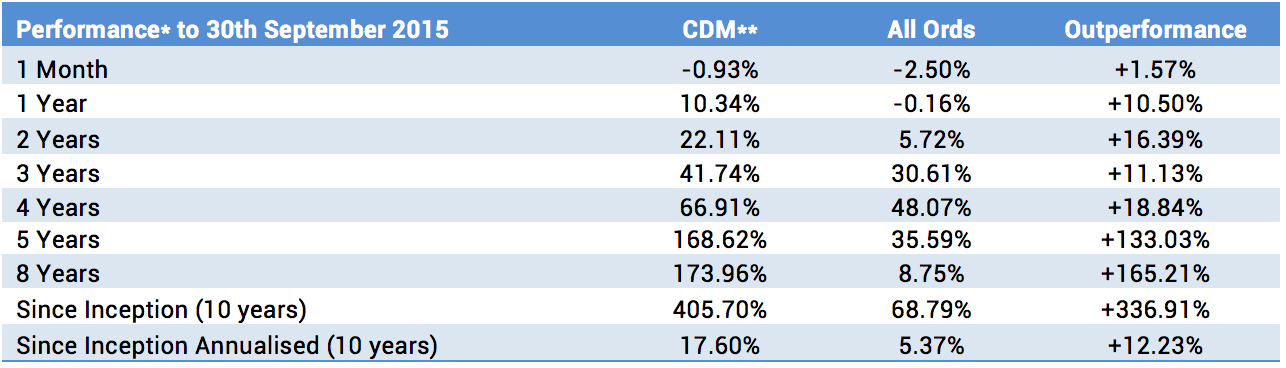

This month marks our 10 year anniversary. Since inception the Company has generated 17.60% per annum against market returns of 5.37% per annum whilst holding on average 24% cash. For the month of September 2015 Cadence Capital Limited returned a negative gross performance of 0.93% compared to a decrease in the All Ordinaries Accumulation Index of 2.50%.

Over the past 12 months Cadence Capital Limited has returned a positive gross performance of 10.34% outperforming the All Ordinaries Accumulation Index by 10.50%. For the financial year to date Cadence Capital Limited has returned a negative gross performance of 1.85% outperforming the All Ordinaries Accumulation Index by 3.94%.

The company is pleased that it successfully raised $18 million at $1.43 through its recent Placement. This brings the total amount raised through the Options exercise and placement to $137 million.

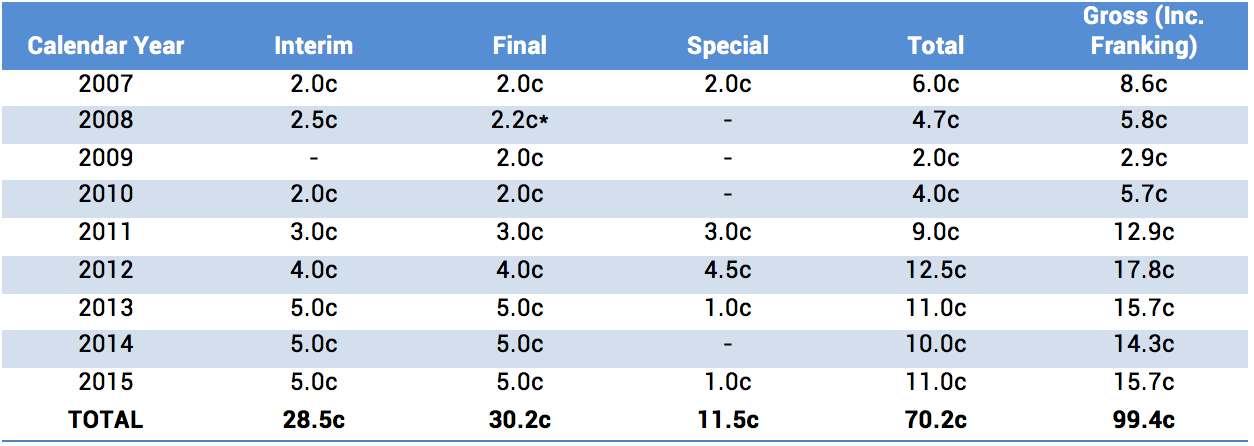

Cadence shareholders will be entitled to the 6.0 cent fully franked year-end dividend. The Ex-Date for the dividend is 20th October 2015 and the Payment Date is 29th October 2015. Based on the end of month CDM share price this equates to a 7.4% fully-franked yield, or a 10.6% yield grossed up for franking credits.

