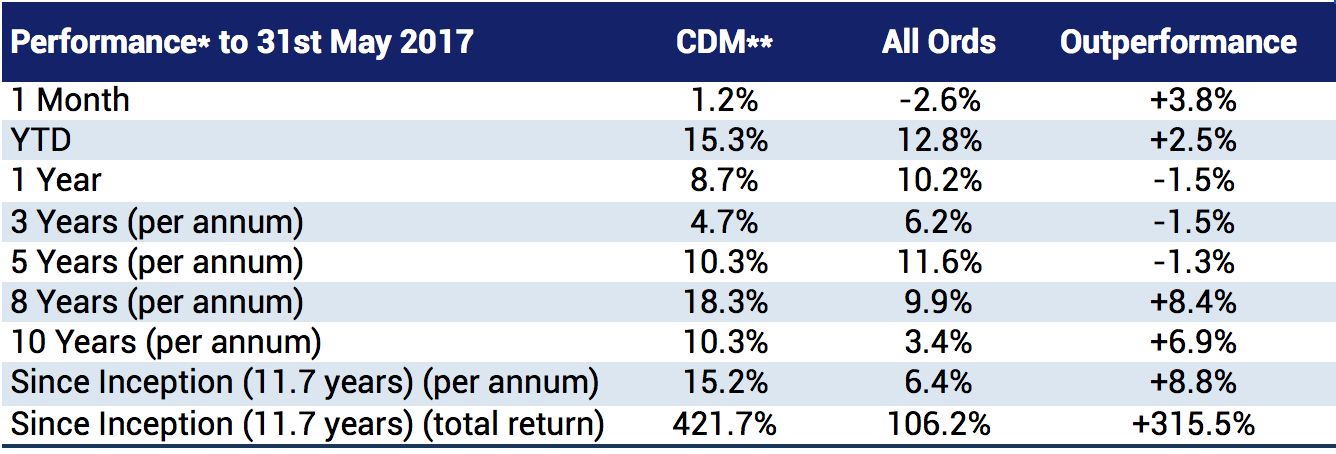

For the month of May 2017 Cadence Capital Limited returned a positive gross performance of 1.2% outperforming the All Ordinaries Accumulation Index by 3.8%. For the financial year to date, Cadence Capital Limited has returned a positive gross performance of 15.3% compared to an increase in the All Ordinaries Accumulation Index of 12.8%.

