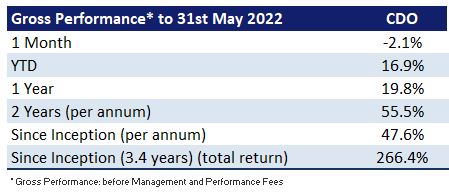

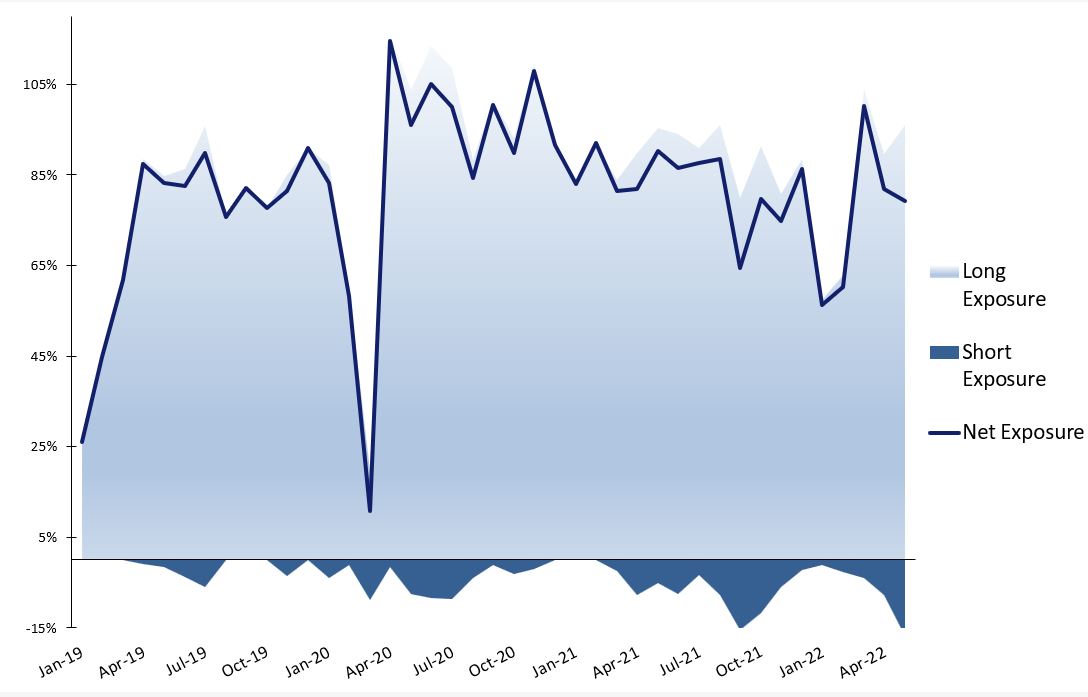

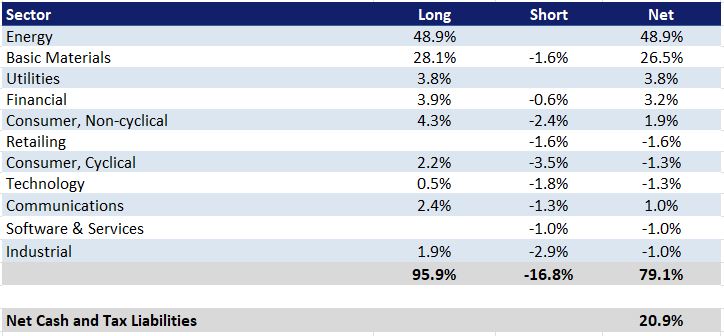

Cadence Opportunities Fund was down 2.1% in May, outperforming the All Ordinaries Accumulation Index by 1.0%. Year to date the fund is up 16.9% outperforming the All Ordinaries Accumulation Index by 14.8%. For May the top contributors to performance were Terracom, Whitehaven Coal, Stanmore Coal and Schlumberger Ltd. The largest detractors from performance were Aussie Broadband, Calix, Seven West Media and Jervois Mining. As at 31 May 2022, the Company was 79.1% invested (20.9% cash and equivalents).

Recent sector trends persisted through May with energy remaining the clear leader while small capitalisation and ‘growth’ style equities led the rest of the market lower. The RBA joined its international peers in raising interest rates by 0.50% early in June and signalled further increases ahead. The trajectory of higher inflation and interest rates is a significant headwind for risk assets, just as low inflation and interest rates have benefitted markets over the past 30 years. The fund’s high weighting to energy continues to deliver strong returns for investors, while high cash levels and a larger short book also aided performance.

Fully Franked Half Year Dividend

The Company’s 7.5 cents fully franked half year dividend was paid out on the 14 April 2022. This interim dividend equates to a 5.1% annualised fully franked yield or a 7.3% gross yield (grossed up for franking credits) on the share price on the date of the announcement of $2.94 per share. After paying this dividend the Company still has more than 50 cents per share of profits reserves to pay future dividends

Quarterly Audiocast

As the portfolio has changed substantially over the past 6 months, if you have not done so already, we strongly recommend that you watch the March 2022 Quarterly Audiocast . In this audiocast Karl Siegling firstly provides an update on the Company’s performance, fully franked interim dividend, portfolio composition and the funds current cash levels. Charlie Gray and Jackson Aldridge then discuss the company’s trading statistics, investment themes and some of its current long and short holdings. Karl Siegling finishes with an update on the outlook for 2022.

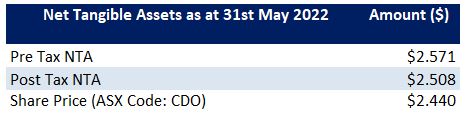

Fund NTA

Fund Performance

Historic Portfolio Exposure

Portfolio Sector Analysis

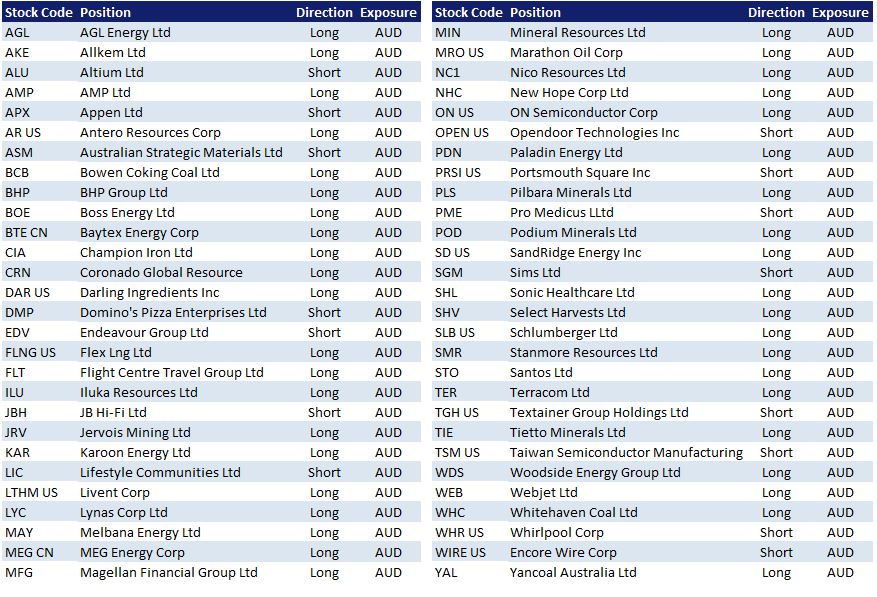

Portfolio Positions

News

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process. To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.