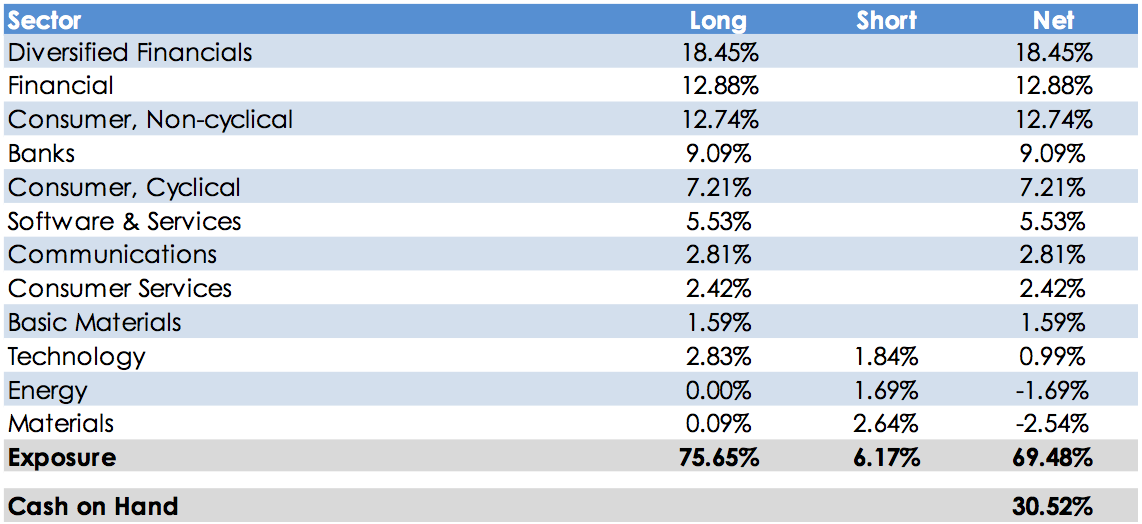

As at the 30th September 2015 the fund was holding 31% cash (69% invested).