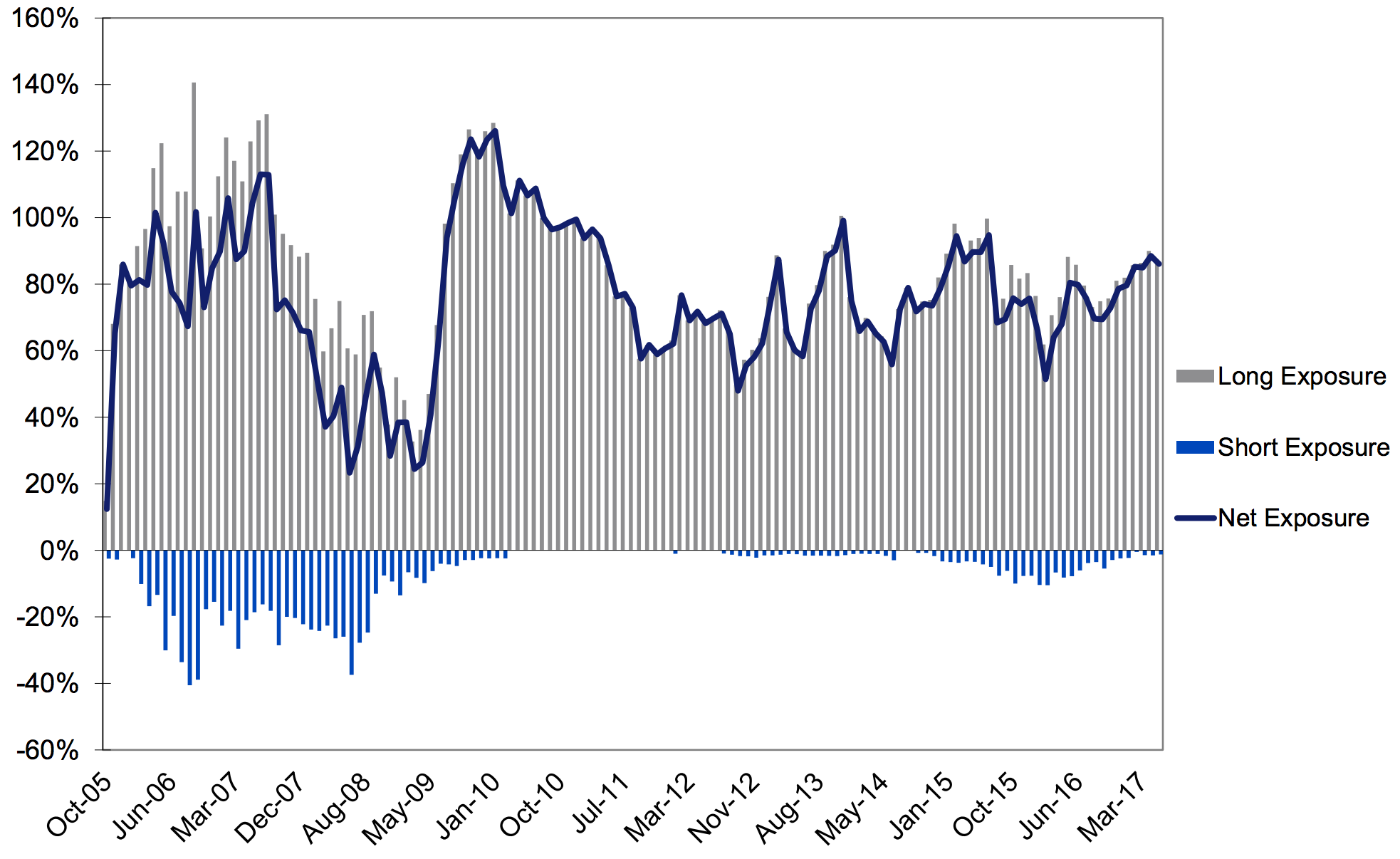

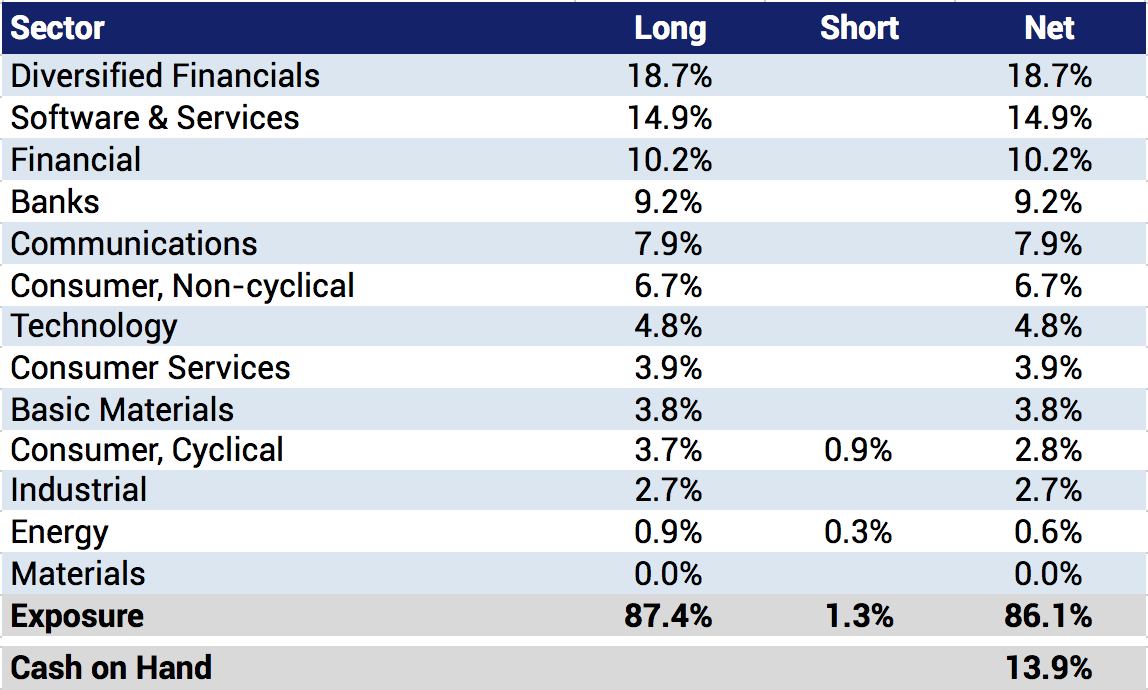

As at the 31st May 2017 the fund was holding 14% cash (86% invested).

