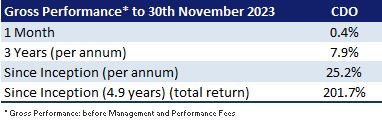

Cadence Opportunities Fund returned a positive gross performance of 0.4% in November, underperforming the All Ordinaries Accumulation Index by 4.8% for the month. Year to date Cadence Opportunities Fund has returned 0.7% compared to the All Ordinaries Accumulation Index which is up 0.5% for the same period. The top contributors to performance during November were Meta Platforms, Netflix, Tietto Minerals, Capstone Copper, Augustus Minerals and Austin Engineering. The largest detractors from performance were Sierra Rutile, Whitehaven Coal, New Hope and AMP.

Capstone Copper performed well in November with its shares rising 18% over the month, compared to a 5% increase in the copper price over the same period. The company is scheduled to complete the expansion of its Mantoverde mine in Chile this year, which will see the mine triple its copper production once the ramp up phase is complete.

We discussed at our AGM that during October Tietto Minerals received a takeover offer from its second largest shareholder, for 58 cents per share, which was a 38% premium to the share price at the time. On the 6 of December the takeover offer was extended until the 12 of January. Tietto shares have continued to trade above the offer price which suggests an improved offer is likely.

Recent AGM Investor Briefing

To watch CDO’s recent AGM Investor Briefing please click here. In this AGM Investor Briefing, Karl Siegling starts by giving an update on CDO past and current year performance, discusses the portfolio and talks about some important market trends. Karl Siegling and Chris Garrard then discuss in detail some of the portfolio’s positions, namely Whitehaven Coal, Stanmore Resources, Westgold Resources, Newmont, Tietto Minerals, Boral, Netflix and Meta Platforms. Karl Siegling then closes with the outlook for 2024.

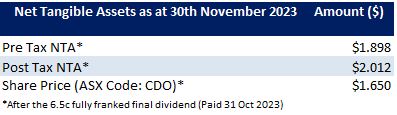

CDO Share Price discount to NTA

At the time of writing this newsletter, CDO is trading at a pre-tax NTA discount of around 15% whilst holding high cash balances. If all the shares in the portfolio fell by 20% the pre-tax NTA would still be above the share price. To put it another way, the shares in the portfolio can be bought at an 20% discount to their underlying value.

Fund NTA

Fund Performance

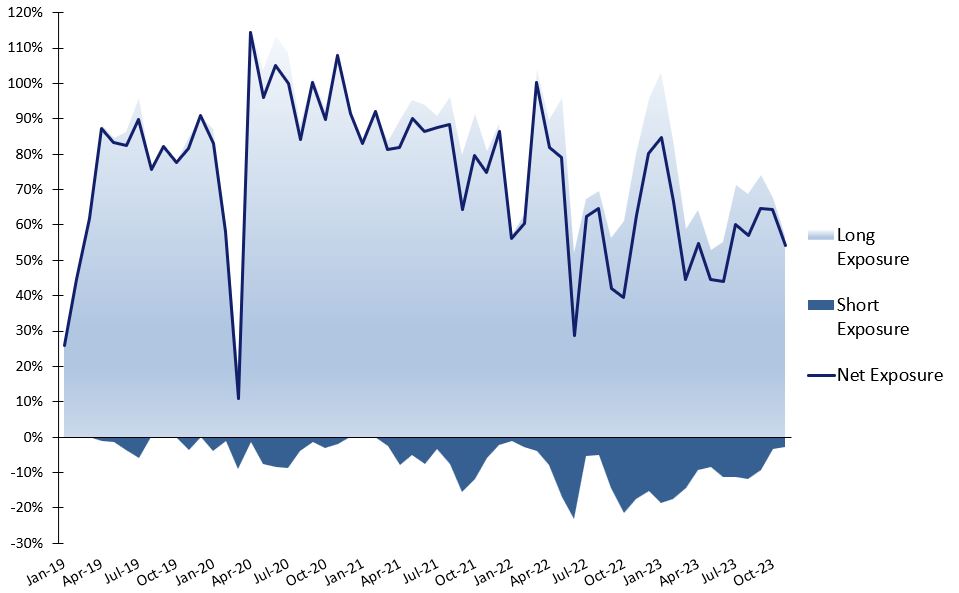

Historic Portfolio Exposure

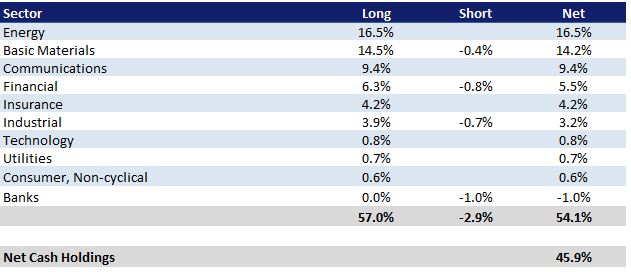

Portfolio Sector Analysis

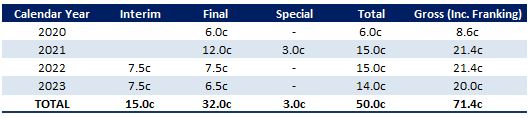

Franked Dividends Declared

News

To view all previous Cadence webcasts and interviews please visit the Media Section of the website.

We encourage you to visit our 52 books you should read before buying your next stock page on our website. We have compiled a list of books/ documentaries that have influenced our investment style or helped provide insight into the investment process.