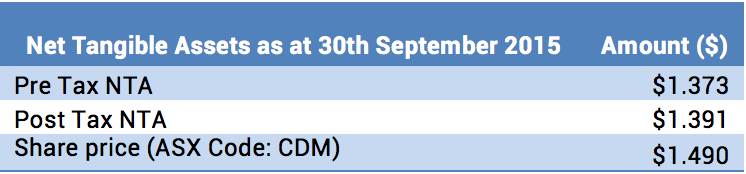

Fund NTA

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

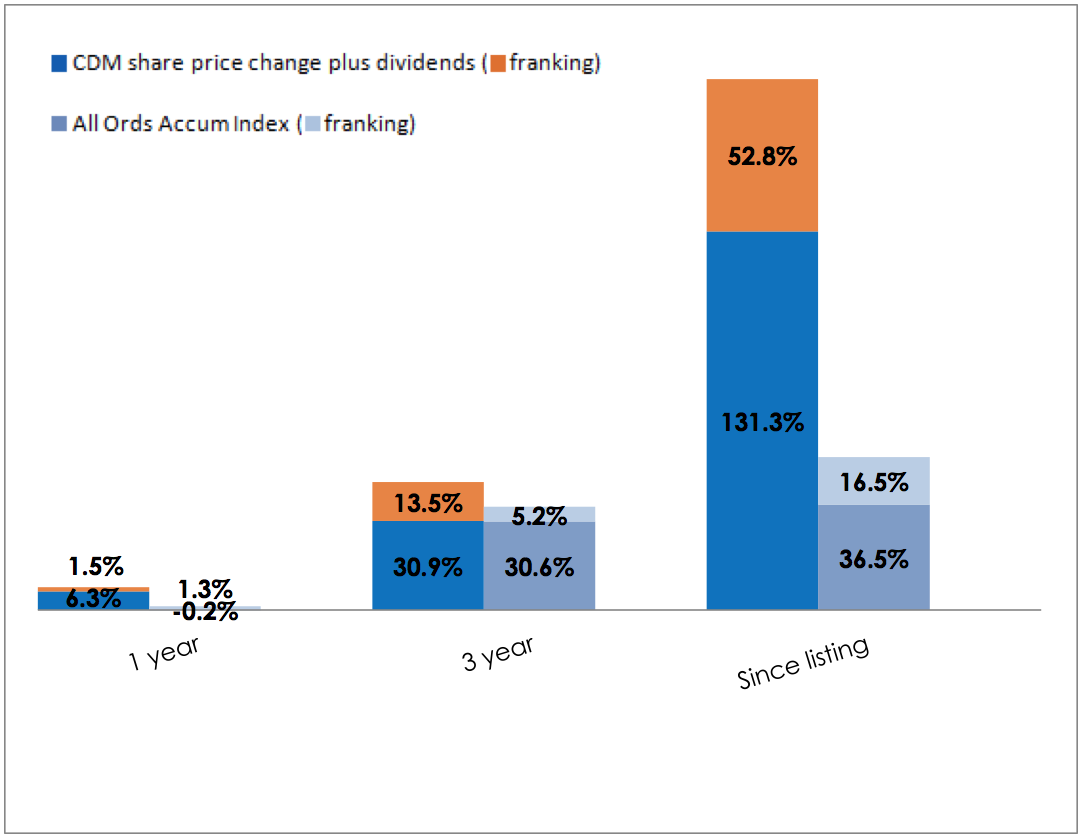

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

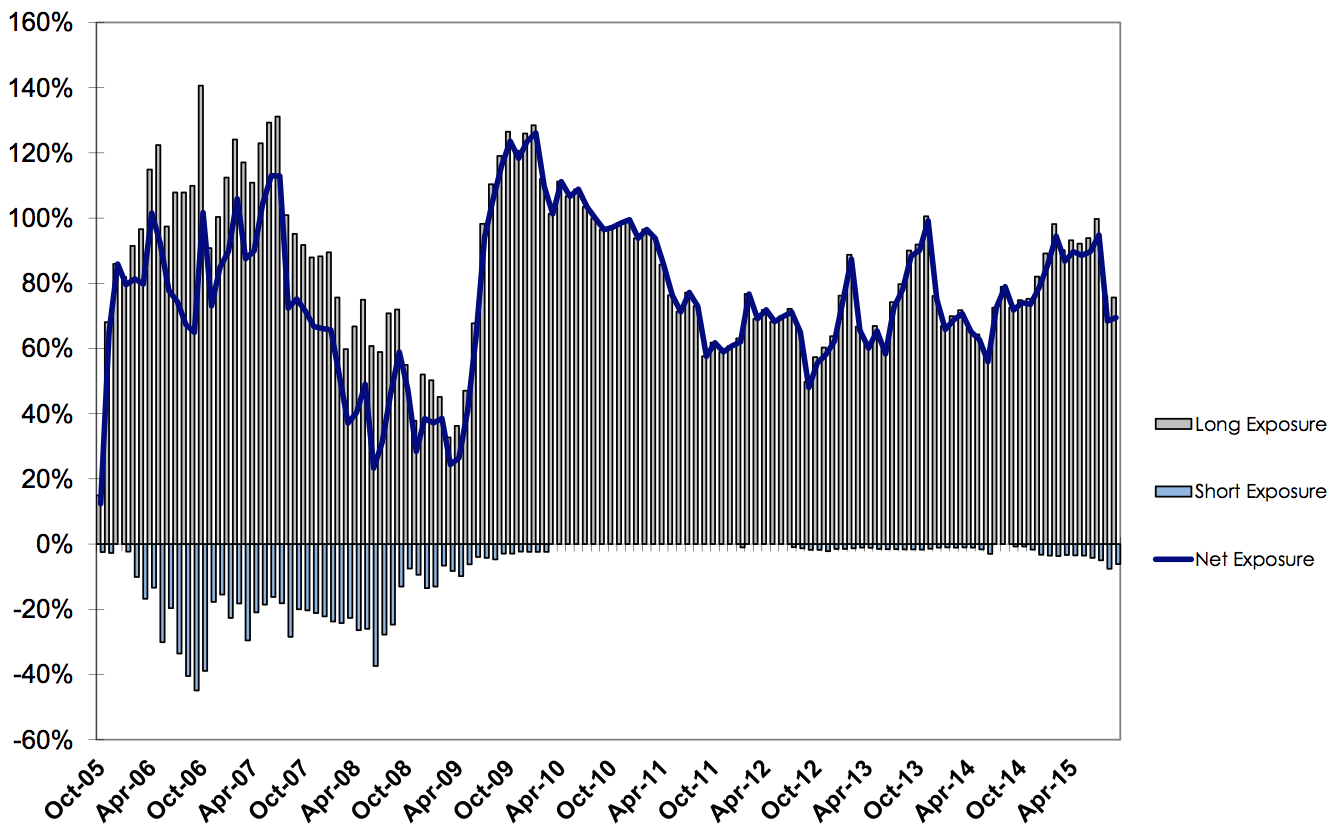

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Karl Siegling was featured in Bell Direct’s CEO interview series where he discussed his favourite stocks and Cadence’s investment philosophy.

Funds management involves a lot of reading and synthesis of information. Whilst not an exhaustive list, we will recommend one book a week for a year in our 52 Books To Read section. This list should provide a good starting point for any interested investor.

Independent Investment Research recently rated CDM “Recommended Plus”. Read the report here.

To view all previous Cadence webcasts and press articles, please visit the Media Section of our Website.