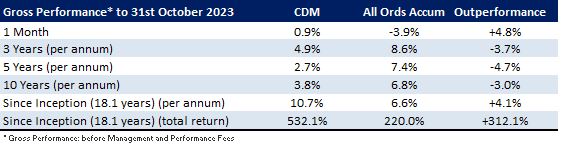

Cadence Capital Limited returned a positive gross performance of 0.9% in October, outperforming the All Ordinaries Accumulation Index by 4.8% for the month. The top contributors to performance during October were Tietto Minerals, Westgold Resources, Newmont/Newcrest merger, Whitehaven Coal, and Red 5. The largest detractors from performance were Capstone Copper, AMP and Tourism Holdings Rentals.

During October Tietto Minerals received a takeover offer from Zhaojin Mining, it’s second largest shareholder, for 58 cents per share, which was a 38% premium to the share price at the time. The Tietto board has recommended that shareholders do not accept the offer. Tietto shares are currently trading at 59 cents which suggests that an improved takeover offer is likely.

We spoke about Westgold in our year end audiocast last month. Westgold has continued to perform well in October. The Australian dollar gold price is at all time highs, and now that Westgold’s hedge book has rolled off they are receiving the full AUD gold price for all gold produced. Westgold recently announced Q1 mine operating cash flow of $60m and reiterated that they were on track to achieve their full year production guidance.

During October the Newmont/Newcrest merger completed. At the start of October there was still a small arbitrage opportunity, and the completion of the merger enabled us to realise this gain as well as receive the fully franked Newcrest special dividend.

Fully Franked Year-End Dividend

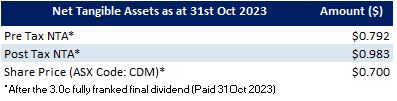

The Company paid its 3.0 cents per share fully franked year-end dividend on 31 October 2023, bringing the full-year dividend to 7.0 cents per share fully franked. The full-year dividend of 7.0 cents per share fully franked equates to a 9.0% fully franked yield or a 12.8% gross yield (grossed up for franking credits) based on the share price of $0.78 on the date the dividend was announced. After paying this dividend, the Company still has 18.6 cents per share of profit reserves to pay future dividends.

The dividend re-investment plan (DRP) was in operation for this final dividend. The issue price for the DRP was $0.7233 per share. The Company has implemented an on-market buy-back to repurchase the shares it issued under the DRP. This buy-back will operate when the CDM share price is trading at a discount to the Pre-Tax NTA. Cadence Capital Limited is looking to support its DRP registered shareholders to reinvest their dividends at a discount to NTA, instead of leaving them to manage market orders for reinvesting their dividends.

CDM Share Price discount to NTA

At the time of writing this newsletter, CDM is trading at a pre-tax NTA discount of around 12% whilst holding significant cash balances. If all the shares in the portfolio fell by 16%, the pre-tax NTA would still be above the share price. To put it another way, the shares in the portfolio can be bought at a 16% discount to their underlying value.

Upcoming AGM and Investor Briefing

We would like to remind you that we are holding our AGM and Investor Briefing at the Museum of Sydney, Warrane Theatre, at 2:00pm (AEDT) on Thursday 23rd November 2023. A dial-in facility is available for those investors that are not able to attend the AGM and Investor Briefing in person. The numbers to dial are as follows:

- Toll Free Australia – 1800 809 971

- Toll Free Australia Back Up – 1800 558 698

A webcast of the Investor Briefing will also be made available online sometime after the meeting. If you have any questions that you would like answered at the AGM please can you email them to info@cadencecapital.com.au.

Fund NTA

Fund Performance

Fully Franked Dividends Declared Since Listing

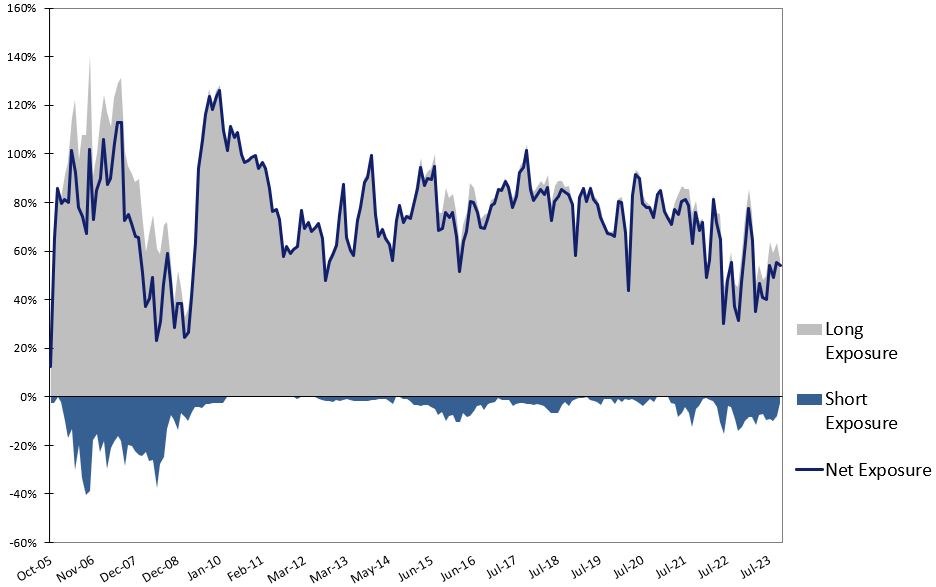

Historic Portfolio Exposure

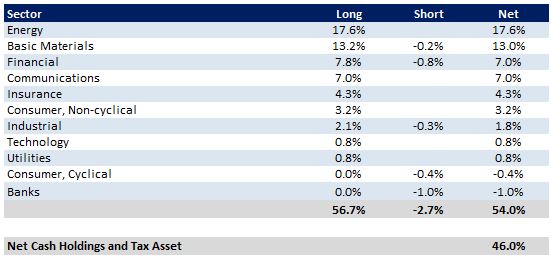

Portfolio Sector Analysis

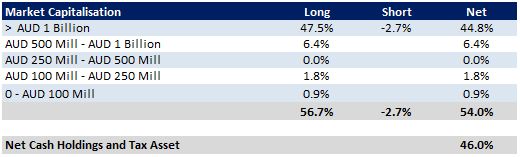

Portfolio Market Capitalisation Analysis

News

If you have not already done so, we would encourage you to watch the recently released Year-End Audiocast. In this audiocast, Karl Siegling firstly provides an update on the Company’s 2023 financial year performance, the 3.0c fully franked year-end dividend, the portfolio’s composition and CDM’s discount to NTA. Karl Siegling and Chris Garrard then discuss their investments in Meta Platforms, Whitehaven Coal and Westgold Resources. Karl Siegling then finishes with an update on the outlook for FY 2024.

We also encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process.