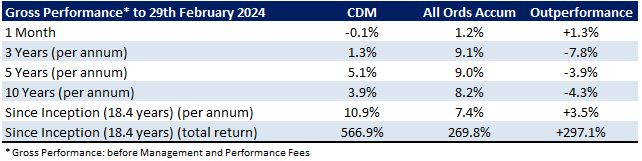

Cadence Capital Limited returned a negative gross performance of 0.1% in February, compared to the All Ordinaries Accumulation Index which was up 1.2% for the month. The top contributors to performance during the month were Meta Platforms, Smartgroup, QBE Insurance, Iris Energy and Netflix. The largest detractors from performance were Whitehaven Coal, Stanmore Resources, Strike Energy, BHP and Westgold Resources.

Smartgroup shares finished the month up 13% after releasing strong full year results. As expected, the government’s policy to abolish fringe benefits tax on electric vehicles that are on a novated lease, has driven strong demand for salary packaging and novated leasing. Electric vehicles were 41% of Smartgroup’s new car orders in H2 2023, compared to about 10% overall in Australia.

Our largest detractors from performance were all resource companies. February was a challenging month for resource companies, with the S&P ASX 200 Resources Index down 6%. BHP was down 7% for the month which was driven by a fall in the iron ore price due to weak demand from steelmakers in China.

Westgold Resources share price also fell in February but has since climbed 26% so far in March. This is primarily due to a strong gold price, with gold reaching an all-time high of USD 2,180 per ounce as at the time of writing this newsletter.

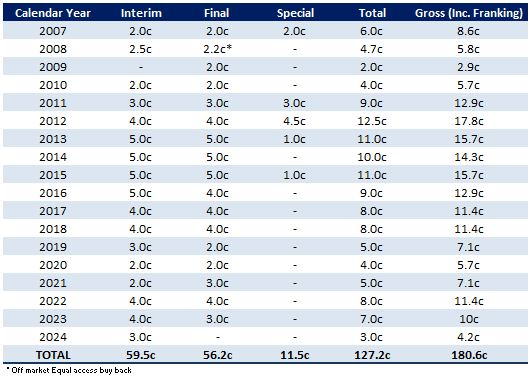

Fully Franked Half-Year Dividend

On the 26 February the Company announced a 3.0 cents per share fully franked interim dividend. This interim dividend equated to an 8.0% annualised fully franked yield or a 11.4% gross yield (grossed up for franking credits) based on the share price on the date of the announcement of $0.75 per share. After paying this dividend the Company still has 15.5 cents per share of profits reserves to pay future dividends.

The Ex-Date for the dividend is the 15 April 2024. The payment date for the dividend is the 30 April 2024.

DRP Operating for Interim Dividend

The dividend re-investment plan (DRP) will be in operation for this interim dividend. We would encourage shareholders to participate in the DRP as an efficient mechanism to add to existing holdings in the fund. The DRP will be priced at the weighted average share price over the relevant DRP pricing period. The Company will buy-back the shares it issues under the DRP. This buy-back will operate when the CDM share price is trading at a discount to the Pre-Tax NTA.

If you are not registered for the DRP and you would like to participate, please contact Boardroom on 1300 737 760.

CDM Share Price discount to NTA

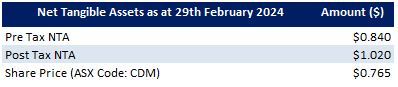

At the time of writing this newsletter, CDM is trading at a pre-tax NTA discount of around 12% whilst holding some cash balances. If all the shares in the portfolio fell by 13% the pre-tax NTA would still be above the share price.

Half-Year Audiocast

In the coming weeks we will be releasing the half-year audiocast which will discuss the Company’s half year performance and dividend, the portfolio composition, its current investment themes and holdings, and the outlook for the rest of the year.

Fund NTA

Fund Performance

Fully Franked Dividends Declared Since Listing

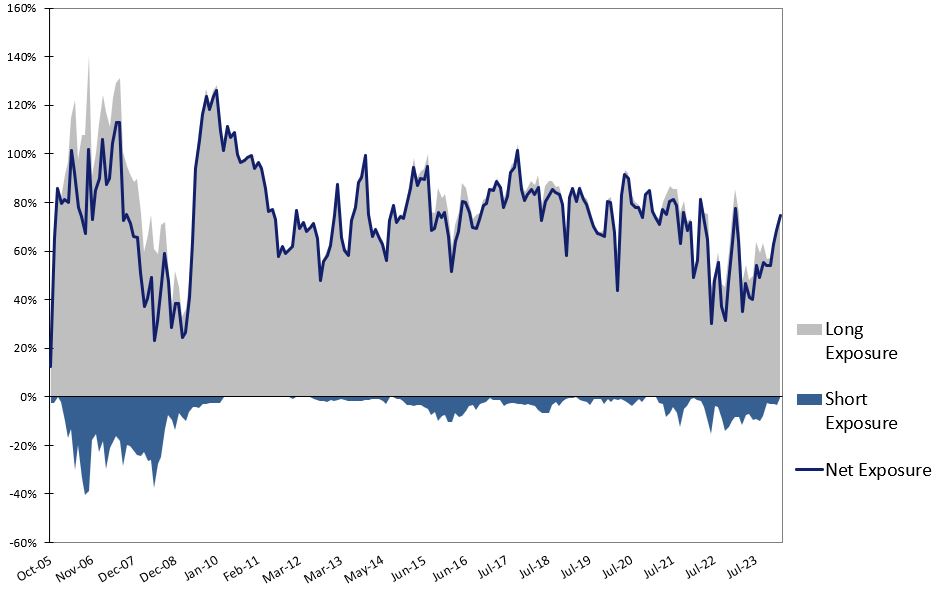

Historic Portfolio Exposure

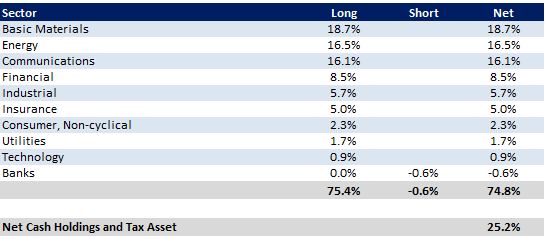

Portfolio Sector Analysis

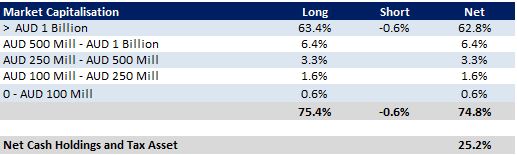

Portfolio Market Capitalisation Analysis

News

To watch CDM’s AGM Investor Briefing please click here. In this Investor Briefing, Karl Siegling starts by giving an update on CDM’s past and current year performance, discusses the portfolio and talks about some important market trends. Karl Siegling and Chris Garrard then discuss in detail some of the portfolio’s positions, namely Whitehaven Coal, Stanmore Resources, Westgold Resources, Newmont, Tietto Minerals, Boral, Netflix and Meta Platforms. Karl Siegling then closes with the outlook for 2024.

To view all previous Cadence webcasts and interviews please visit the Media Section of the website.

We also encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process.