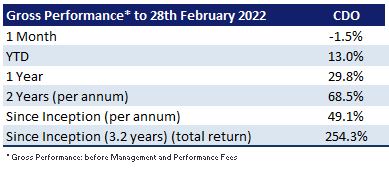

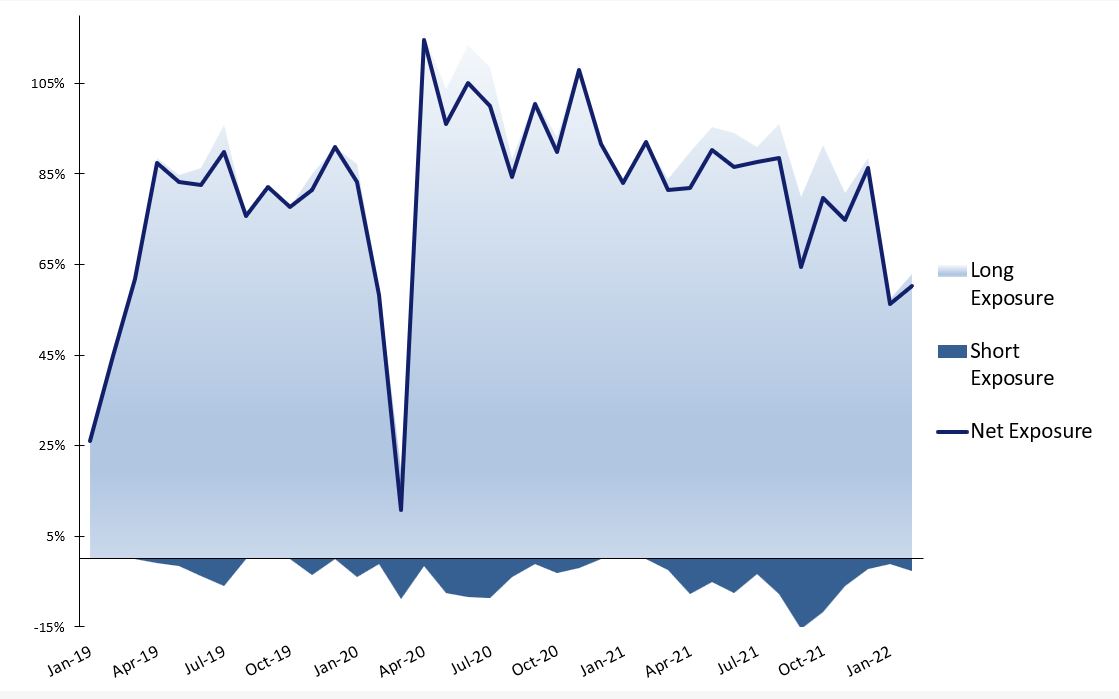

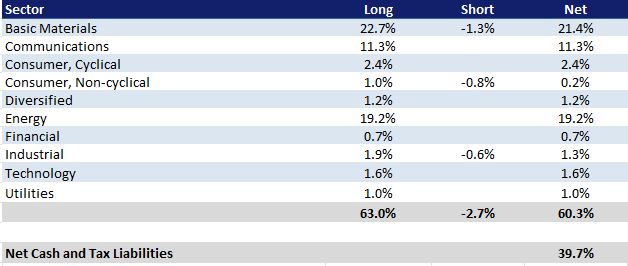

Cadence Opportunities Fund was down 1.5% in February, compared to the All Ordinaries Accumulation Index which was up 1.7% for the month. For the 8 months ended 28 February 2022 the fund is up 13.0% outperforming the All Ordinaries Accumulation Index by 13.6%. For February, the top contributors to performance were Whitehaven Coal, Woodside Petroleum and Novonix. The largest detractors from performance were Uniti Group, Netflix and Monday.com. As at 28 February 2022, the Company was 60.3% invested (39.7% cash).

February was another volatile month for markets as investors grappled with a very uncertain environment. Towards the end of the month and into early March the underlying themes of energy and resources strength and weakness in high-valuation growth style stocks continued. Russia’s invasion of Ukraine and the resultant sanctions imposed by many nations has significantly impacted global food and energy supply chains. While we are hopeful for a peaceful outcome, rebalancing commodity markets will take time and likely require ongoing higher prices. The portfolio currently holds over 30% cash and approximately 60% of its invested portfolio is exposed to energy and resources.

Half Year Audiocast

Over the next week we will be releasing the December 2021 half year audiocast which will discuss the Company’s first 6 months performance, its interim dividend, its portfolio composition, its current investment themes and holdings, and the outlook for the rest of the year.

Fully Franked Half Year Dividend Declared

In January the Board declared a 7.5 cents fully franked half year dividend, an annualised increase of 25% on last year’s ordinary dividends. This interim dividend equates to a 5.1% annualised fully franked yield or a 7.3% gross yield (grossed up for franking credits) on the share price on the date of the announcement of $2.94 per share. After paying this dividend the Company still has more than 50 cents per share of profits reserves to pay future dividends

The Dividend Re-Investment Plan (“DRP”) is in operation for the interim dividend. The issue price will be at a 5% discount to the weighted average of the prevailing share price over the relevant DRP pricing period. If you are not registered for the DRP and you would like to participate, please contact Boardroom on 1300 737 760.

The Ex-Date for the dividend is the 31st March 2022. The payment date for the dividend is the 14th April 2022.

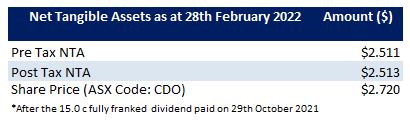

Fund NTA

Fund Performance

Historic Portfolio Exposure

Portfolio Sector Analysis

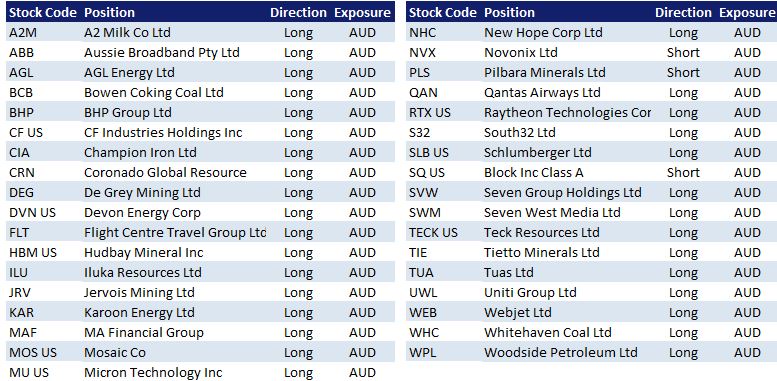

Portfolio Positions

News

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.