For the month of July 2016 Cadence Capital Limited returned a positive gross performance of 4.30% compared to an increase in the All Ordinaries Accumulation Index of 6.29%.

July has seen a recovery in equity markets and in particular a change in sentiment away from ‘panic’ in relation to the ‘Brexit’ vote. Many world equity markets are actually recording all-time highs. This recovery has been assisted in Australia by a cut in interest rates to all time record low cash rates of 1.5%. Approximately 40% of the developed world currently has negative interest rates. Our portfolio has benefitted from these developments in July and continues to do so in August. Examples of stocks with significant change in sentiment have been Macquarie Group (ASX code MQG) and Henderson Group (ASX code HGG).

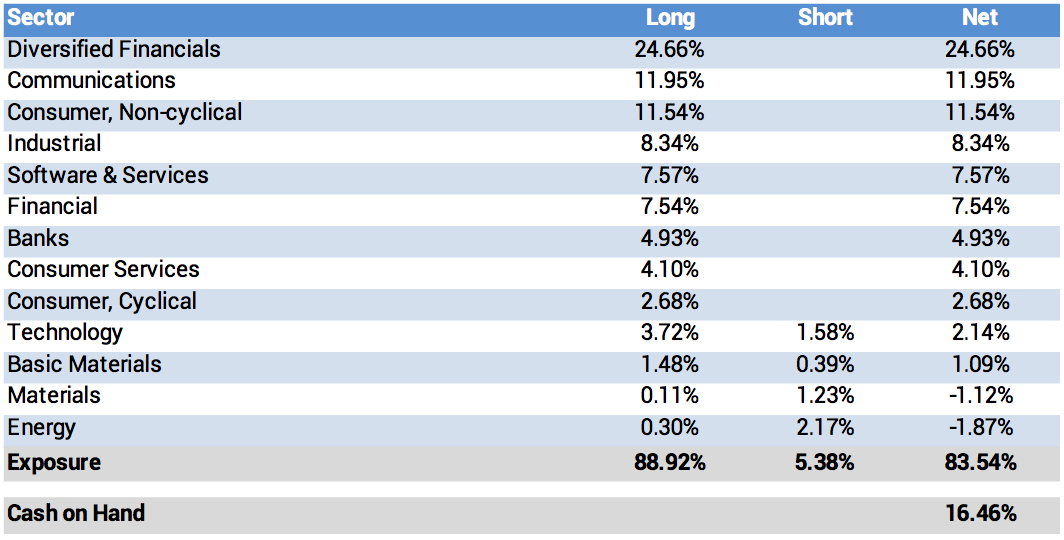

As at the 31st July 2016 the fund was holding 16% cash (84% invested).

