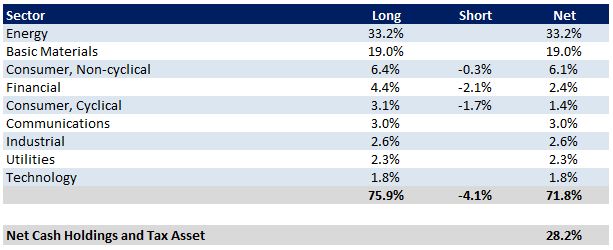

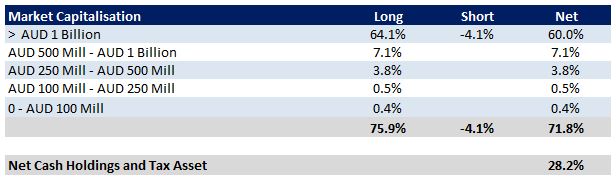

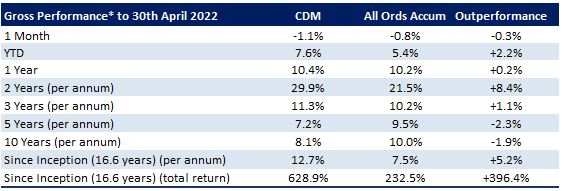

Cadence Capital Limited was down 1.1% in April, compared to the All Ordinaries Accumulation Index which was down 0.8% for the month. Year to date, for the 10 months ended 30 April 2022, the fund is up 7.6%, outperforming the All Ordinaries Accumulation Index by 2.2%. For April, the top contributors to performance were Whitehaven Coal, New Hope, Coronado Global Resources, Stanmore Coal and Flight Centre Travel. The largest detractors from performance were Enphase Energy, Peabody Energy, Melbana Energy and Life360. As at 30 April 2022, the Company was 71.8% invested (28.2% cash and equivalents).

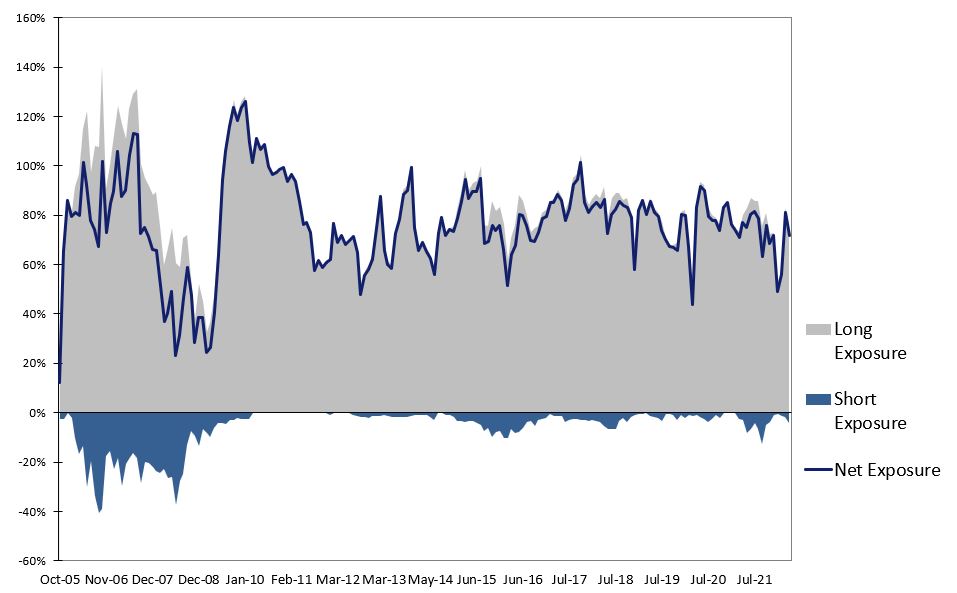

Financial markets remained volatile through April, with Australia again materially outperforming its international peers. For example, the S&P 500 and NASDAQ were down 8.8% and 13.0% in April respectively. Cash levels in the fund increased towards the end of the month as positions were exited that broke trend, and this activity has continued in early May as markets have continued to fall with the portfolio currently holding around 45% cash and equivalents. The fund’s ability to move into high levels of cash in markets that are trending down is an important tool in preserving our capital and maintaining buying power to scale into new investment opportunities that meet our criteria.

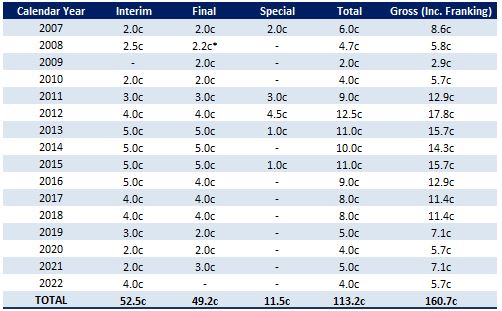

Fully Franked Half Year Dividend

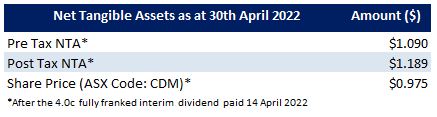

The Company’s 4 cents fully franked half year dividend was paid on the 14 April 2022. This interim dividend equated to an 8.2% annualised fully franked yield or a 11.7% gross yield (grossed up for franking credits) based on the share price on the date of the announcement of $0.98 per share. Importantly this equated to a 7.2% dividend yield based on pre-tax NTA, as the Company shares are currently trading at a discount to NTA despite the fund’s recent strong performance and a 16-year track record of significant outperformance against the All Ordinaries Accumulation Index. After paying this dividend the Company still has 30 cents per share of profits reserves to pay future dividends.

Quarterly Audiocast

In the coming weeks we will be releasing our quarterly audiocast which will give an update on the Company’s performance, the portfolio’s composition, its current investment themes and holdings, and the outlook for the rest of the year.

Fund NTA

Fund Performance

Fully Franked Dividends Declared Since Listing

Historic Portfolio Exposure

Portfolio Sector Analysis

Top 20 Portfolio Positions

Portfolio Market Capitalisation Analysis

Recent News

We recommend that you watch the December 2021 half year Audiocast where Karl Siegling firstly provides an update on the Company’s half year results, fully franked interim dividend and the portfolio’s composition. Charlie Gray and Jackson Aldridge then discuss some of the Company’s investment themes and positions held. Karl Siegling finishes with an update on the outlook for 2022.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.