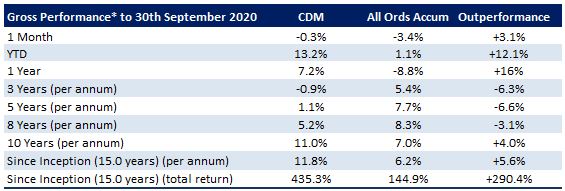

Cadence Capital Limited returned a negative gross performance of 0.3% in the month of September, compared to the All Ordinaries Accumulation Index which was down 3.4% over the same period. The fund has had a good start to the new financial year, returning 13.2% outperforming the All Ordinaries Accumulation Index by 12.1% during this period. The largest contributors to performance during September were Resimac Group, Webcentral Group, Pinterest Inc, Citadel Group and Shine Justice Ltd. The largest detractors from performance were EML Payments and Credit Corp Group.

The Company will be releasing its September webcast in the coming weeks. This webcast will give shareholders an update on the fund’s performance, dividends, its current portfolio positioning, discount to NTA, current investment themes and market outlook.

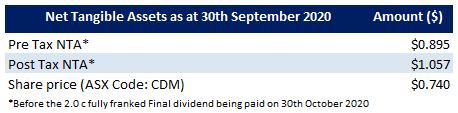

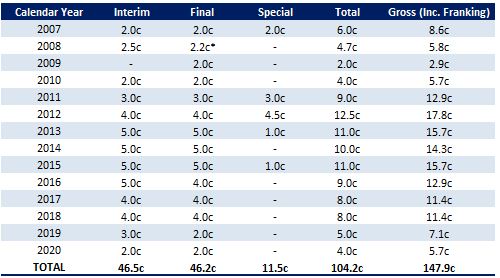

In August 2020, the Company announced its full year results and a 2.0 cents fully franked final dividend. This brought the 2020 fully franked full year dividend up to 4.0 cents per share equating to a 5.7% annual fully franked yield, or an 8.1% gross yield based on the CDM share price on the date of the announcement. The Ex-Date for the dividend is the 19th October 2020 and the payment date for the dividend is the 30th October 2020. The dividend re-investment plan (DRP) is not in operation for this final dividend as the Company’s shares are currently trading at a large discount to the underlying NTA per share of the Company. The Company has implemented an on-market share buy-back which increases the NTA per share for all existing Cadence Capital Limited shareholders.

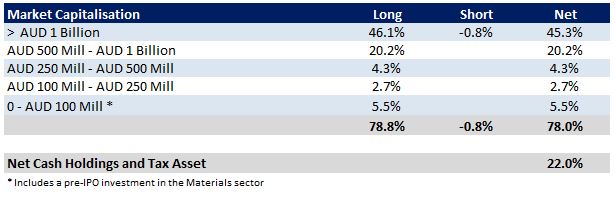

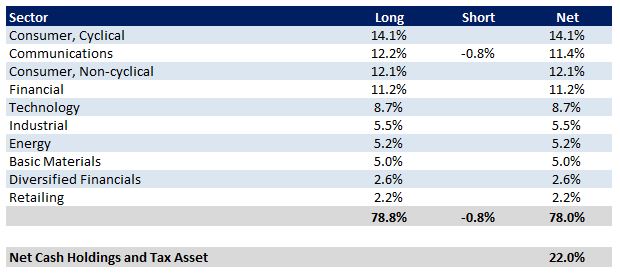

At 30 September 2020, the Company was 78.0% invested.

Fund NTA

Fund Performance

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

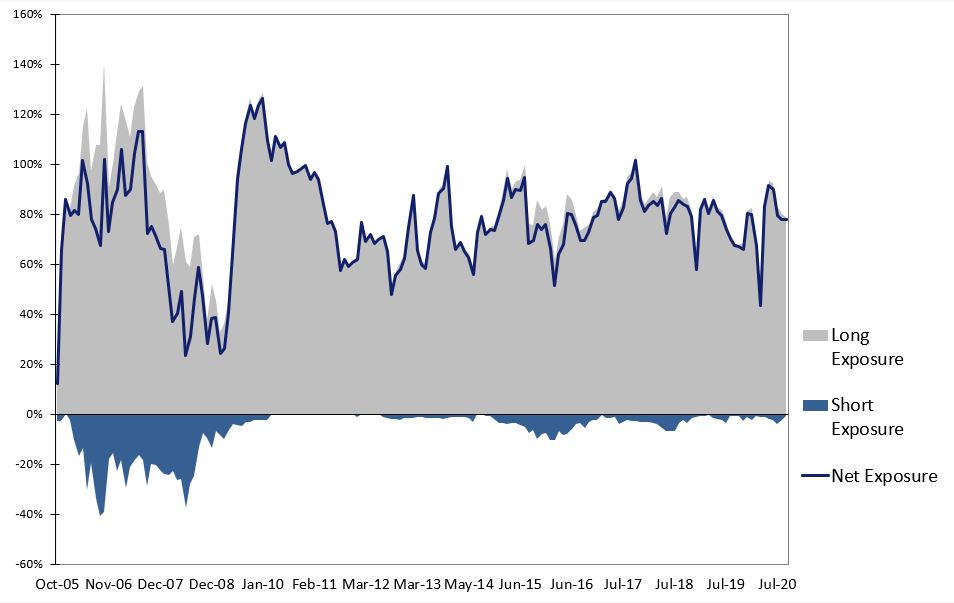

Historic Portfolio Exposure

Portfolio Sector Analysis

Top 20 Portfolio Positions

Portfolio Market Capitalisation Analysis

Recent News

In June this year the Company held its June 2020 Investor Presentation followed by a Q&A Session involving portfolio managers Karl Siegling, Charlie Gray and Jackson Aldridge. In this online investor presentation, Karl Siegling provided an update on the fund including its recent performance, current holdings and positioning, and the key investment themes emerging in the portfolio. He also discussed the Company’s discount to NTA, tax asset, and capital management strategy.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the Cadence investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.