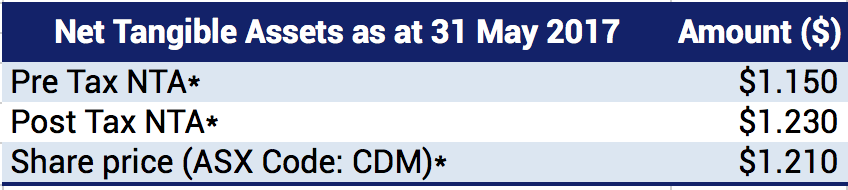

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

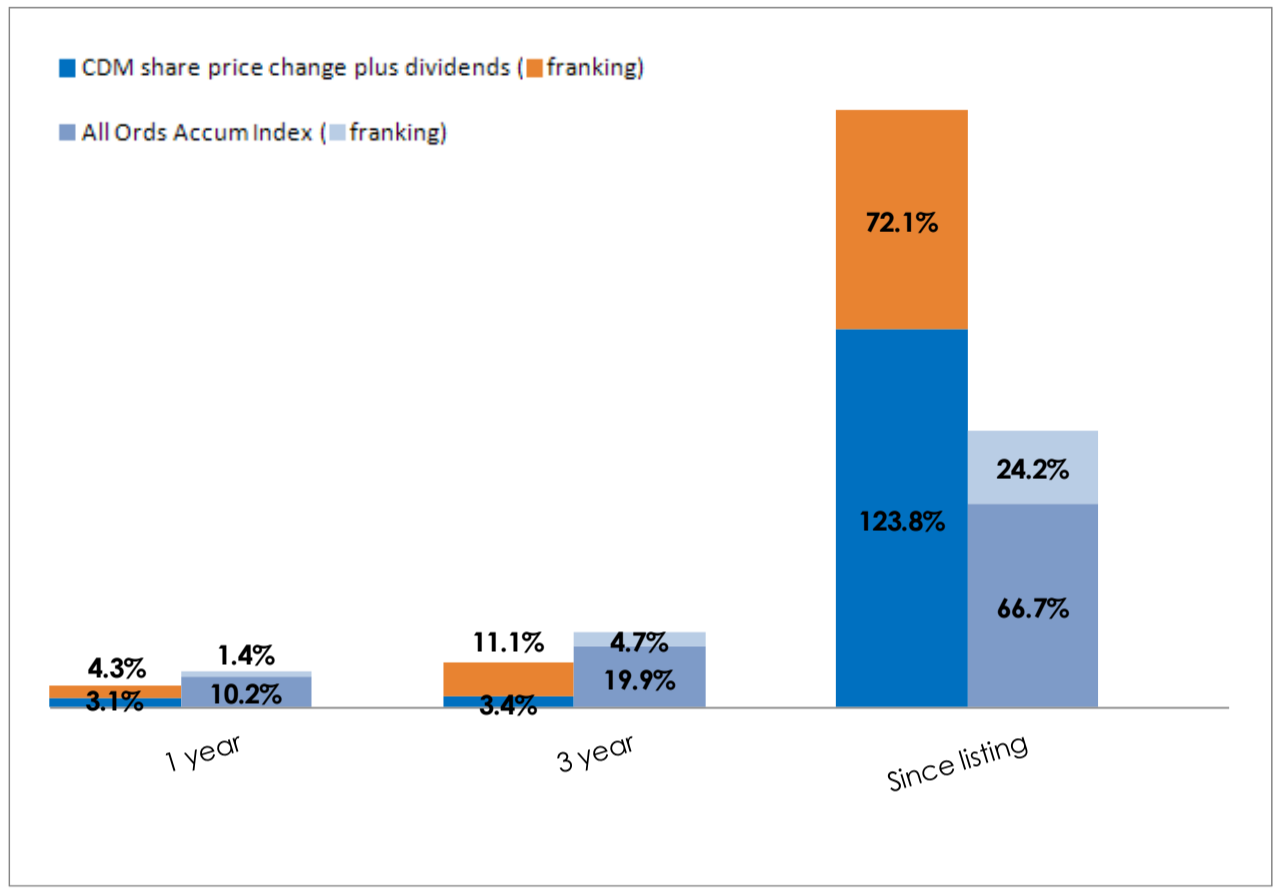

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

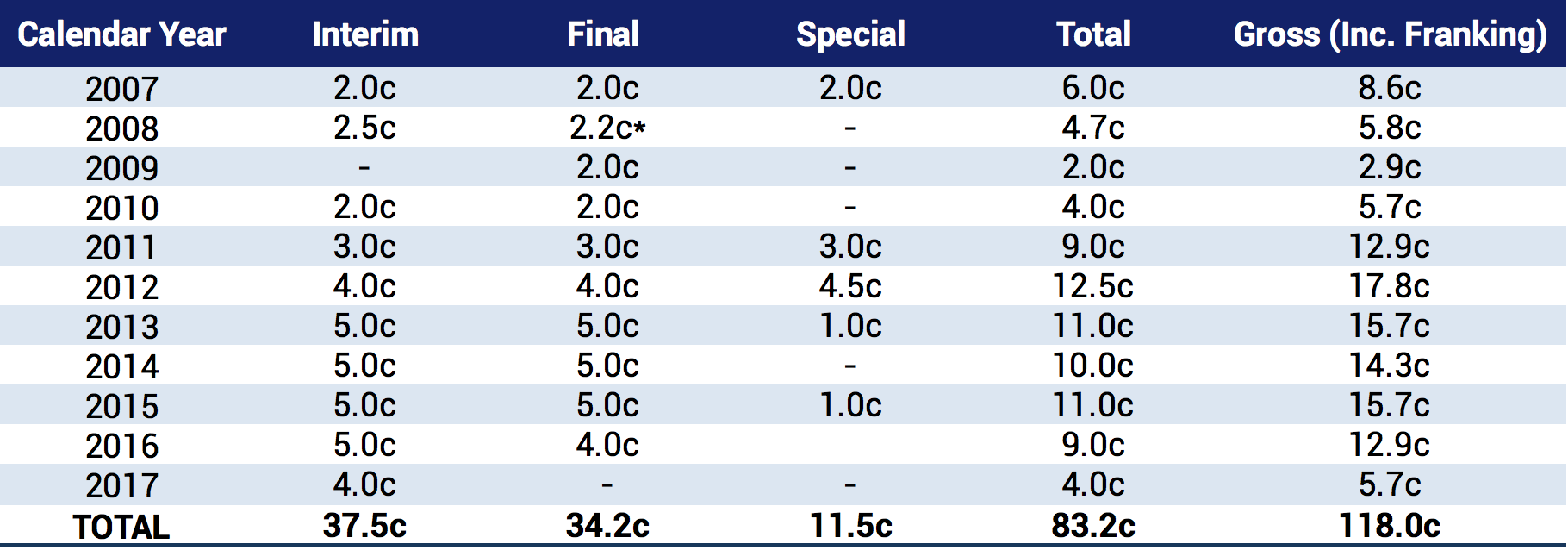

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Please view the March 2017 Quarterly Webcast which provides an update on the fund’s performance and a brief outlook for the Company. It then discusses the portfolio’s holdings, and gives a detailed update of the Company’s largest holding Melbourne IT (ASX:MLB).

Cadence Capital was quoted in the press in May in the following news articles The Australian – PM’s former firm Melbourne IT making its mark, AFR Chanticleer – Macquarie deserves re-rating as a fund manager and The Australian – Macquarie chief calls for infrastructure blitz.

Karl Siegling was also featured in Cuffelinks Newsletter on the impact of global migration of millionaires.

Please visit our 52 books you should read before buying your next stock section on the Cadence website to view some recently added titles.

To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.