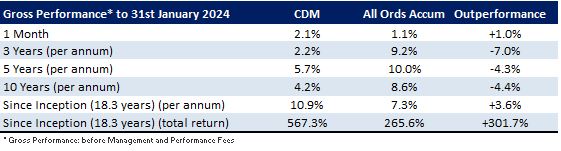

Cadence Capital Limited returned a positive gross performance of 2.1% in January, outperforming the All Ordinaries Accumulation Index by 1% for the month. During January the fund further invested its cash as more new investments were identified and as existing investments that continued to trend up were added to.

The top contributors to performance during January were Whitehaven Coal, Meta Platforms, Netflix, Alumina, Smartgroup, QBE Insurance and Austin Engineering. The largest detractors from performance were BHP, Evolution Mining and Syrah Resources.

Whitehaven Coal continued to perform well following its announcement of the acquisition of the Daunia and Blackwater metallurgical coal mines from BHP. Once the acquisition is complete Whitehaven Coal will derive approximately 70% of its revenue from metallurgical coal and 30% from thermal coal. The move to predominantly metallurgical coal was well timed, as thermal coal prices have fallen since the acquisition announcement, whereas metallurgical coal prices have risen.

Meta Platforms has had an excellent start to the year, with the share price rising 32% so far in 2024. On the 1st of February Meta Platforms released their fourth quarter results which significantly beat expectations. Online shopping companies in China such as Alibaba and Temu continued to drive strong demand globally for advertisements on Facebook and Instagram. Meta Platforms net income of USD 39b for 2023 was a 69% improvement on the 2022 result, and we expect 2024 to be another year of strong income growth for Meta Platforms.

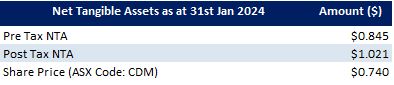

CDM Share Price discount to NTA

At the time of writing this newsletter, CDM is trading at a pre-tax NTA discount of around 11% whilst holding cash balances. If all the shares in the portfolio fell by 13%, the pre-tax NTA would still be above the share price. To put it another way, the shares in the portfolio can be bought at an 13% discount to their underlying value.

Fund NTA

Fund Performance

Fully Franked Dividends Declared Since Listing

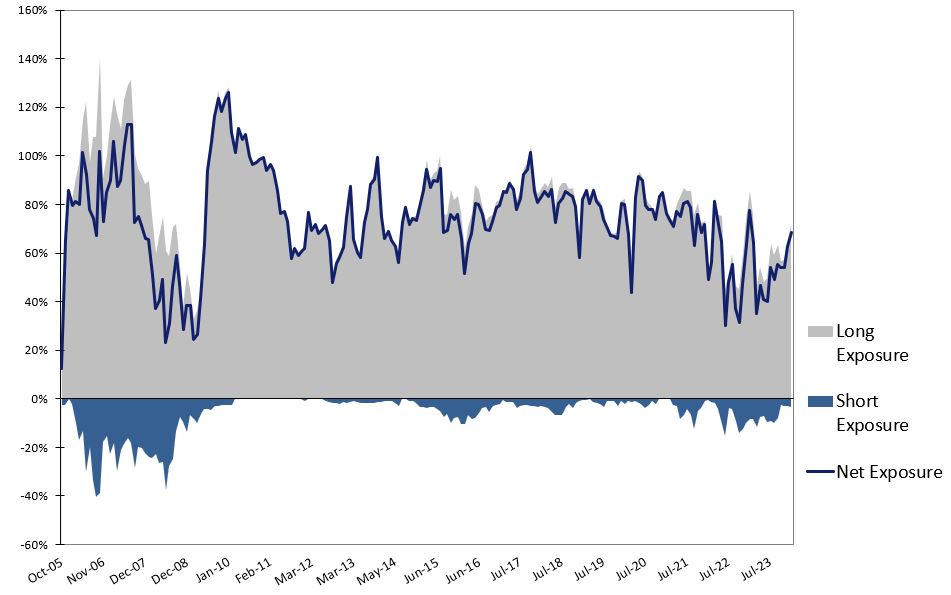

Historic Portfolio Exposure

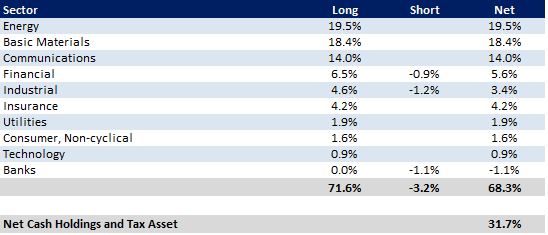

Portfolio Sector Analysis

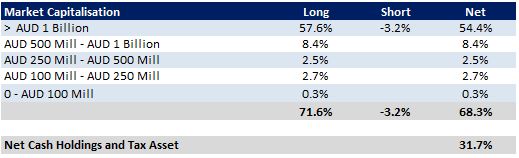

Portfolio Market Capitalisation Analysis

News

To watch CDM’s AGM Investor Briefing please click here. In this Investor Briefing, Karl Siegling starts by giving an update on CDM’s past and current year performance, discusses the portfolio and talks about some important market trends. Karl Siegling and Chris Garrard then discuss in detail some of the portfolio’s positions, namely Whitehaven Coal, Stanmore Resources, Westgold Resources, Newmont, Tietto Minerals, Boral, Netflix and Meta Platforms. Karl Siegling then closes with the outlook for 2024.

To view all previous Cadence webcasts and interviews please visit the Media Section of the website.

We also encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process.