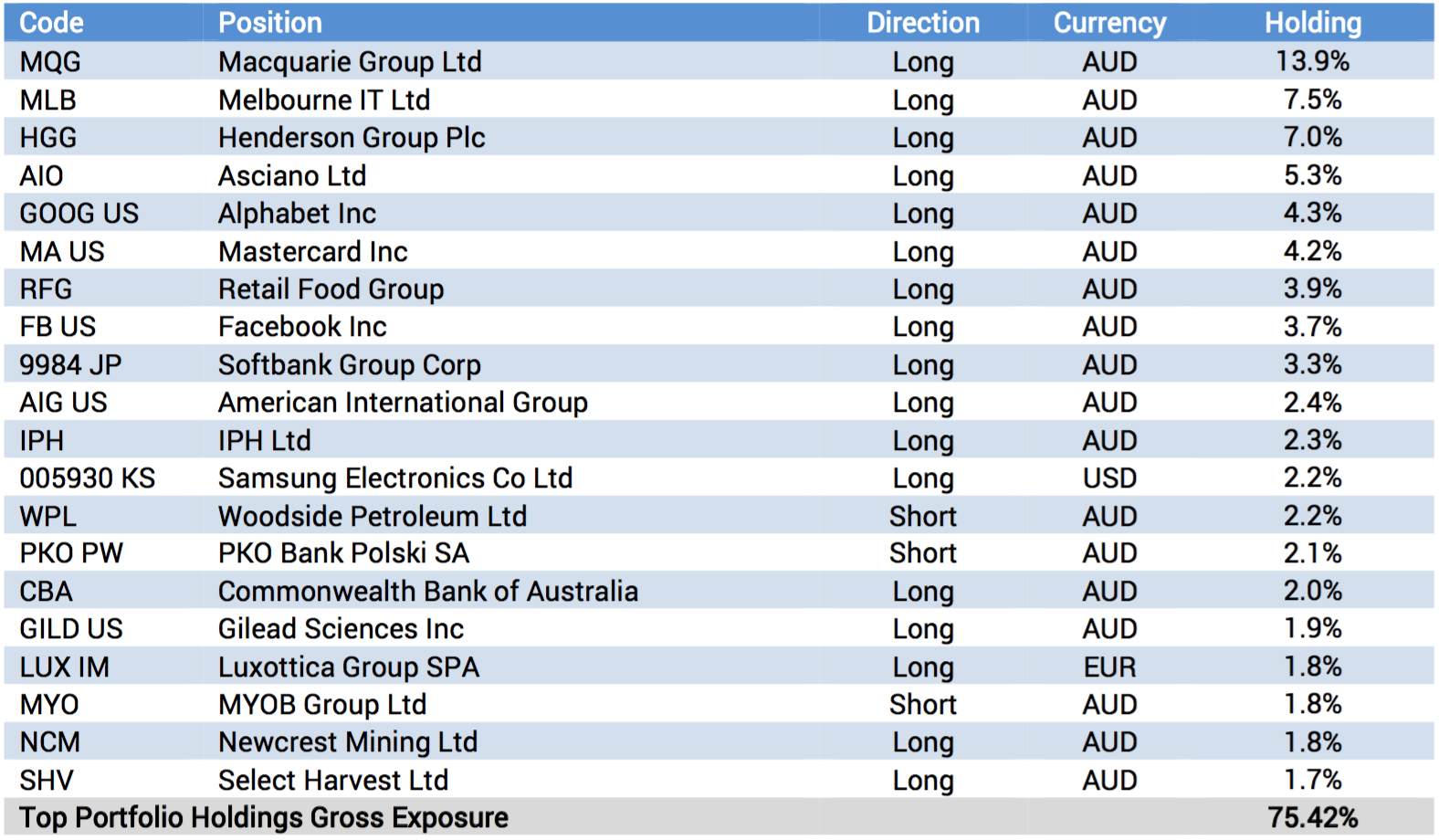

Top Portfolio Positions

Recent News Articles

Karl Siegling’s latest article, “Commodities: Has the trend changed?”, was published in the 157th edition of the Cuffelinks newsletter. The article explains the cyclical nature of commodities, and gives an overview of how we deal with this at Cadence.

Watch our latest quarterly webcast for an update of the fund’s performance, information about the Company’s 5.0 cent interim dividend and an update on the Company’s outlook. In addition, Karl Siegling shares his views on Macquarie Bank (MQG).

You can read our latest book reviews, including Hot Commodities by Jim Rogers, in the 52 Books You Should Read Before Buying Your Next Stock section.

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.