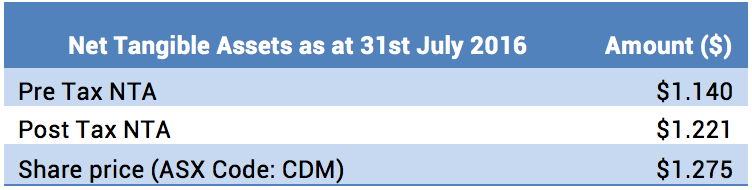

Fund NTA

* The NTA’s and Share price are post the 5.0c fully franked interim dividend

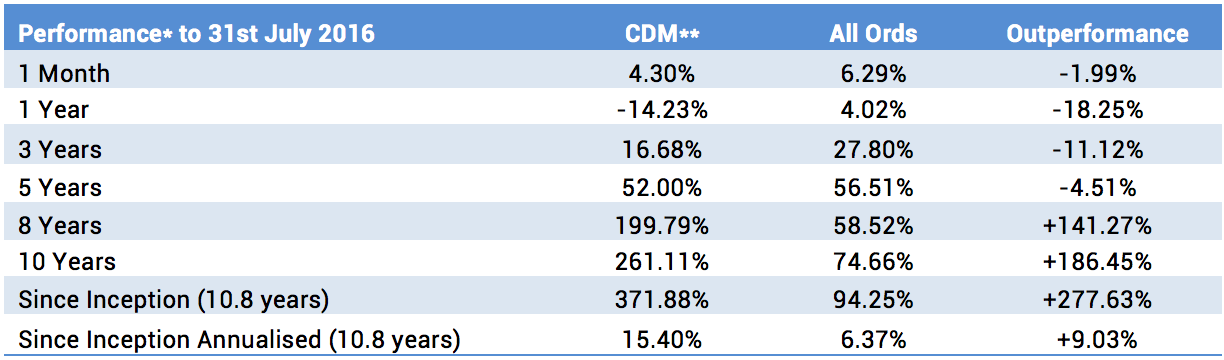

Fund Performance

* Before Management and Performance Fees

**These numbers include the franking value of the substantial dividend from its RHG holding received in May 2011.

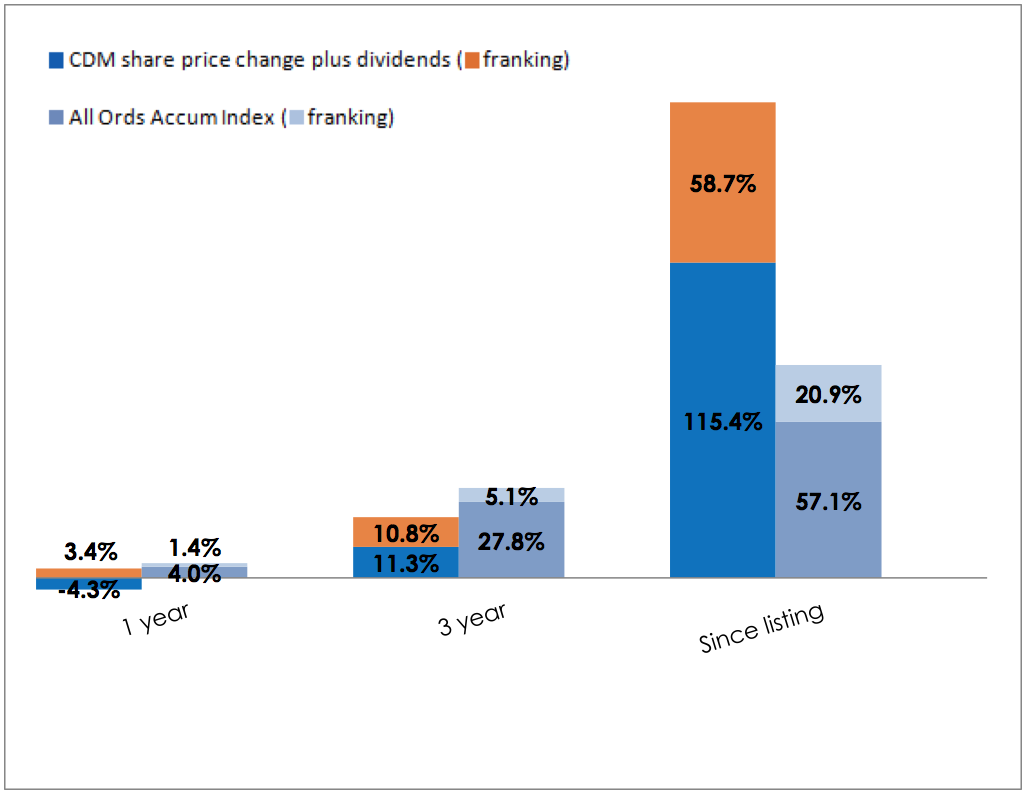

CDM Share Price and Option Returns plus Dividends & Franking

* CDM 1 year figures reflect the share price move from a premium to a discount to NTA

