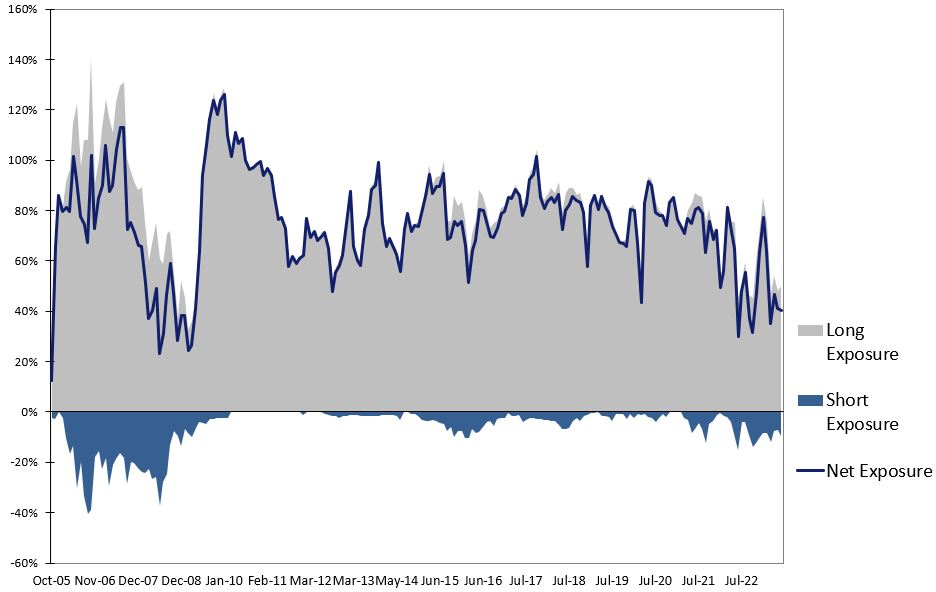

Cadence Capital Limited returned a positive gross performance of 1.5% in June, compared to the All Ordinaries Accumulation Index which was up 1.9% for the month. The top contributors to performance during June were Iris Energy, Meta Platforms, BHP Group, Sierra Rutile, QBE insurance and Netflix. The largest detractors from performance were Patriot Battery Metals, Qantas Airways and Resolute Mining. Cadence Capital Limited remains conservatively positioned with gross exposure of 60% and around 50% of its investable portfolio in cash.

In June, the share price uptrend in Meta Platforms, Netflix and Iris Energy continued, and we added to all three positions in line with our investment process. Netflix estimates that there are about 100 million people using Netflix by borrowing a friend or family member’s password, and they have recently announced initiatives to convert these users to paying customers, which we expect will have a positive impact on its upcoming financial results. Meta Platforms also announced Thread as a potential competitor to Twitter in June.

CDM Share Price discount to NTA

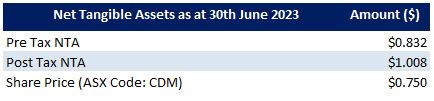

CDM is currently trading at a pre-tax NTA discount of around 9% whilst holding around 50% cash. If all the shares in the portfolio fell by 18% the pre-tax NTA would still be above the share price. To put it another way, the shares in the portfolio can be bought at an 18% discount to their underlying value.

Fund NTA

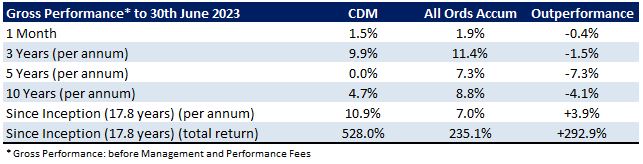

Fund Performance

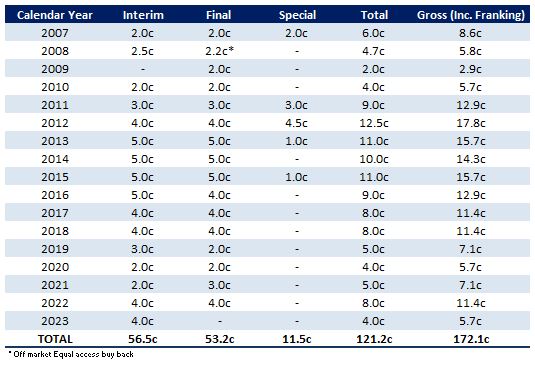

Fully Franked Dividends Declared Since Listing

On the 28th of April the Company paid its 4.0 cent fully franked half-year dividend. After paying this

dividend the Company still has 22 cents per share of profits reserves to pay future dividends.

Historic Portfolio Exposure

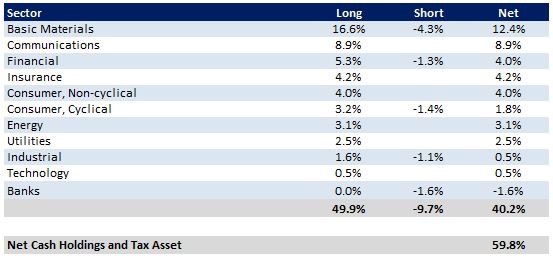

Portfolio Sector Analysis

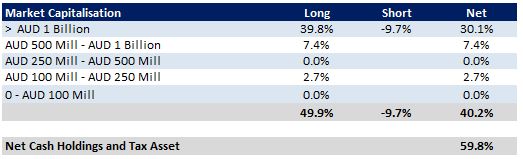

Portfolio Market Capitalisation Analysis

Recent News

To hear CDM’s latest Quarterly Audiocast please click here. In this audiocast, Karl Siegling firstly discusses the Company’s recent performance, CDM’s Total Shareholder Return (incl. franking), CDM’s Share Price vs NTA and the current composition of the portfolio. Karl then discusses some of CDM’s current investment themes and then looks in detail at two of its current investments, Newcrest Mining and Meta Platforms. Karl finishes with the outlook for the rest of the year.

To view all previous Cadence webcasts and interviews please visit the Media Section of the website.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process.