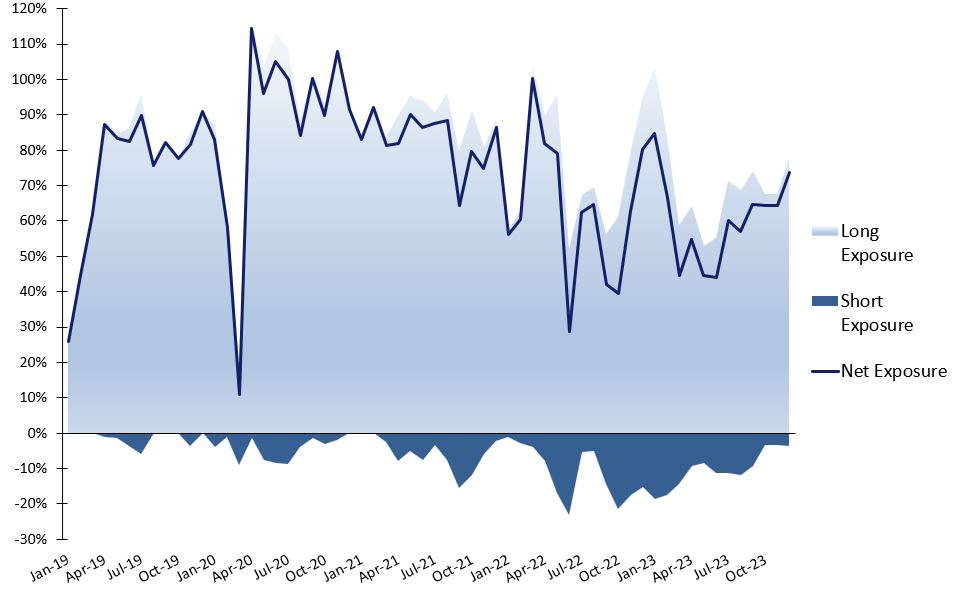

Cadence Opportunities Fund returned a positive gross performance of 2.9% in December, underperforming the All Ordinaries Accumulation Index by 4.5% for the month, which was driven by high levels of cash. These high levels of cash protected the fund during the recent periods when the market moved downwards. During December the fund invested 10% of its cash as new investments were identified and as existing investments that continued to trend up were added to.

The top contributors to performance during December were Zillow Group, Meta Platforms, Whitehaven Coal, BHP, Capstone Copper, Strike Energy, Genworth Financial and Stanmore Resources. The largest detractors from performance were Augustus Minerals, Red5 and QBE.

The Zillow Group share price rose over 40% in December. There were two main factors driving this increase. In the short term, interest rates in the US look like they have peaked, with the US Federal Reserve stating that “a lower target range for the federal funds rate would be appropriate by the end of 2024”. Higher interest rates have caused a slowdown in the US real estate market, which has impacted on Zillow’s revenue.

In the longer term there may be an opportunity for Zillow to utilise its number one position in US real estate listings to become more like realestate.com.au in Australia. A recent court case found that home buyers in the US should have more choice around whether to use a buyer’s agent, and how much commission the buyer’s agent should receive. This could lead to the US home buying process becoming similar to that in Australia where buyer’s agents are uncommon, and sellers are more focused on appealing directly to home buyers through quality listings on websites like Zillow.

Recent AGM Investor Briefing

To watch CDO’s AGM Investor Briefing please click here. In this AGM Investor Briefing, Karl Siegling starts by giving an update on CDO’s past and current year performance, discusses the portfolio and talks about some important market trends. Karl Siegling and Chris Garrard then discuss in detail some of the portfolio’s positions, namely Whitehaven Coal, Stanmore Resources, Westgold Resources, Newmont, Tietto Minerals, Boral, Netflix and Meta Platforms. Karl Siegling then closes with the outlook for 2024.

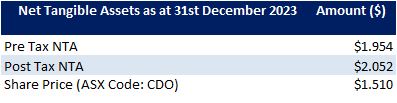

CDO Share Price discount to NTA

At the time of writing this newsletter, CDO is trading at a pre-tax NTA discount of around 18% whilst holding reasonably high cash balances. If all the shares in the portfolio fell by 21% the pre-tax NTA would still be above the share price. To put it another way, the shares in the portfolio can be bought at a 21% discount to their underlying value.

Fund NTA

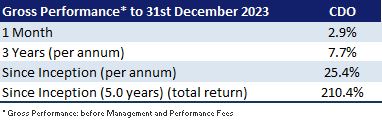

Fund Performance

Historic Portfolio Exposure

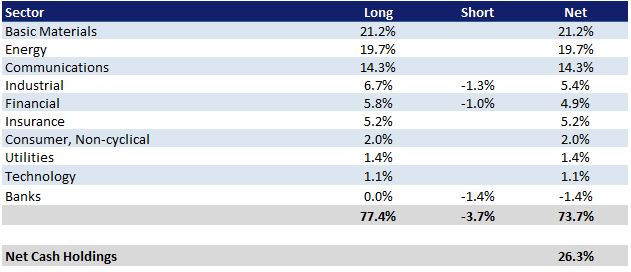

Portfolio Sector Analysis

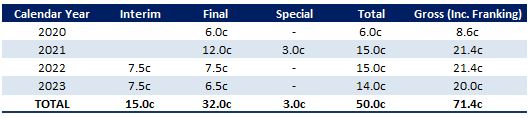

Franked Dividends Declared

News

To view all previous Cadence webcasts and interviews please visit the Media Section of the website.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process.