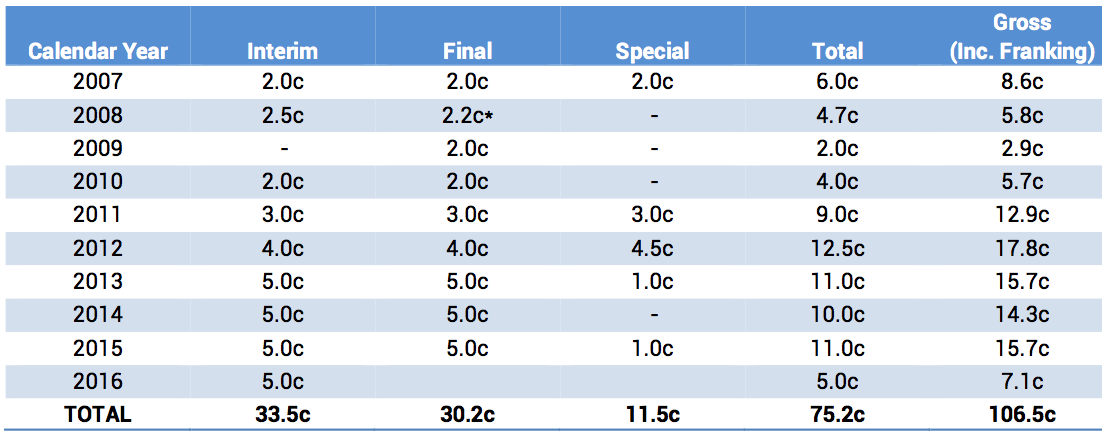

Fully Franked Dividends Declared Since Listing

* Off market equal access buy back

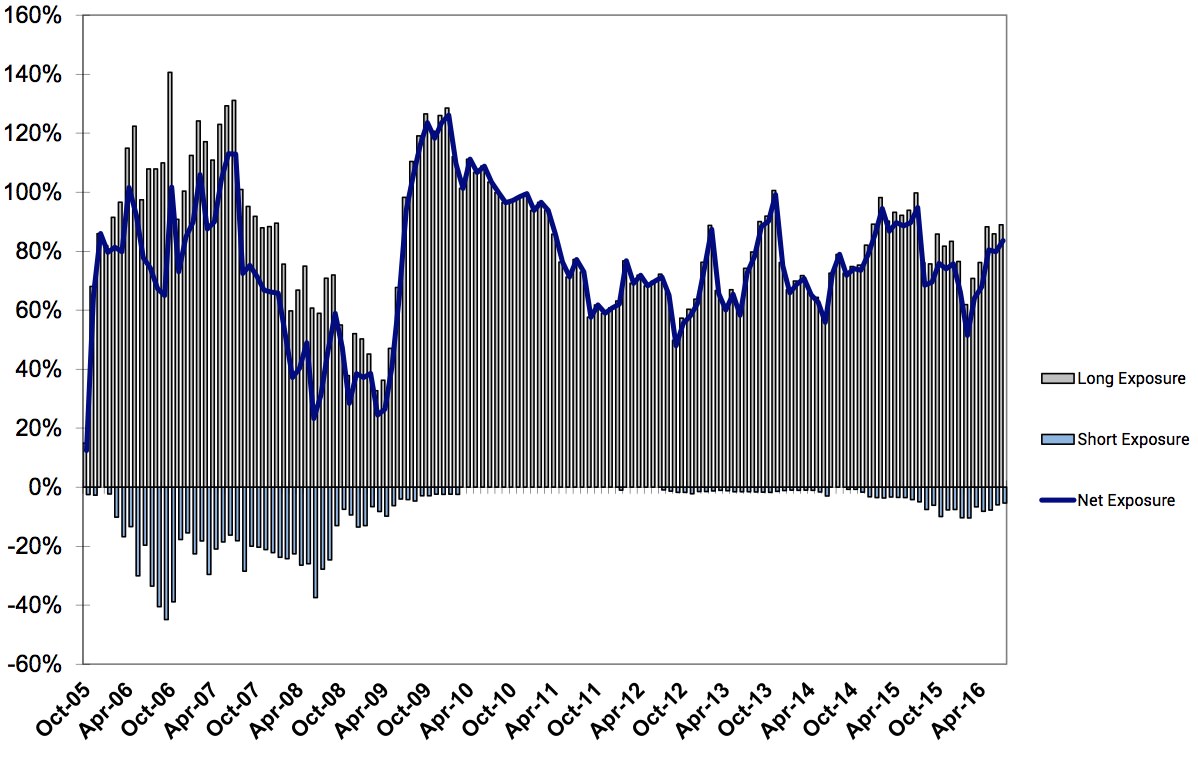

Historic Portfolio Exposure

Portfolio Sector Analysis

Top Portfolio Positions

Recent News Articles

Our latest Quarterly Webcast was released last month, and you can watch the full webcast on our website. We also released the stock-specific section of the webcast as a separate video titled Karl Siegling Discusses Top Portfolio Positions: MQG, MLB, AIO & HGG.

Following up on Karl Siegling’s article titled “Commodities: Has the trend changed?” which was published in May, Cadence portfolio manager Chris Garrard wrote an article focusing on two of our current commodity positions: Rio Tinto (RIO) and Woodside Petroleum (WPL). You can read the article here: Rio Tinto & Woodside Petroleum: Has the trend changed?.

Karl Siegling was quoted by the AFR in an article titled Macquarie Group’s Nicholas Moore coy on Brexit impact, where he shares his views on Macquarie Group’s outlook for the year.

We’ve updated our 52 Books You Should Read Before Buying Your Next Stock list with our latest book reviews including The Rise And Rise of Kerry Packer by Paul Barry, The Next Great Bubble Boom by Harry S. Dent Jr. and When Genius Failed by Roger Lowenstein. The Cadence team also shares links to interesting articles which you can find in the Interesting Links section.

To view all previous Cadence webcasts and press articles, please visit the Media Section of the website.